Financial Planners

Are you concerned that your new employment contract may not be in your best interests? Schedule a consultation with our Career OD Consultant to gain valuable insights and ensure your career goals are aligned with your employment agreement

Student Loan | Associate Doctor (W2, 1099) | Sublease Owner | Practice Owner

Optometry Wealth Advisors is a financial planning and investment advisory firm serving only optometrists, nationwide. Our process, approach, and focus on optometry helps you to master your cash flow, grow your net worth, and ultimately plan more purposefully around the financial decisions you face as an optometrist (and practice owner).

As part of our services, we help you navigate:

- ✅ Cash Flow and Debt Management

- ✅ Student Loans - Crafting a student loan repayment plan

- ✅ Tax Planning - Proactive tax planning each year

- ✅ Understanding your Practice Financials

- ✅ Planning for Financial Independence and Retirement

- ✅ Estate and Insurance Planning - Managing your financial risks

- ✅ Investment Management - Incorporating leading academic research

- ✅ Ongoing Monitoring of Financial Health

Evon Mendrin is the Founder and Lead Advisor of Optometry Wealth Advisors, as well as the host of The Optometry Money Podcast. He’s a Certified Financial Planner™ (CFP®) professional and a Certified Student Loan Professional™ (CSLP®), and he loves to help optometrists navigate that critical intersection between personal and practice finances.

👉 Schedule a Free Consultation - Start with a no-commitment, 20-30 minute Introduction Call. As a part of the conversation, we’ll provide a free financial “health” assessment!

📧 Contact: evon@optometrywealth.com | 559-345-5059 | www.optometrywealth.com

Student Loans | Associate Doctors | Sublease Holders

Prudent Financial Planning is a comprehensive fee-only firm based in Naples, Florida. We specialize in helping young professionals especially optometrists navigate the financial planning process and provide the best solutions for paying off their student loans. Acting as a fiduciary for our clients means we are committed to always putting YOUR best interests first. We provide advice in areas of financial planning, student loan solutions, tax planning, cash flow, investing, insurance analysis, and every area of your financial life. Schedule a free initial consultation today to find out whether working with Prudent Financial Planning is the right fit for you! We work with young professionals, doctors and lawyers who want to get out of debt and make their money to work for them.

- ✅ Financial Planning

- ✅ Student Loan Solutions

- ✅ Cash Flow +Investing

- ✅ Estate + Retirement Planning

⏩️ Promo: Receive 10% discount on upfront fee for OD's on Finance Member discount(Starts at $630 upfront and $275/month after discount has been applied). This is a month-to-month agreement.

👉 BOOK A FREE CONSULT TODAY

Patrick Logue, founder of PFP, is a Certified Student Loan Professional (CSLP®) and has the advanced knowledge required to provide high quality student loan repayment planning advice within the scope of a holistic financial plan.

📧 Contact: Patrick Logue CFP®, CSLP® | (239) 230-0395 | pat22@prudentfinancialplan.com

Sublease Owners | Practice Owners

Here at IPWM, we subscribe to a core set of investment principles, largely dictated by the great empirical research done in both academia and at Dimensional Fund Advisors (DFA). Our portfolios, and the funds used in those portfolios, subscribe to a set of rules and principles that guide how we see capital markets and how we believe we can help deliver a great investment experience for our clients.

✅ Our goal for this process is to demonstrate, in plain English, how we can serve you in helping you make the most out of your life with the wealth you have and how we bring simplicity, clarity, and confidence to an otherwise confusing, complicated, and intimidating subject: money.

✅ Who do we serve? As the husband of a practicing optometrist, Adam knows the practice and business landscape of optometry has changed significantly in the recent past. So, too, have the financial implications of being an optometrist.

✅ Before committing your time or ours, this 20 to 30-minute phone call will give us both a chance to make sure your situation matches our expertise. We want to get a vision of your goals, intentions, challenges, and opportunities unique to your situation and circumstances. After all, you wouldn’t schedule testing without a patient inquiry.

👉 BOOK A FREE TRIAGE CALL TODAY

📧 Contact: Adam Cmejla CFP | adam@integratedpwm.com for any questions

⚠️ NATALIE IS UNABLE TO TAKE ON NEW CLIENTS DUE TO LIMITED SPACE UNTIL FURTHER NOTICE

Sublease Owners | Practice Owners

Hayes Wealth Advisors is a fee-only advisory firm that helps optometric practice owners and employed ODs build wealth outside their practices through financial planning and investment management. We collaborate with optometrists to develop a customized Personal Wealth Action Plan, which is a roadmap to a successful financial future and covers the following and more:

- ✅ Account and asset positioning

- ✅ Cash flow planning

- ✅ Tax strategies

- ✅ Private sale and private equity practice value and exiting strategies

- ✅ Investment strategy and implementation

- ✅ Retirement planning

- ✅ Risk management review— insurance and estate planning

Owner Natalie Hayes Schmook, MBA, CFP®, CVA®, CEPA grew up in the optometric industry as the daughter and sister of well-known practice management experts. An advisor since 2006, Natalie left her big bank background to apply her planning and investment management skills to the optometric profession.

👉 BOOK A FREE CONSULT TODAY

📧 Contact: Natalie Hayes Schmook CFP | natalie@hayeswealthadvisors.com for any questions

Related Articles

June 2023 Market Update for Optometrists: Latest Economic & Financial Trends

Welcome to the June 2023 market update, where Aaron and myself will provide you with an overview of the latest economic trends and developments, including what we as optometrists should watch out for and how we should adjust our investing plans.

Good vs. Bad Optometry Debt – 4 Ways to Use Good Debt to Your Advantage

That being said, debt can be a useful tool for achieving financial goals, but not all debt is created equal. Some debt can be beneficial, while others can be detrimental to your financial well-being. Let’s explore the difference between good debt and bad debt and how you can use debt to your advantage.

Q1/2023 Market Update for Optometrists: Latest Economic Trends And How To Adjust Your Financial Plan

Welcome to the Q1/2023 market update, where Aaron and myself will provide you with an overview of the latest economic trends and developments, including what we as optometrists should watch out for and how we should adjust our investing plans… So we hope to provide a comprehensive overview of the latest economic trends and developments, highlighting the challenges and opportunities in today’s market for optometrists.

9 Financial Tips For Optometry Students

As an optometry student preparing to enter the field, it’s important to understand the financial implications that come with this profession. From budgeting for school supplies to managing debt and investing in your future—all these responsibilities add up quickly! With these 9 financial tips, you’ll equip yourself with the knowledge needed to navigate a successful career as an optometrist.

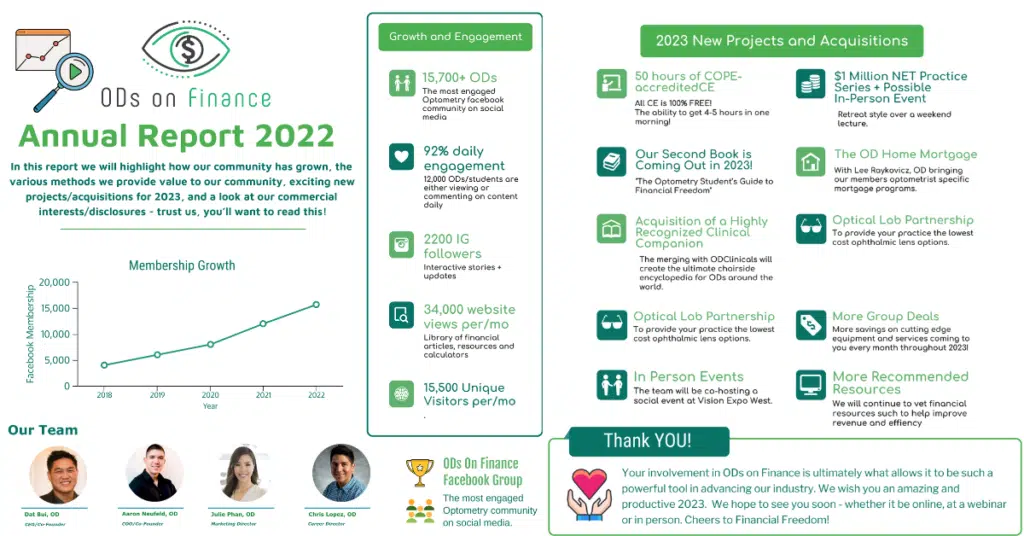

State of ODs on Finance: 2022 in Review, and a Look at 2023!

It’s hard to believe, but the year 2022 has vanished in the blink of an eye. This past year, we’ve had the pleasure of seeing ODs on Finance continue to grow and help ODs on their financial journey, whether they be new grads or seasoned veterans. We are thankful for your attention, your questions and your contributions. Two tenets that hold paramount value to us at ODs on Finance are transparency and productive growth. In this letter, we will highlight how our community has grown, the various methods we provide value to our community, exciting new projects/acquisitions for 2023, and a look at our commercial interests/disclosures – trust us, you’ll want to read this! Here is a quick recap of 2022!

Action Plan: What To Do with My Optometry Student Loans Before 2023?

Our inbox has been getting slammed with ODs asking for advice on what to do with their federal student loans as we get closer to the 0% forbearance expiration date of 12/31/22. Politics aside, based on the most recent federal news which removes a lot of uncertainty that we had last month, we are going to break it down with some actionable plans that optometrist can take:

The Optometrist’s Guide to Short Term Investing

With the recent volatile market and pending economic recession, many investors are looking to hold their cash in a relatively safe place, especially as our economy faces surging inflation. In this article, we will talk about short term investments and where we can place these funds, aside from just storing cash. What is a short-term investment?

3 Take-Aways That Optometrists Should Know About Biden’s Student Loan Debt Relief

On Wednesday, Aug 24, 2022, President Biden, along with the US Department of Education announced a three-part plan to help student borrowers with federal loans transition back to regular payments. In addition, we do want to let our members know that it took us a little while to gather our thoughts after the dust settled to address our community.. So let’s begin with the facts first and any questions that optometrists might have. PART 1: Final extension of the student loan repayment + 0% Interest pause forbearance until 12/31/2022

$182K in 2.75 years | Balancing Residency, Future Goals and Aggressive Loan Payoff with Dr. Andreas Zacharopoulos O.D

When we think about paying off student loans, it is hard to couple the ideas of finishing a residency and also knocking out student loan debt quickly. Simply put, a residency provides great experience but comes at a cost – a year of well-below average wages. Despite this hurdle, our Student Loan Success Story and active ODs on Finance member Dr. Andreas Zacharopoulos was able to knock out his debt and start setting himself up for financial success. In this article, Andreas gives us a detailed account of how he paid off his student loans and some helpful strategies for overcoming some common struggles in the quest for financial freedom.