Dental Investment Group | Student Loan Refi

This is Sunny - I am ecstatic to join forces with Dat from ODsonFinance (The world's largest optometric personal finance community) to give dentists the best and lowest student loan ReFi rates, in addition to some of the highest cash back bonuses!

We know just how much our massive student loan debt (sometimes as high as 6.8% interest) impacts wealth building, so if you are NOT going for any forgiveness program like 10years PSLF, it's a no brainer to refi and take advantage of historically low interest rates!

Dat and I were able to negotiate and advocate for the best term rates and highest cash back bonuses for all DIG members looking to refinance their dental student loans. As always, we are here to give any guidance as needed"

Dr. Sunny Pahouja DDS

Dr. Dat Bui O.D

Financial Disclosure Some of the links below are affiliate links, meaning, at no additional cost to you, we will earn a commission if your application is approved. Any profits are used to fund our dental community help educate future young dentists in achieving their financial freedom

Benefits:

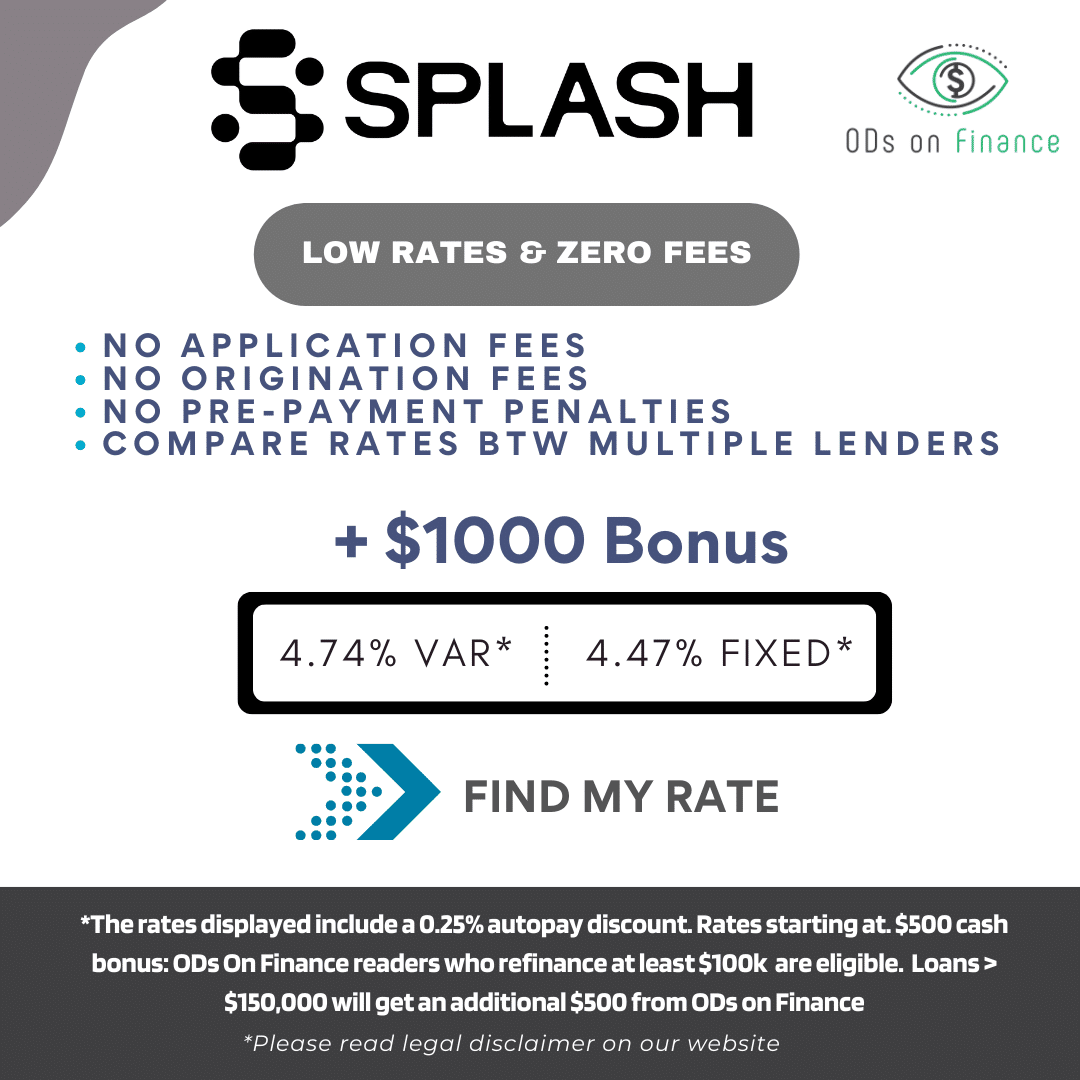

- ✅ Fast and easy rate check without affecting your credit score. No application or origination fees, with no prepayment penalties

-

✅ Forbearance, discharge on death/disability, cosigner release is dependent on individual lenders

- ✅ $500 cash bonus: ODs On Finance readers who refinance at least $100k through Splash are eligible. If you refinance over $150,000, ODoF will contact you for $500 additional once it closes (90-120 Day after your loan closed), but if issues arise, please email admin@odsonfinance.com

Requirements:

- ▶️ Resident okay

- ▶️ All States eligible

- ▶️ Loan amounts: $25,001 to $500,000

- ▶️ Typical credit score: 700+

- ▶️ 2 years of 1099 History required

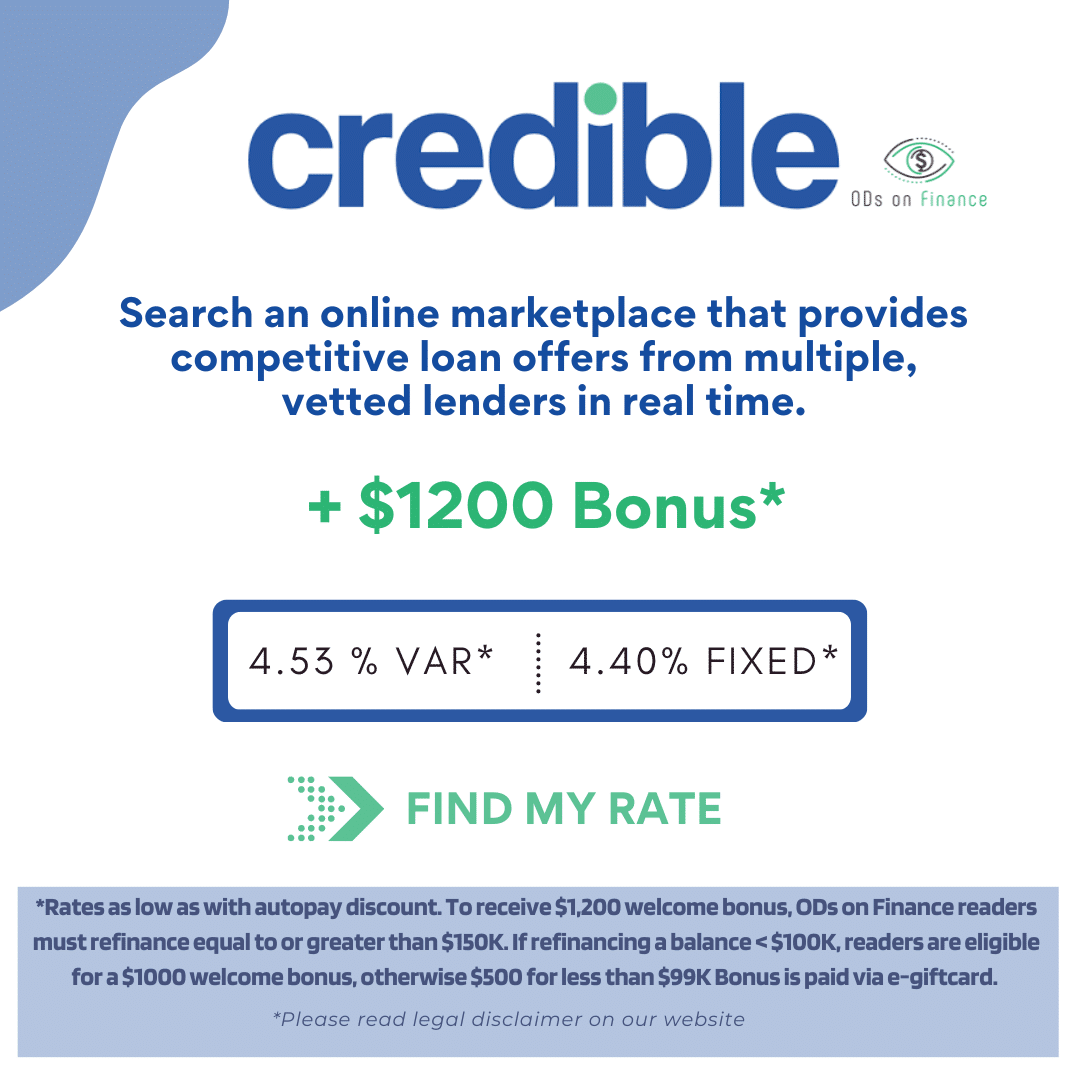

Credible: $1200*

Benefits:

- ✅ Free, fast and able to compare prequalified rates from multiple lenders under 2 minutes, without affecting your credit score. Get a final offer as little as 1 business day! No prepayment penalties, loan application fees, or origination fees.

-

✅ Forbearance, discharge on death/disability, cosigner release is dependent on individual lenders

-

✅ Special Promo: Get up to $1200 bonus for loans over $100K, $500 Bonus if less than $100K loan

Requirements:

- ▶️ Residents Okay

- ▶️ All States eligible

- ▶️ Typical credit score of approved borrowers or co-signers: 700+

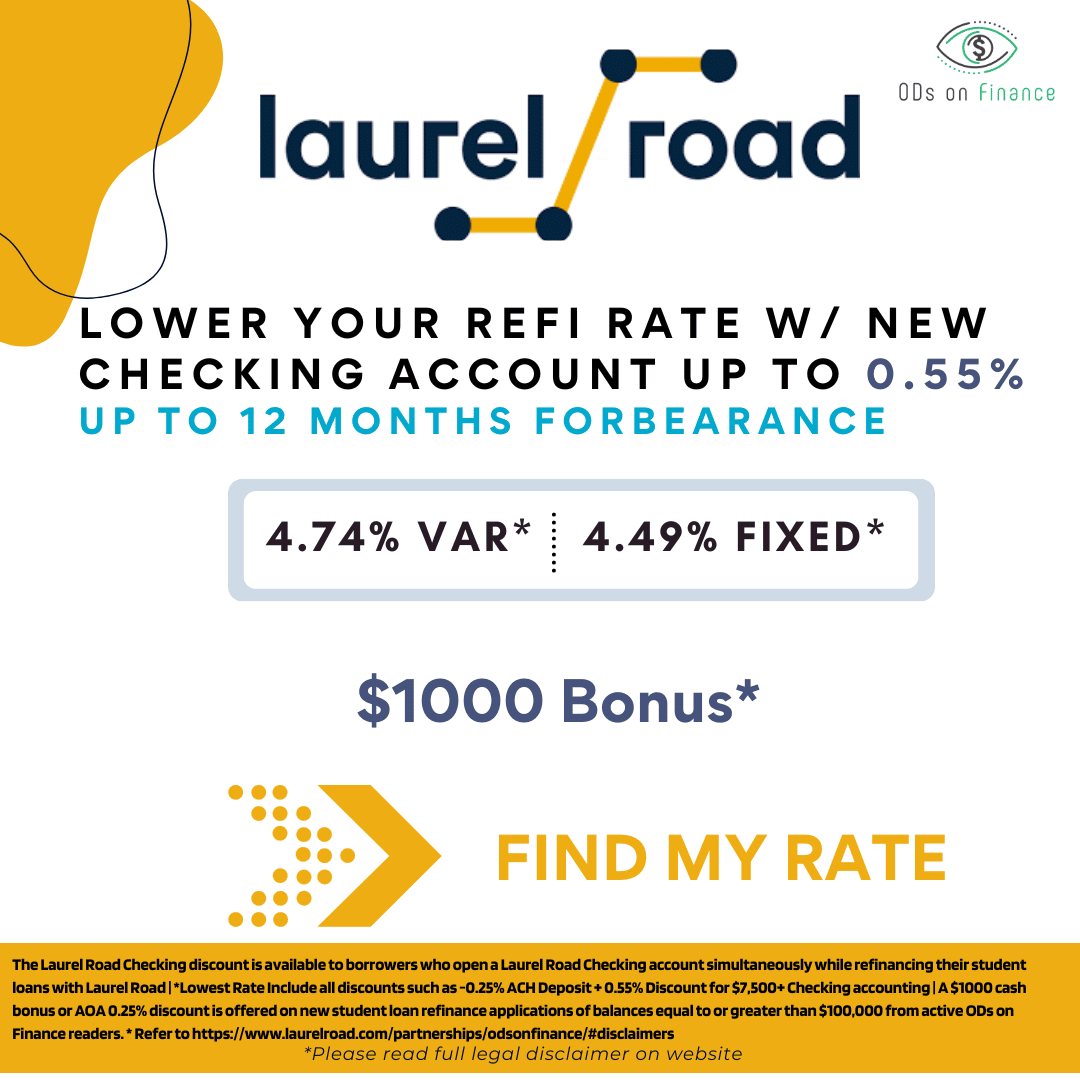

Benefits:

- ✅ $300 for refinancing 50k to 100k, $1,000 for refinancing over 100k†

-

✅ For a limited time, get a $300 cash bonus with $2,500 in direct deposits.* When you open a Laurel Road Checking℠ account during your student loan refinancing, you’ll qualify for an introductory 0.25% off your interest rate for the first 3 months. After that, your interest rate discount will vary based on your total monthly direct deposit amount – you could lower your student loan refinancing rate by up to 0.55%

- ✅ ODs on Finance readers must apply through www.laurelroad.com/odsonfinance to access these benefits.

- ✅ Up to 12 months of forbearance is available†

-

✅ Academic deferment, military deferment, forbearance | Loans are discharged on death or disability | Cosigner release (36 months): YES†

- ✅ Approval: Must be a U.S. citizens or permanent resident. Permanent residents must have a valid I-551 card (green card)

- ✅ Rates as of 12/08/22, rates subject to change. Terms and Conditions Apply. All products subject to credit approval. Laurel Road Terms and Conditions†

Requirements:

- ▶️ All States eligible

- ▶️ Loan Amount: $5,000 up to your total outstanding loan balance

- ▶️ Typical credit score of approved borrowers or co-signers: 650+

- ▶️ 1099: Doctors/Optometrists are underwritten as healthcare employees and as such we do not have a 2 year self-employment requirement

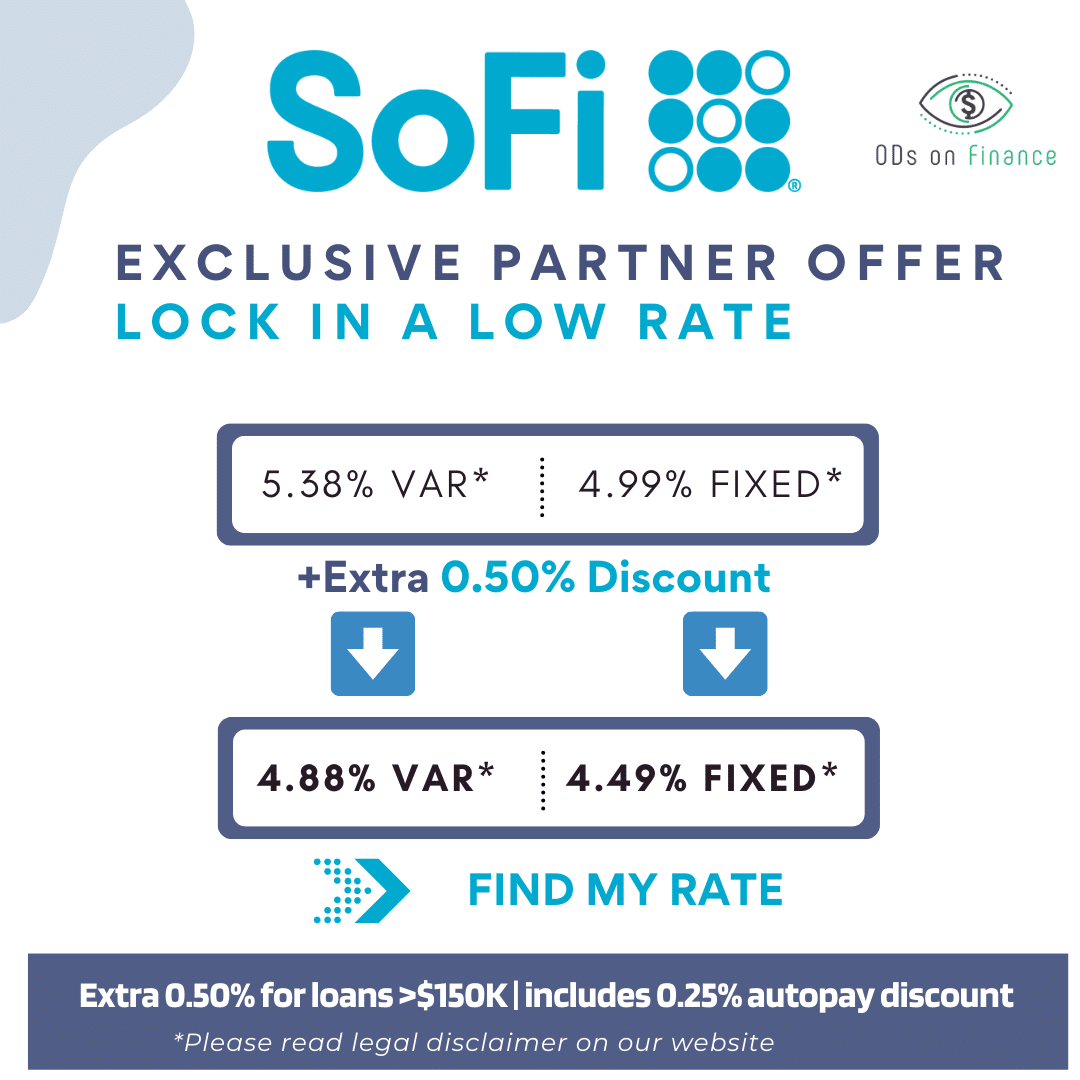

Benefits:

- ✅ No extra fees: No application fees, no origination fees, and no prepayment penalties for paying off your loan early

- ✅ Guaranteed Rate Match: SoFi will offer the lowest student loan refinance rates a qualified borrower finds; if a competitor offers a lower rate, they will match it and give you $100 when your loan is funded for your trouble of having to upload docs and complete the funding process.

-

✅ Academic deferment, military deferment, forbearance | Loans are discharged on death or disability | ⚠️ Cosigner release: No

- ✅ Approval for visa holder (E-2, E-3, H-1B, J-1, L-1, or O-1)

- ✅ *Sofi Legal Disclaimer: Please Read for more details

Requirements:

- ▶️ All States eligible

- ▶️ Loan Amount: $5,000 up to your total outstanding loan balance

- ▶️ Typical credit score of approved borrowers or co-signers: 700+

Benefits:

- ✅ Simple, consistent and transparent which allow you to compare multiple of lenders in under 2 minutes to get the best rate

-

✅ Forbearance, discharge on death/disability | Cosigner release is dependent on individual lenders

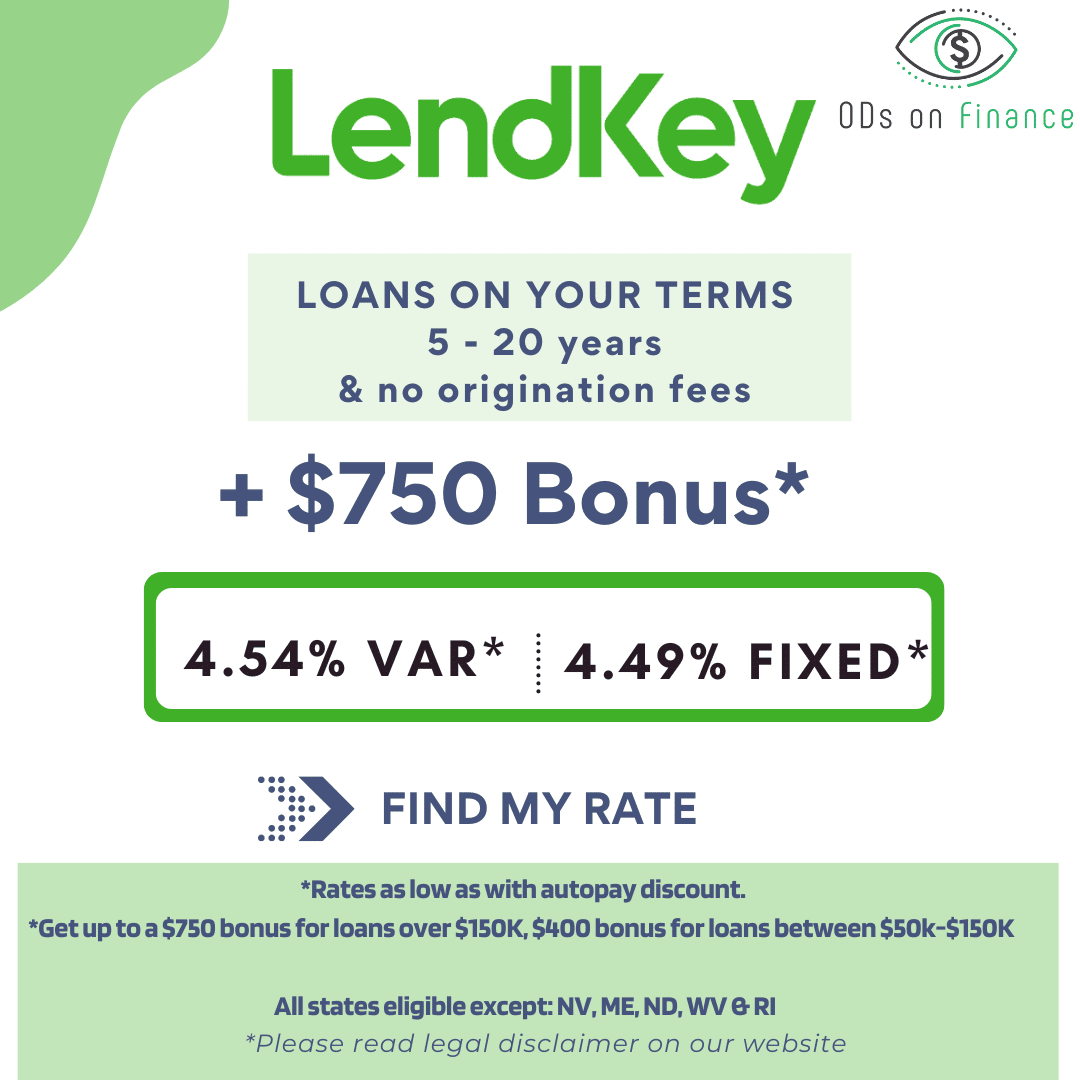

- ✅ Get up to a $750 bonus for loans over $150K, $400 bonus for loans between $50k-$150K

Requirements:

- ▶️ All States eligible except for NV, ME, ND, WV, RI.

- ▶️ Loan amounts: $5,000 to $300,000, depending on the highest degree earned

- ▶️ Typical credit score of approved borrowers or co-signers: 751+

Benefits:

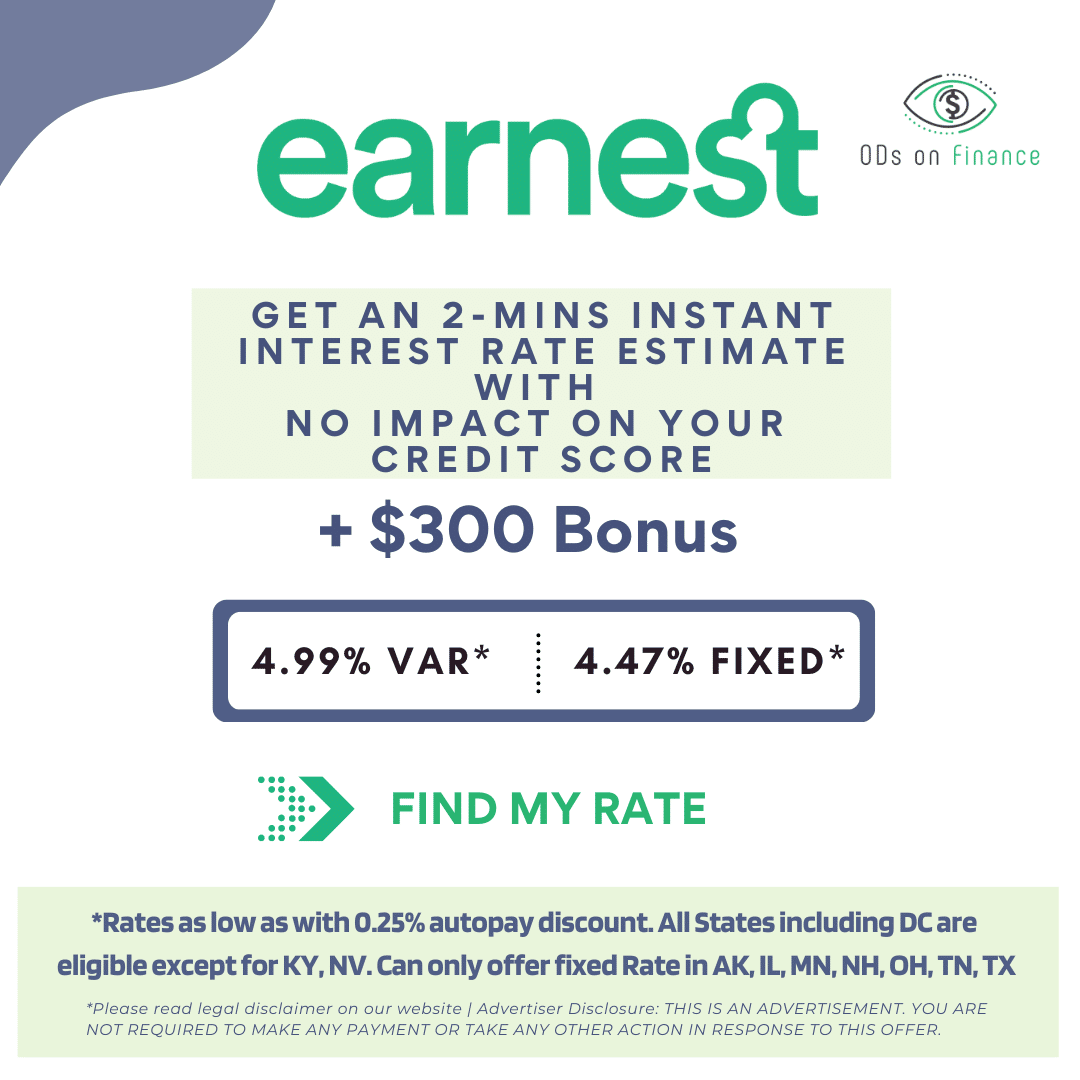

- ✅ Analysis of information beyond your credit score, Earnest can provide an instant rate estimate using data other lenders don’t, such as your savings patterns, investments, and career trajectory—to give you the best possible rate

-

✅ Academic deferment, military deferment, forbearance | Loans are discharged on death or disability | ⚠️ Cosigner release: No

- ✅ $300 Bonus* Must refinance greater than $100K using Earnest via our link

- ✅ Client Welcome Disclosure: Please Click here to read

Requirements:

- ▶️ All States eligible except for NV, ME, ND, WV, RI.

- ▶️ Loan amounts: $5,000 to $300,000, depending on the highest degree earned

- ▶️ Typical credit score of approved borrowers or co-signers: 751+

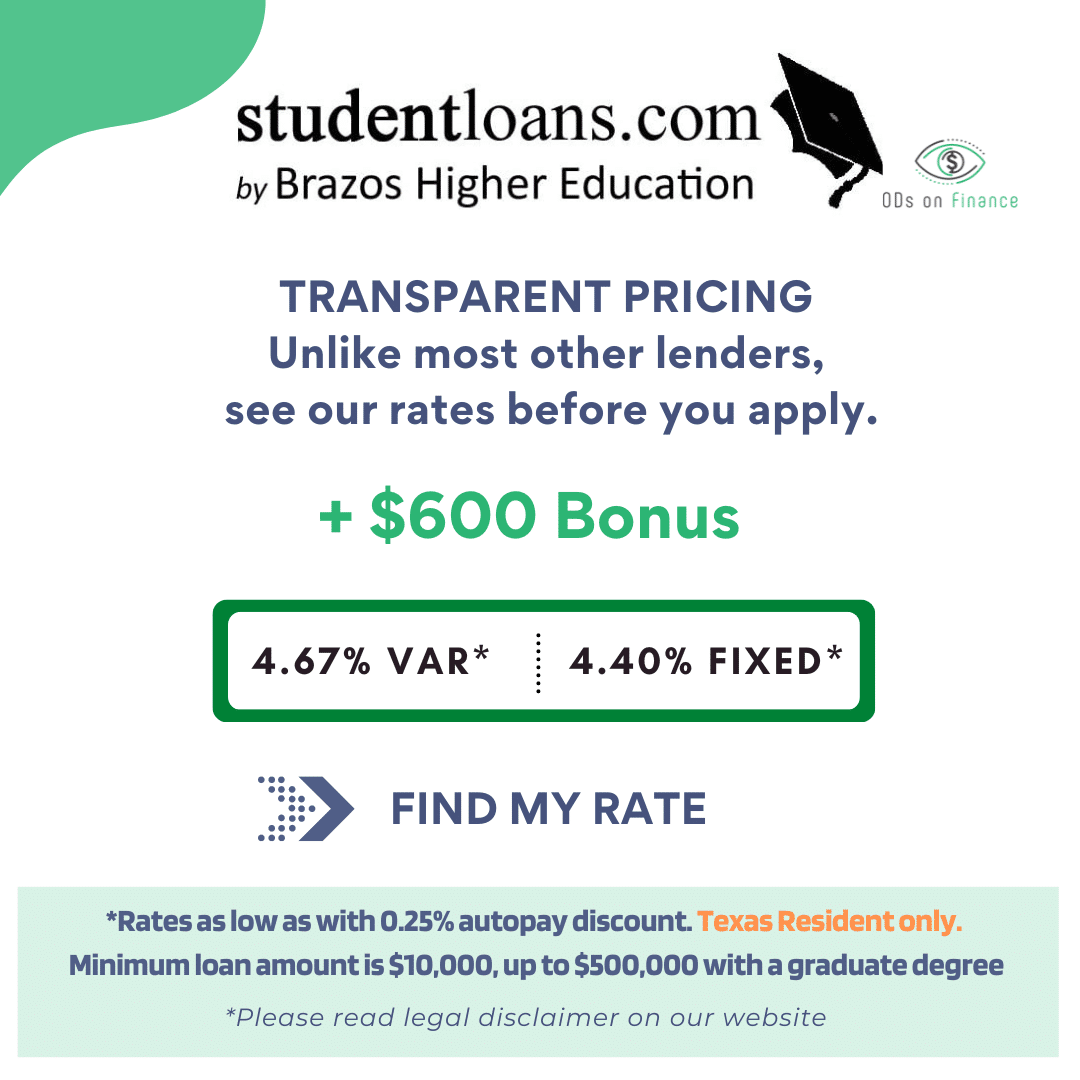

Benefits:

- ✅ No extra fees: Transparent pricing, zero fees, and some of the best rates available due to non-profit status

- ✅ Military deferment, forbearance | Loans are discharged on death or disability | ⚠️ Cosigner release: No

- ✅ *Brazos Legal Disclaimer: Please Click here to Read

Requirements:

- ▶️ Texas Resident only

- ▶️ Minimum loan amount: $10,000, up to $400,000 with a graduate degree

- ▶️ Typical credit score of approved borrowers or co-signers: 720+

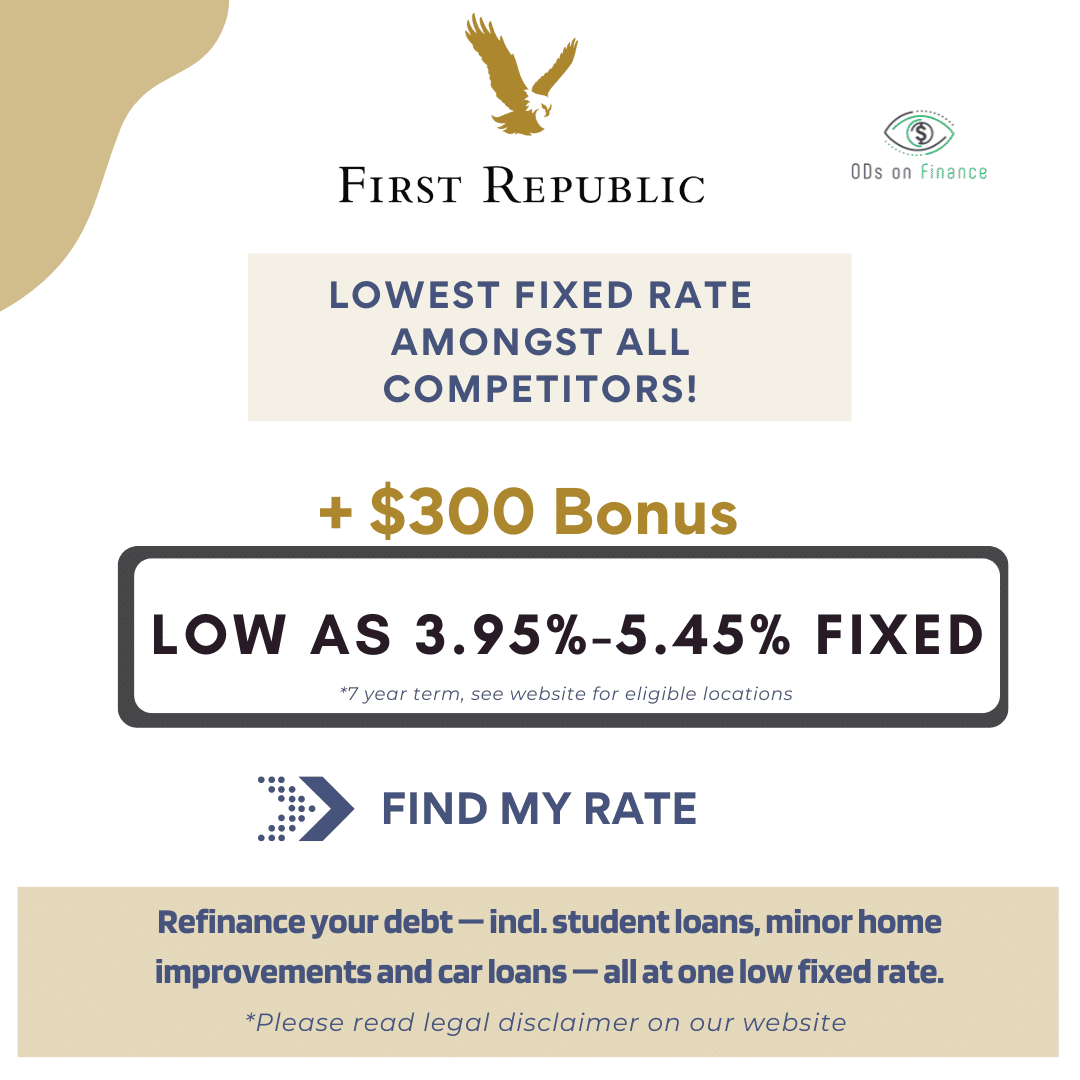

Product Features:

- ✅ Refinance existing debt and have the convenient access to funds with a Personal Line of Credit1

- ⚠️ No forbearance but hardship deferment (up to 1 month) | ⚠️ Loans are NOT discharged upon death or disability | ⚠️ Cosigner release: No

Requirements:

- ▶️ Must Open a First Republic ATM rebate Checking account and maintain a certain balance

- ▶️ Must be near one of its Bank locations: California (Bay Area San Francisco, Palo Alto, Mountain View, Newport Beach, Palm Desert, Los Angeles, San Diego, and Santa Barbara), Boston MA, Portland OR, Jackson WY, Greenwich CT, Palm Beach FL, New York, NY

- Disclaimer: Once you refinance your student loan into a personal line of credit, it will be difficult (or not possible) for you to refinance again with other student refi lenders due to loan type

- ▶️ First Republic Legal Disclaimer: It is quite long, Please Click here to Read 1/2/3

- ▶️ Contact: Ummay Azam | (415) 296-5969 | uazam@firstrepublic.com

GENERAL

CREDIT AND OTHER FINANCIAL QUESTIONS

CASH BONUS AND DISCOUNTED RATE FOR MEMBERS

OTHER QUESTIONS FOR SUNNY | DAT

Any Questions or Concerns, please read Frequently asked questions (FAQ) and as always, please don't hesitate to contact at Admin@ODsonFinance.com