How to Invest Efficiently and Successfully!

Investing is a daunting process, but is very rewarding and a necessary step to ensure financial well-being. Understanding how investing works and what investment vehicles do are vital first steps on your path to financial freedom.

The Optometrist’s Guide to Investing 101

- How to Create The Ideal Portfolio of Stocks and Bonds

-

How to Rebalance your Asset Allocation & Other Additional Classes

- How to Quickly Assess a Mutual or Index Fund?

- Target Date Retirement Funds and the age of Robo-advisors; Which Brokerage is right for me?

- How to Monitor your Investment Performance and other wealth-building Tips

Short-term Investing:

Related Articles

Ask the CFPs Part 2 – Perspectives on Investing. (FB Live Event)

Investing has been one of the most discussed topics on ODs on Finance. With the current stock market showing heavy volatility, it is impervious to have a solid understanding of how investing works and how it can help you achieve financial freedom. Our CFP-partners are here today to answer questions on this very subject. Our…

8 Financial Lessons that I Learned during COVID-19

As we approach the end of August, we have experienced the worst market down-spiral in mid-March since the 2008 housing recession, with a -20% stock market crash. Luckily, year to date (YTD), the S&P 500 index has recovered nicely to roughly baseline. While we are not out of the woods yet, I have learned some important financial lessons, both as an investor and as an individual during this once-in-a lifetime catastrophe. Here are 8 things the pandemic has taught me.

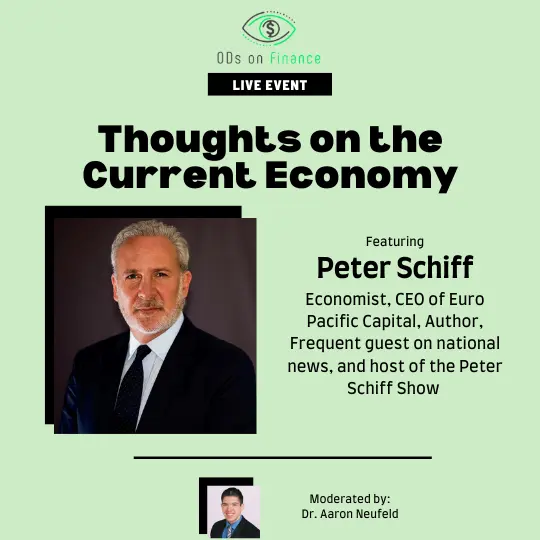

Thoughts on the Current Economy with Peter Schiff (FB Live Event)

With the world under distress at both a political and public health level, it is hard to make sense of economic activity. Furthermore, with heavy government involvement in the economy, long term implications are both scary and unknown. In this live event, famed economist Peter Schiff helps us understand his vision of the economic future…

8 Reasons Why Every Optometrist should Invest in Index Funds

KEY POINTS: (1) Better Performance (2) Lower Cost (3) Less Time consuming (4) Less Risky (5) More Tax-Efficient (6) Ease of use in Building your Portfolio (7) Wide Availability (8) Eliminate Behavioral aspect and No Feeling of missing out (FOMO) Due to the recent COVID shelter in place order, many investors (new and experienced) are…

The Optometrist’s Guide to Side Hustles

With the increasing burden of massive student debt and low insurance reimbursement rates, many optometrists are searching for income alternatives to make extra money aside from their full-time optometric profession. Many optometrists are looking for ways (either passive or active) to supplement, or even completely replace, their current income by doing a “side hustle”. Do…

Is the 2020 Real Estate Market Like 2008?

Editor’s Note: This is a guest post written by one of our sponsorship partners. Josh Mettle NMLS #219996 is an industry leading author and ranked in the top 1% of mortgage originators in 2018 by Mortgage Executive Magazine. You can get more great real estate and mortgage advice here or by visiting his book’s website. Josh is also a…

My Office is Closed; I am Out of Work, What Do I Do?

[Disclaimer] This article was written to the best of our knowledge with the latest news released from the Federal government. Some information may change/modify so we will keep the information updated to the best of our ability On March 17, 2020, the CDC and subsequently the AOA has urged all non-essential eye care providers to…

The Federal Reserve Just Slashed Interest Rates to 0%, What Does This Mean for Me?

March 2020 is shaping to be one of the craziest months our country has experienced in quite a while. There is no doubt that these next few weeks will find their places in US History books that our children and grandchildren will study in the future. With widespread quarantine efforts by the government and CDC,…

Navigating Market Mantras During Volatility and Uncertainty

The perfect storm of the COVID-19 outbreak and the upcoming election has led to an extremely volatile market. March 16, 2020 marked the second largest single day loss by the Dow Jones Industrial Average, in the history of the US. With the market down and heavily volatile, a few mantras regarding how to invest with…

- « Previous

- 1

- 2

- 3

- 4

- Next »