How Much Profit Should Rental Properties Generate?

KEY POINTS:

-

(1) Check the Rent on Rentometer.com! Use the median to get an average expectation, or you can take the low number for a more conservative estimate. Depending on the time of year, as well as supply and demand, you may set your rental listing price accordingly. A higher market rent may stay on the market longer, but may attract a higher tenant pool.

-

(2) Aim for 1% Rule: This means my rent should be around 1% of my purchase price and any rehab costs to get the property rent ready.

-

(3) The typical rule is that 40% of your rent will go directly to expenses. It is important to remember that this rule generally assumes that the property is already in good shape and does not need major repairs.

-

(4) Reserves are very important and #1 thing most investors forget. Imagine an “imaginary bucket” of money that you have set aside each month for any major “oopsies” or “expected or unexpected” repairs that come up.

-

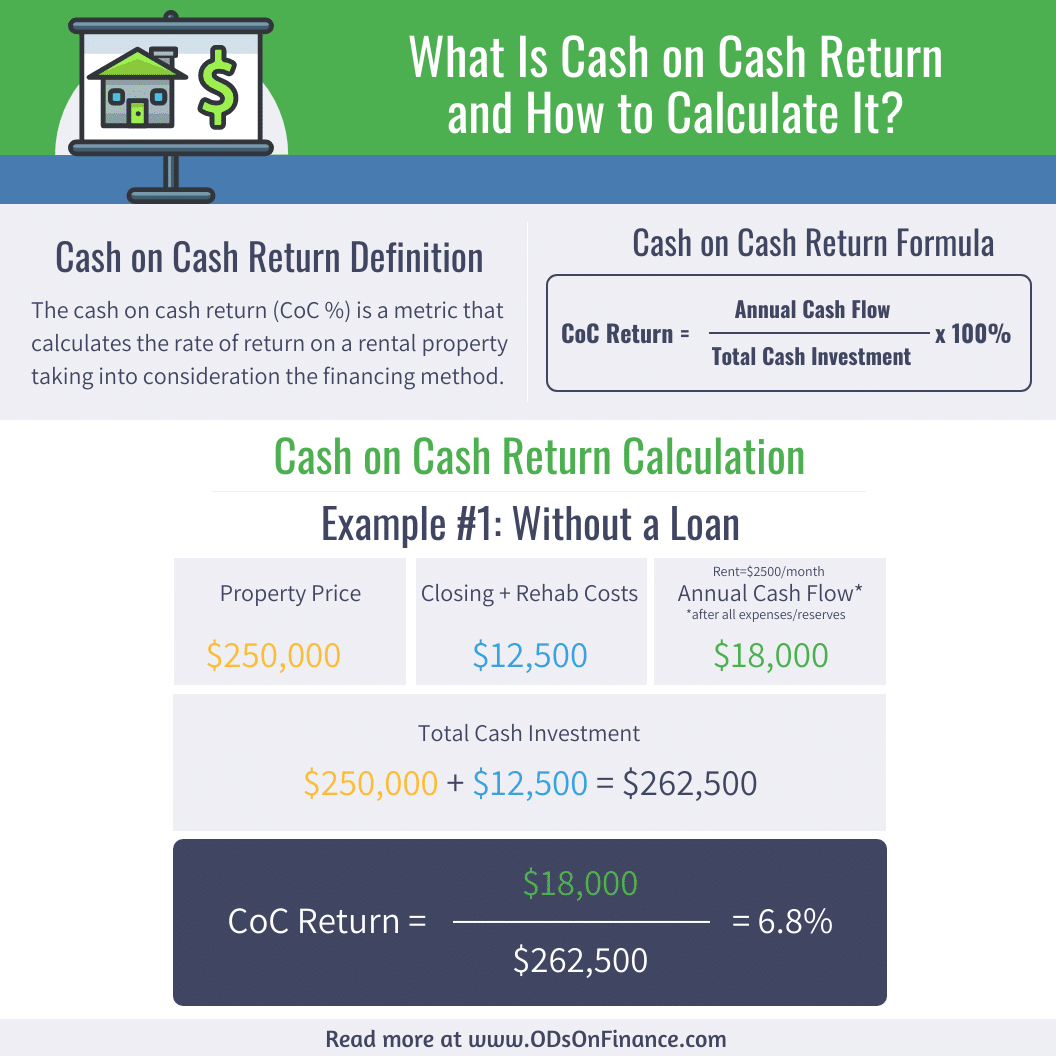

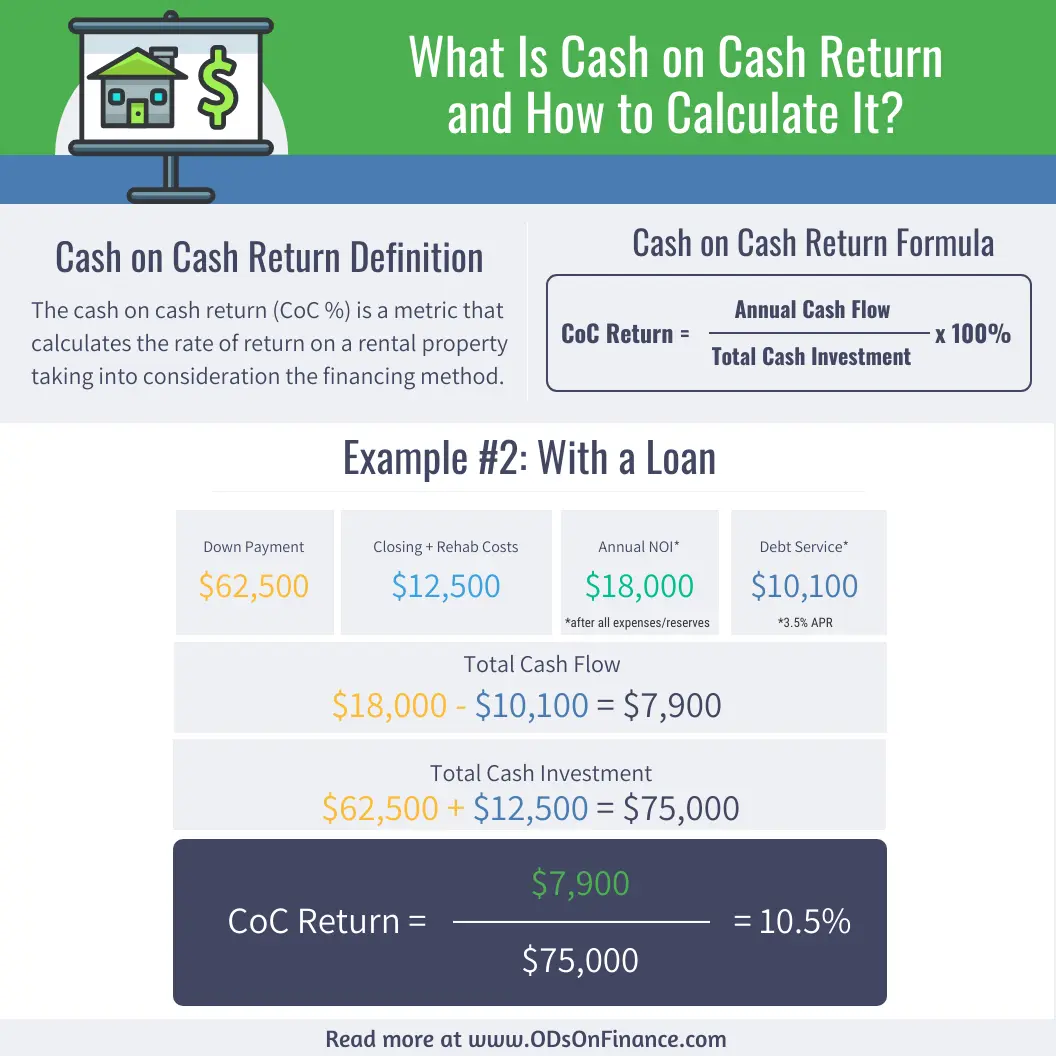

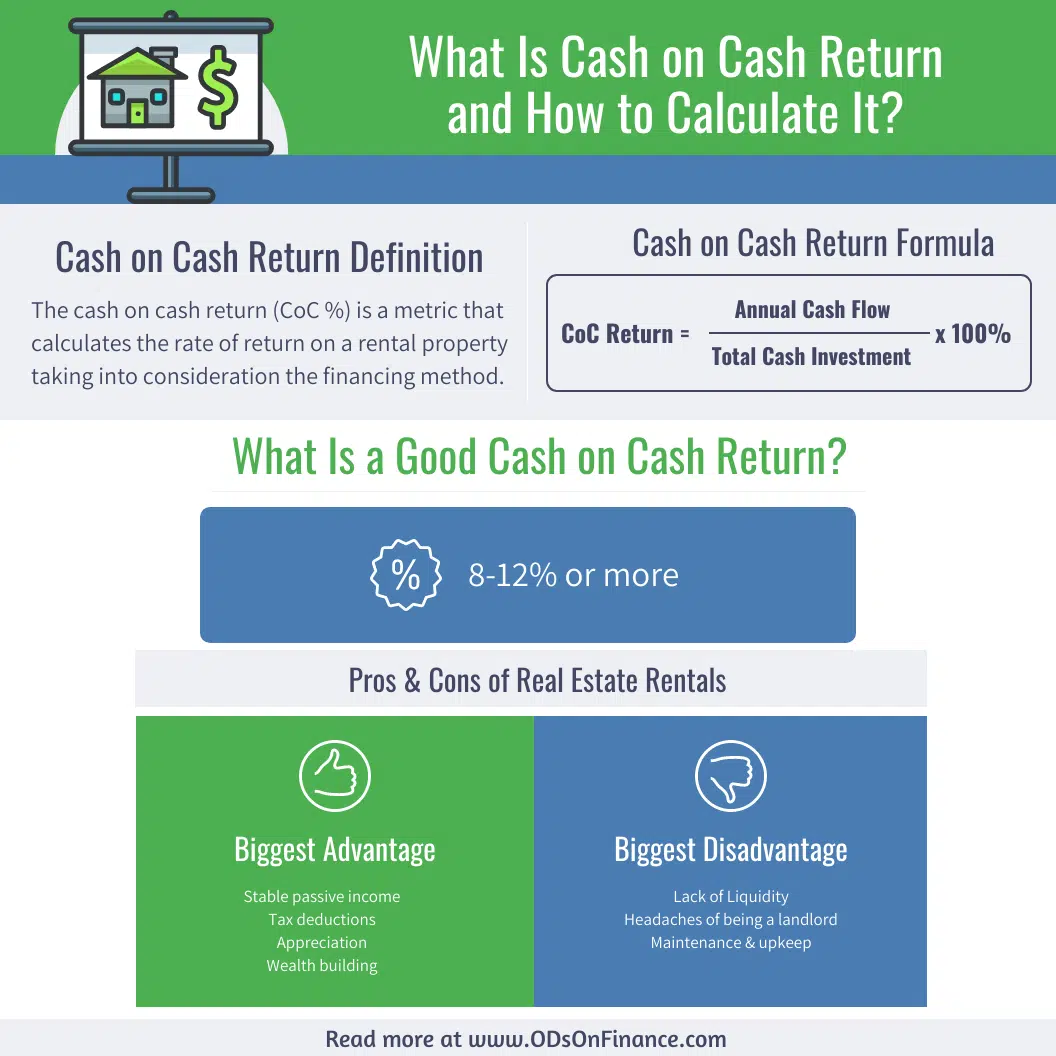

(5) Most investors aim for a cash on cash return of at least 8-10%. Why? Because it beats the average return you would get if you just left your money in the stock market.

For real estate investors, the ultimate goal is obviously profit. However, one of the most common questions people have when considering investing in a rental property is: how much profit should expect? This article will help you to estimate your potential profit on a particular property investment.

There are a number of variables that should be considered whenever estimating profit. It is also important to remember that every market is somewhat different. However, ultimately, there are a handful of core questions that can be asked to help estimate potential profit.

(1) What is the Rent?

This sounds like a relatively simple question and may be. If the unit you are considering purchasing is currently rented, simply find out how much rent the current tenant pays and to see if the rent is at or under-market.

However, if the unit is unoccupied, you will need to do a little more due diligence. Do some analysis of the neighborhood to determine the rent in similar nearby units. Many websites such as Zillow, Hotpads, and Rentometer provide a rent estimate calculator as well.

My favorite is Rentometer. If you haven’t already, head over to www.rentometer.com and enter the location of the property along with the number of bedrooms. I recommend looking at a .5 mile radius to see the average rental comps surrounding your property. Also, look to see if the rental comps are of updated units that match the same rehab caliber as the property that you are listing for rent. This will help you decide if you should price your listing lower, at, or higher than what is available on the rental market.

When conducting research, you may come up with a range for the rent value of the property. In these situations, you can use the median to get an average expectation, or you can take the low number for a more conservative estimate. Depending on the time of year, as well as supply and demand, you may set your rental listing price accordingly. A higher market rent may stay on the market longer, but may attract a higher tenant pool.

(2) Meet The 1% rule

I like to aim for my rents to meet/beat the 1% rule. This means my rent should be around 1% of my purchase price and any rehab costs to get the property rent ready. For example, if my property purchase was $110,000, and the cost to rehab the property was $10K, my total investment in the property is $120,000. By applying the 1% rule, I would need my rent to be at $1200, which meets the 1% rule.

Why is the 1% rule important for analyzing rental properties?

Having a high enough rent that covers the mortgage, tax, property insurance, property management and any reserves will allow for positive cash flow. Some investors invest for appreciation, however, if you are investing primarily for the cash flow, following the 1% rule will allow you to achieve positive cash flow after all expenses are set aside. Any appreciation that your property receives will be an extra bonus!

(3) What Will Your Expenses Be?

The amount of rent received is the gross income; thus, the next step of the process involves subtracting costs from that. So let’s look at the expenses.

The typical rule is that 40% of your rent will go directly to expenses. It is important to remember that this rule generally assumes that the property is already in good shape and does not need major repairs.

What is covered by this 40%? This covers things such as taxes, insurance, and any costs associated with property management among other things. This is a conservative estimate, which means that you probably won’t experience any unpleasant surprises.

However, the 40% is not necessarily all of the expenses. Most people will utilize a loan to purchase the property. Thus, this will also need to be subtracted from the rent.

(4) What is the #1 Expense that most investors tend to not account for? Reserves!

Reserves are very important. Imagine an “imaginary bucket” of money that you have set aside each month for any major “oopsies” or “expected or unexpected” repairs that come up. Most new investors forget to account for reserves, and when year 3 comes along and the AC needs replacement, the entire cash flow that was saved in the past 3 years all goes *poof* into paying for the AC replacement. When you have proper reserves in place, any small or major repairs won’t put a dent in your “cash flow” because they have already been accounted for in reserves.

When I calculate my returns and project my monthly cash flow, I like to set aside about 5-10% of my rental income towards each “imaginary bucket”.

My reserves account includes future expense items such as:

(1) Vacancy

The amount of lost income expected when a property is vacant, or not generating revenue. Assuming a 1 month vacancy, for a property that rents at $1200/month. I like to set aside about 10% of my rent a month, which equates to about $120/month. If my property goes vacant in 1 year, I would have saved up about $1440, which will account for the 1 month of loss of rent to turn the property as well as any fees to the property management company to market the property.

(2) Maintenance

The amount set aside to cover any unexpected repairs. Common repairs include plumbing leaks, AC/furnace issues, and appliance breakdowns. My average repairs, if any, come out to be about $150-250 (including trip charge), and I normally get repair calls every 3-6 months. If I'm lucky, sometimes these calls are just once or twice a year. I like to set about 5% of the rental income for maintenance costs in a “reserve account. For a rental that brings in $1200/month in rent, I set aside $60/month or $720/year.

(3) Cap-Ex

This is an amount set aside to replace your big ticket items. These include replacing a HVAC, Furnace, Hot water tank, roof, flooring, new paint, windows, driveways etc. If you have recently fully rehabbed your property, and all big ticket items are brand new, you may opt not to put anything aside, especially if you plan to sell in the next 10 years. When I rehab my properties, I replace most of my major cap-ex items, and still put aside reserves for them, because I’m just extra conservative. For me, I like to put away about 10% a month. I would have $120/month or $720/year. If nothing breaks down in 5 years, I’m ahead of the game.

Let's do some simple calculations to see what the rental income would be for this property, that you purchased for $120,000 and rents for $1200. Assuming a mortgage payment of $600 (principal/interest, property tax, insurance), you will have $600 left over for other expenses. Here's the breakdown of all the expenses:

0%

0%

0%

0%

$0

(Rental income) - Mortgage payment/tax/insurance - Expenses/reserves = Total NET Rental Income

$0

$0

$0

$0

Most investors aim for a minimum of $150-200/month cash flow per door. Sounds very little right? Go ahead and keep reading….

(5) Are There Any Other Factors?

Cash on cash return percentage is also a very important value to consider. What if I told you that you can make $2400 a year ($200/month cash flow) by investing just $10,000 of your money? You’d say YES! Why? Because that is a 24% cash on cash return! What if you invested $20,000 and made $2400 a year in cash flow? That is 12% cash on cash return. Well both 12% and 24% COC% both beats any savings account and are much less riskier than bitcoin!

Most investors aim for a cash on cash return of at least 8-10%. Why? Because it beats the average return you would get if you just left your money in the stock market.

So when calculating profit, don’t forget to look at cash flow AND cash on cash return, they are both very important.

(6) Is It Really that Simple?

Yes, it really is. It’s just math and projections. But remember, they are just projections. It is important to realize that this is an estimate; however, it is intentionally a conservative one. Consider that you are purchasing a rental property that has rental income of $1,000 per month. Here's quick and dirty if you are analyzing 10 properties a day, like me: using the 40% rule, we can estimate your expenses at $400, leaving $600 remaining. If you have a loan for $400 per month, this means you can expect $200 in profit for this particular property.

Final Thoughts

So How Do I Know If It Is Worth It?

This is a harder question. It depends on the rest of your cash flow situation. Do you need that $200 a month to supplement your lifestyle? Or perhaps you have a cushy day job and you want real estate to be a form of passive income. $200 a month in cash flow may not seem much, but the goal of real estate investing is to scale. A savvy real estate investor may aim for 10 units in 10 years which will equate to $2000/month in pure cash flow. Possibly after 10 units, those 10 units can be traded up for an apartment complex. The possibilities are endless. The most important part of real estate investing is you are not trading time for money. Real estate investing is not easy, and comes with much risk, but if you have done your due diligence, profit analysis and set aside proper reserves, you will come ahead and be a profitable real estate investor!

Want to follow Julie's REI Journey? Follow Julie on Instagram @ House_hustle

Want to get a full blueprint on How to start? Buy our Book The Optometrist's Guide to Financial Freedom

Related Articles

- « Previous

- 1

- 2

- 3

Facebook Comments