COVID-19’s Impact on the Real Estate Investing, Mortgage Lending Requirements, & Perspective for the On-going Pandemic.

This week’s Live Q&A session, features top mortgage lender, Aaron Chapman and real estate investor Dr. Julie Phan. They address COVID-19’s impact on the real estate market, mortgage lending lending requirements, and offer their perspective on the on-going pandemic.

Our Guests

- We are excited to welcome Aaron Chapman of Security National Mortgage to our show! If you frequent BiggerPockets, you may see his name mentioned by many real estate investors. He is well known by his clients as the “battle -worn partner” that every real estate investor needs on their team. Aaron has helped real estate investors since 1997 to get the loans they need to build a robust real estate portfolio. He is presently ranked #14 in an industry of over 300,000 licensed loan originators for transactions closed annually. He is also a passionate real estate investor himself, owning properties in 5 different states. He enjoys sharing his knowledge in what is going on in the mortgage lending industry and how that’s going to affect real estate investors.

Want to know more about the BRRRR Method? And 5 Steps to Start your REI Journey?

Questions

- In light of COVID-19, my income has dropped to zero, I am on unemployment income and receiving government funding. How will my current financial situation affect my ability to acquire lending in the next few months? 7:40

- What kind of finances do we need to have to get started in real estate investing? How much liquidity/down payment do we need? 14:00

- Regarding COVID-19 effects on the market: Do you anticipate any decreased ability to do refinances on investment properties or tightening of requirements? 16:40

- The Feds have cut rates to 0%, does that mean I can expect mortgage rates to continue to fall? 17:40

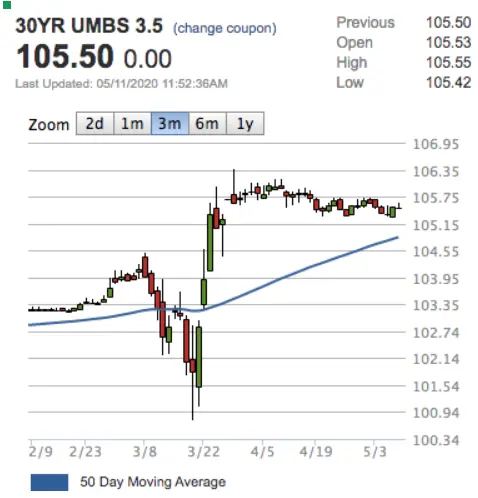

- Trend in the mortgage backed security chart: 25:00

- Is this a good time to purchase a rental property or should I wait for the market to crash? 29:50

- Can you explain what delayed financing is? How are real estate investors utilizing delayed financing in their deals? 33:50

- Tips on a successful cash out refi? What can I do to prepare my property for a good appraisal? 39:30

- With the delayed financing strategy , are there any other acceptable sources of funding your initial buy/rehab besides actual cash or a HELOC. For ex. Can we use funds from other sources? 42:30

- With the current economic conditions would you see a potential opportunities in purchasing long term rental from short term rental owners in certain markets? 44:10

- I have a huge chunk of student loans left - should I pay it down to qualify for mortgage lending? How does my added debt from rental properties affect my financing qualifications for future lending? 47:00

- Should I refinance my property during a market downturn? I.e. if housing value decreases? 48:30

- How important is a mortgage rate when it comes to rental properties? 49:40

- Do you have products for portfolio loans? 54:45

- How often have you worked with investors who start to reach the limit of the number of conventional mortgages that they can get, and how have those individuals expanded their real estate portfolio despite this limitation? 53:38

- Delayed financing can get your money/ cash back before 6 month. You still have to get a mortgage and then pay it off. What am I missing? 59:30

Documents Mentioned:

We hope you enjoy this panel discussion! Click below to listen/watch! Remember to follow Julie's Real Estate Investing Journey on IG @ House_Hustle

Facebook Comments