Health Insurance Basic 101 That Every Optometrist Should Know

Editor’s Note: This is a guest post written by Dr Gopita Patel OD who is a licensed Health Advisor. She is partner of ODsoFinance and help ODs navigate the difficult huddles of health insurance. Aaron and Dat are extremely strict about guest requirements in that they must be educational and informative to our readers. Every guest post is vetted, read and upheld to the highest standards of ODsonFinance. Your trust is the most valuable factor to us. We like having experts in their field write on our website, enjoy and give us feedback!

KEY POINTS:

-

(1) Understand 6 key terms and how they apply to your health insurance (Premium, Deductible, Co-insurance/Co-pays, Maximum out of pocket, Benefit caps)

-

(2) Understand network options (HMO, EPO, POS, PPO)

-

(3) Employer coverage is great for the employee, but often more costly to add-on dependents and a spouse.

-

(4) ACA/Marketplace/Obamacare options are based on your income and are great options for those that need major medical coverage or have low-income and need subsidies. As an Optometrist, the majority of our income levels fall outside of subsidy ranges and therefore we are subjected to paying full prices.

-

(5) Private plans are based on individual health and are great options if you can qualify as they are generally lower in cost with better benefits. They also don't have any limitations on income level and give you PPO nationwide coverage.

Whether you are a New O.D or Seasoned O.D ….healthcare is changing every year.

Working in the medical field, I thought I understood how health insurance worked, until I ended up in the emergency room for two hours earlier this year. A month after my visit I received an explanation of benefits (EOB) in the mail and was entirely shocked that a total of 2 hours, a CT scan, a single blood test, 1 dose of nausea medication, 1 dose of pain medication, and less than 5 minutes with the doctor led to a billing of $30,000. I'm pretty sure I grew several extra gray hairs just after looking at that.

The moral of the story is you just never know when something will happen. Let's be honest, the cost of healthcare is outrageous in our country but unfortunately it's not going away any time soon. So it’s really important to know what options are available for us.

One of the most common things I hear from friends, family members, and clients is the phrase...

I’m healthy, why do I need insurance?

- 1) It’s better to have it and not need it, than to need it and not have it.

- 2) We don't get health insurance for the day-to-day things, we get it for the “What if situations”

What information do I need to know to pick a good plan?

Insurance Language 101

(1) Monthly Premium

The monthly cost of your health insurance

(2) Deductible

- Additional amount you have to pay out of your pocket (Gasp!) per year before your insurance plan pays anything.

- You are required to pay full price or “the designated before deductible amount” until you meet that deductible.

(3) Co-insurance & Co-Pays

Co-pays- “Payments you make each time you get a medical service” (office visit, medications etc); typically flat rates

Co-insurance- Shared cost between you and the insurance company.

- Example: 80/20 Co-insurance (Insurance pays 80% of cost, you pay 20% of cost until you meet your deductible or max-out-of-pocket)

(4) Maximum out of pocket “MOOP”

If there is one thing you want to know….its this!

The maximum out of pocket per individual or family is your worst case scenario (i.e. the most you will have to pay out of pocket per year before the insurance company covers the cost at 100%)

- Note: in & out-of-network MOOP may differ

(5) Benefits Cap- “Annual limits & Lifetime limits”

Short term plans & Health care sharing ministries will have a cap to what they will cover in a given year or over several years

4 Types of Networks (PPO, EPO, POS, HMO)

(1) PPO (preferred provider organization)

Ding, ding, ding! This is what we want!!

- More widely accepted, greater accessibility of doctors, & no referrals needed to see a specialist.

- Can choose to go in or out-of-network (note: with out-of-network- benefit levels and coverage is often reduced).

- Nationwide coverage! Great option for those that travel across states for work or even for vacation.

HMO/EPO/POS

Smaller, restricted networks, often limits coverage to zip code/county. May need referral from primary care doctor to see specialist.

- (2) HMO- Health Maintenance Organizations

- Most commonly found on the ACA/marketplace

- Require Primary care physician (PCP) to coordinate care with specialist

- Often limited to In-network only (some exceptions with regard to emergency care)

- Can be lower in premium but watch that deductible and max out-of-pocket amounts as they will likely be higher.

- (3) EPO- Exclusive Provider Organization

- I find many people think they have a PPO plan but really have an EPO plan which is becoming more common on the ACA/marketplace in certain states

- Unlike HMO, you don't need a referral from your PCP, however the number of providers that take EPOs is limited

- (4) POS- Point of Service

- Even smaller network of local doctors and hospitals

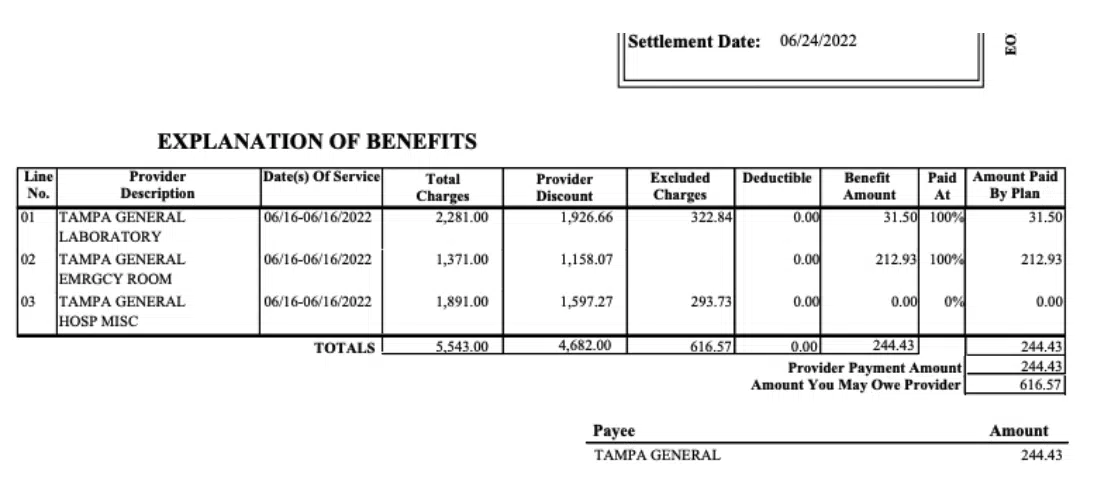

Remember how the majority of plans work- everything is co-insurance or full price until the deductible is met. Only some larger employers provide ER co-pay plans. If you don’t have one of those, that EOB will make you very happy. Patient responsibility from a $5,543 bill was only $616.57!

Okay great now that I learned a new language…..What are my options?

In reality we have 3 real options for full health coverage.

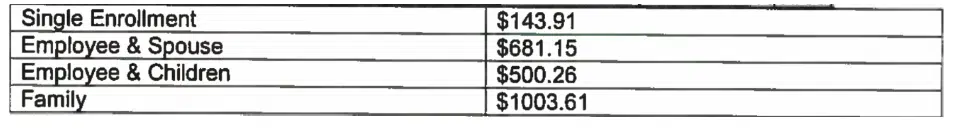

- Cost

- Employee- These are often great choices for the employee because employers have to cover at minimum 50% of the premium

- Add-ons (spouse + dependents) -majority of the employer plans charge full prices for non-employees

- Example: Employer Group PPO option (see above)

- Coverage & Networks- most group plans give several options for you to choose from.

- HMO options are lower costing, PPO options are often higher costing

- HMO options are lower costing, PPO options are often higher costing

- Enrollment periods- vary.

(1) Large Group Employer Plan

Financial Pearl

"For Large Employer Plan, did you know you can split coverage? The employee stays on their employer plan and dependents/spouse find other options. This can save you thousands a year!

(2) Obamacare/Marketplace/ACA

- Cost

- Premiums are based on age & household income

- Often have high deductibles & max-out-of-pockets

- (↓ premium = ↑ deductible )

- Coverage

- Most plans cover preventative services such as routine physicals & screening tests, everything else is subjected to copays &/or deductibles

- Great option for those that need major medical coverage as there is no pre-existing limitation

- Limitations

- Income level- Sadly but not sadly many of us optometrists fall outside of this due to our income size and are often paying full prices for these plans

- Network limitations-many zip codes only offer HMO, EPOs, or POS

- Networks

- Certain states offer PPO options

- most available options HMO, EPO or POS Networks which limits your provider selection

- Discounts- Government discounts/subsidies

- Available based on your household size and Income level

- Available based on your household size and Income level

- Enrollment period

- Open enrollment is November 1st- December 15th. Plan starts January 1st.

- Limitations- Only eligible to sign up during this enrollment period or if you have a qualifying life event (moved, got married, had a baby etc).

Financial Pearl

"Remember that if you decline group employer coverage you are NOT eligible for government subsidies!

Also remember that if you are an independent contractor/1099 worker and you underestimate your income for the year you will likely have to pay back those premium discounts in the form of taxes! Yikes, who wants to do that?"

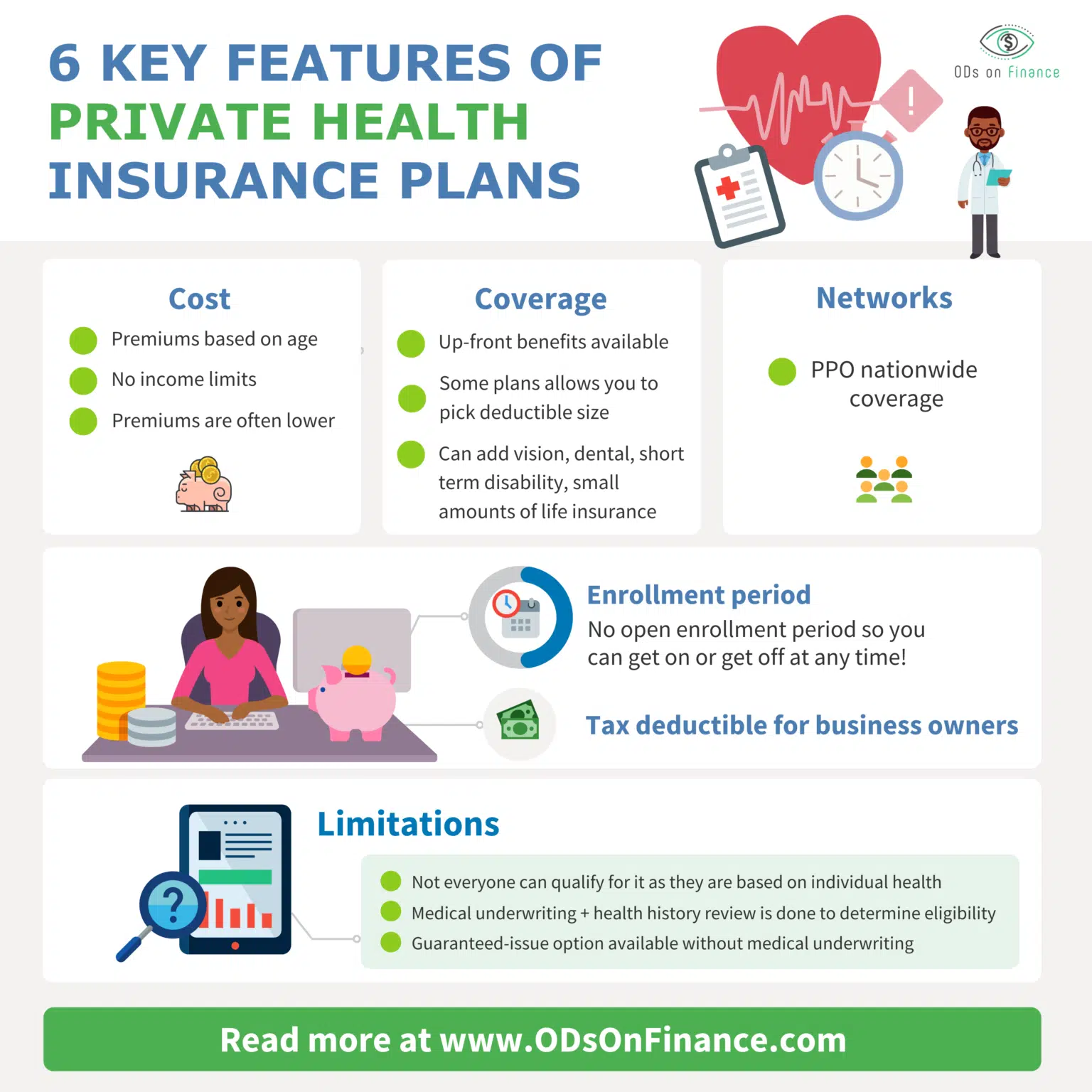

(3) Private Plans

- Cost

- Premiums based on age- there are no income limitations

- Often times premiums are lower or similar & rarely higher (unless you get subsidies)

- Coverage

- Up-front benefits available so you don't have to deal with deductibles or copays first.

- Customizable options available

- Some plans allow you to pick deductible size

- Can add vision, dental, short term disability, small amounts of life insurance

- Networks

- PPO nationwide coverage

- PPO nationwide coverage

- Limitations- Private plans sound amazing so what's the catch?

- Not everyone can qualify for it as they are based on individual health

- Medical underwriting and health history review is done to determine eligibility

- Guaranteed-issue option available without medical underwriting-recommend learning about the details and how the plan works

- Enrollment period

- No open enrollment period so you can get on or get off at any time!

- No open enrollment period so you can get on or get off at any time!

- Tax deductible for business owners

(4) Other options-Health Share/Christian Ministries; Short Term plans

-

Short term plans

-

-

- Bridge the gap plans if you need something for 30-60 days

- Often have a cap to benefits per year and per lifetime

- Deductibles can reset every 30-60-90 days

- No true max out of pocket

-

-

Health Share/Christian Ministries

-

- Cost-sharing organizations. Not real insurance companies (it says it right on their brochure/website). They help members share & reduce cost of healthcare however, they are not legally bound to pay claims so if funds run out you risk the chance of not having claims paid.

- Premiums are much less as they often also limit those with major pre-existing conditions. These funds are in turn used to pay medical expenses for others who participate in the sharing.

- Limitation on membership to those who share a common religious faith.

- Won’t cover things outside of their faith (i.e. won’t cover maternity if it did not happen naturally, ex: in-vitro)

Financial Pearl

"Remember that health-sharing organizations are NOT real insurance companies, hence why they are so cheap so they are not legally bound to pay claims if the funds ever run out. In addition, certain faith-organization won't cover medicals treatment outside their beliefs such as in-vitro! So proceed carefully"

I’m Ready….but how much should I be spending?

That’s the magical question and unfortunately there is NO one-size-fits-all answer.

All insurances will incorporate your age when it comes to rates. The older we are, the riskier we become to insure, so you will see changes in rates over time. In addition to age, ACA/Marketplace/Obamacare plans also take your income into account and Private options take your health into account.

Every year, taking a look at your options can save you hundreds a month. Let’s face it, plans are getting more expensive and benefits are changing often and not for the better. I have had several family members and clients get large premium increases in their Obamacare plans and benefits cut in half. I have not seen that happen with private plans and rather seen benefits increase with changes in inflation. Remember you may see a small increase in premiums year after year to account for age increases.

To conclude: Health insurance can be complicated and overwhelming but a necessary task we must all look into. Even knocking off $100 a month leads to $1200 a year in savings. I always recommend shopping around and talking with a health insurance advisor to find the best option cost and coverage wise for you and your family!

Want to learn how to manage your life or disability insurance? Check out The Optometrist's Guide to Life Insurance. + Disability Insurance

Need to find a financial expert? Check out our Recommended & Highly Vetted Resources

Facebook Comments