Insurance Agents

Need help trying to find the best term life, disability or malpractice? Or don't have health insurance? Check out these recommended and trusted insurance Agents! They will work hard to find you the best rates for your financial situation and necessary protection for your loved ones, if anything was to happen!

Health Insurance

Health insurance can be confusing. Even as optometrists and medical professionals, insurance is often not taught as part of our training so navigating the various plans and options can be overwhelming. It's too easy to get stuck with an insurance plan that is not only unnecessarily expensive but also doesn't give you the coverage you need. As a Licensed Insurance Advisor, I have access to all the plans available and can shop around for you!

👉 Schedule Free Consult Today or email me with any questions. If you are unable to find a time that works for you, please send me an email!

📧 Parita Patel | parita.insurance@gmail.com | Book via Calendly

Malpractice | Business's Owner | Medicare | Worker's Comps | Long Care

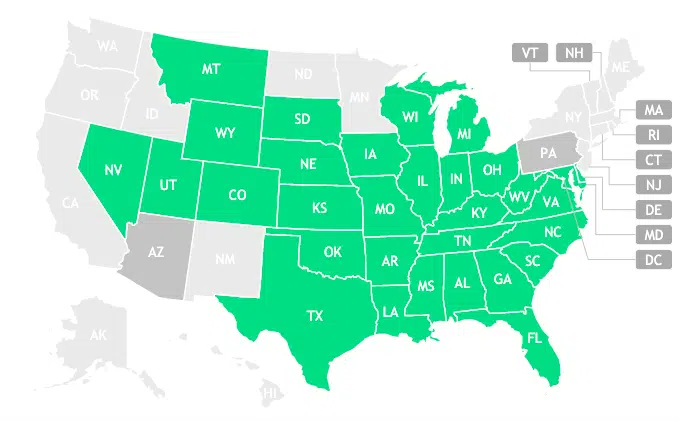

Professional Insurance Plans has been in business since 1991, specializing in malpractice insurance for optometrists all across the country. Whether you are shopping for malpractice insurance, business personal property, or workers comp, our highly experienced staff can help you find the right coverage at the lowest rate no matter what your needs are.

- ✅ Malpractice Insurance

- ✅ General Liability

- ✅ Business | Property Coverages

- ✅ Cyber Liability

- ✅ Workers Compensation

We are endorsed by the Kentucky and Tennessee Optometric Associations, as well as Walmart/Sam’s Club nationally, insuring Optometrists is our specialty. Feel free to contact us for information regarding any of these coverages.

Locations: Eligible in all state

📧 Contact info: Greg Bellamy | agent@professionalplans.com | 800-783-7086

Term Life | Disability

Michael Relvas, CFP® helps medical professionals nationwide with their term life and disability income insurance needs. Using a structured, objective and education-based approach, Michael can make the process of securing coverage more transparent and seamless for you.

He’s very approachable and can help you evaluate all of the leading Term life & Own-Occupation disability insurance providers so you can make a truly informed decision on the policy that best suits your specific needs and budget.

👉 To Compare Own-Occupation disability insurance policies that pay benefits when you’re unable to work as an Optometrist, opposed to just “any” occupation, Start here

👉 To Compare Term life insurance rates, Start Here

📧 Contact: 800-817-4522 | Michael Relvas | MRelvas@mrinco.com

Term Life | Disability

Specializing in "Own Specialty Discounted Disability Insurance Contracts," our firm's experience with Optometrists focuses on providing income protection if you are unable to perform the duties of your specific specialty. Our focus is to provide financial independence with a paycheck that will remain and not be offset due to other benefits or other income sources.

✅ Our commitment lies in tailoring the optimal policy for each individual, considering personal needs not just what a software program says is best for you. Our complimentary consultations walk you through each feature, so you only purchase the riders that bring you the most value. Typically, our clients add on Term Life Insurance in the process; either for their personal or business needs. Our insurance planning provides family protection and substantial savings on premiums over the years, contributing to Financial Freedom and peace of mind.

✅ With a collective experience of over 40 years, our team has assisted thousands of doctors nationwide in safeguarding their futures through Disability Income Insurance and affordable Term Life Insurance options.

👉 To Compare Life/Disability insurance rates, Start Here

📧 Contact: 480-707-2771 | Email at Insurance@AmberStitt.com

Related Articles

How does the “Families First Coronavirus Response Act” affect me?

In the past week, small businesses across America are feeling the financial impact from coronavirus restrictions that placed millions of people at home – avoiding non-essential activities, even visits to their eye doctors. As optometrists, we are in one of the highest risk categories for transmission and contraction of the virus. We are also responsible…

COVID-19 Has Closed My Practice, What Should I Do?

We are experiencing uncharted territory as the coronavirus pandemic continues to ravage the economy, health and mental stability of the American population. As of March 23, 2020, multiple states have issued “Shelter in Place” acts which limit business operations to essential businesses only. The big concern that arises for practice owners from extended closures/minimum operation…

5 Mistakes People Make with Insurance Planning

Editor’s Note: This is a guest post written by one of our sponsorship partners. Aaron and Dat are extremely strict about guest requirements in that they must be educational and informative to our readers. Every guest post is vetted, read and upheld to the highest standards of ODsonFinance. Your trust is the most valuable factor…

The Optometrist’s Guide to Disability Insurance

Optometrists with an average salary of $120,000 will make approximately $10 million dollars over their working career when factoring in raises and inflation. It took you 8-10 years of schooling to get to where your career is, in addition you probably took over $200,000 worth of student loans to invest in your future. Therefore, with…

7 Reason why Indexed Universal/Whole Life Insurance Suck

During the lifetime of ODs on Finance, we have received quite a few messages from doctors, family and friends about Indexed Universal Life Insurance (IULs). IULs are promoted to mimic the Index SP 500 return. They are basically Whole/University/Variable insurance in disguise and present a variety of unneeded complications. Don’t fall for them! An important…

- « Previous

- 1

- 2