Annual Report: 2020

Hello ODs on Finance Family,

Well 2020 has surely been a year! Let’s be honest, we all went into the year 2020 with big expectations - but the so-called Year of the Optometrist had some nasty surprises up its sleeve. Despite the trials and tribulations that 2020 brought, it also brought important lessons, and the looming importance of financial education definitely bubbled to zenith when we all scrambled to figure out how to brace for an uncertain future.

All of us at ODs on Finance definitely learned a thing or two during this whirlwind year, and as is our tradition, we aim to be 100% transparent with all our members by publishing an annual report. So let’s get started!

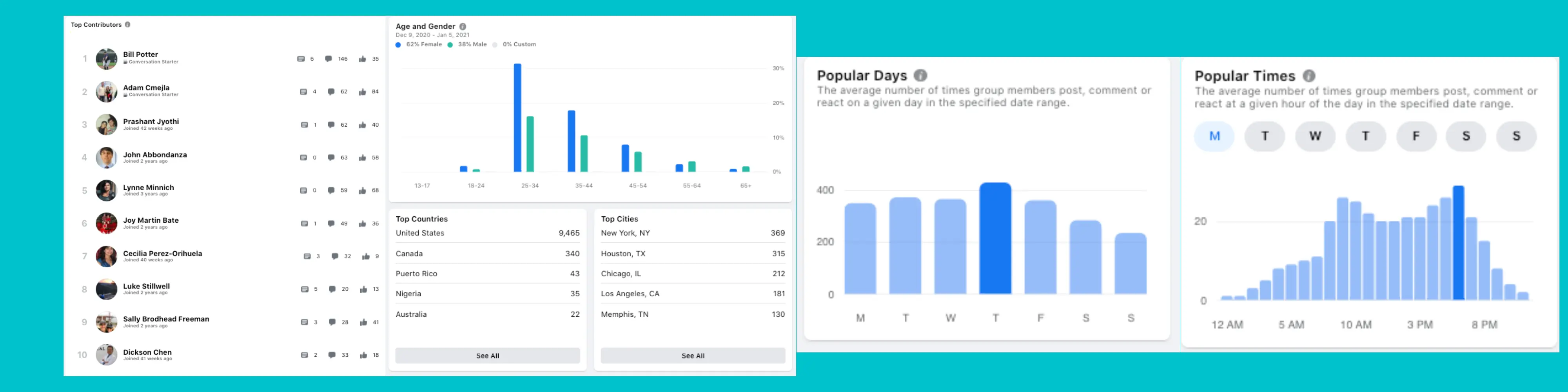

(1) Facebook Group: 45% Growth

Facebook remains our top level of engagement. The Facebook group setting enables anyone to post a question or comment. We have been happy to see steady growth in our membership numbers, however our group engagement numbers tell an even more astounding story. Nearly 95% of our members are actively engaged in the group.

Facebook group statistics point to 20-30% as being the benchmark average for group engagement and 70% engagement being the gold standard for successful groups. We are ecstatic to see such high engagement because it allows for more diverse conversation and more learning. Give yourselves a round of applause!

Here is a list of our top Facebook group contributors (Thank you for taking the time to answer questions!) While many are familiar faces with sage advice, a few new faces have popped up as well. Looks our top cities are New York, NY and our most popular day and time is surprisingly Thursday around 4pm Pacific/ 7pm Eastern time. We love the fact that this financial group is female-dominated community with 62% of our members being female. Definitely beat the stereotype that Wall Street is an old boy's club!

(2) Website: 427% Growth

We are happy to see a monumental growth in our website traffic this past year. While Facebook is the best platform for discussion and questions, the website acts as a library of resources for our members to access. Total and unique views for our website are up drastically, as is our content thanks to more contributions coming from our team as well as new article themes we have added such as our #studentloansuccesstories series.

Talking about the website would not be complete without giving our Co-Founder Dat Bui credit for all the hard work he has put into website building. We’ve added a variety of tweaks and widgets in order for the website to run smoothly and not crash quite as often when under heavy traffic (like when Julie’s PPP article got nearly 30,000 unique views in one day back in April 2020). Being the perfectionists we are, the website will continually be improved as we find new ways to do so.

(3) Instagram: 533% Growth

Our Instagram page saw a complete revamp this year as our team member Julie Phan took the reigns. New curated content was created in an easy-to-digest format (infographics) and interactive stories helped followers learn about new concepts and participate in answering questions. We are so thankful to have Julie’s eye for design and thankful to all of you who have followed the page and helped make it educational, yet fun.

(4) Podcast/Facebook Live Events/Webinars

We continued to hold live events focusing on pertinent financial issues in optometry. We held events with industry experts on topics ranging from real estate investing to practice growth to tax questions, with both optometrists and financial professionals participating in the conversation. The two events with the highest attendance came during the initial COVID shutdowns as a panel of key opinion leaders in optometry gave their opinions on practice recovery, and one of our CFP partners answered questions on the initial CARES act.

The end of the year also brought a new addition to the ODs on Finance platform - Live COPE approved CE lectures. We were happy to host three CE lectures on our platform focusing on practice growth and financials. Each lecture averaged between 200-300 attendees. We are hoping to grow the CE section of ODs on Finance even more this year. If you have a relevant COPE-approved lecture that you would like to give, reach out to us!

(5) Book/Audible

A year and a half ago we released our first book, The Optometrist’s Guide to Financial Freedom. The book was a passion project of both Dat and I, and gives a blueprint for eliminating debt and building wealth. We are happy to announce that total book sales have officially eclipsed close to 1500 copies! Considering how niche the book’s audience is, we could not be more happy or thankful for the response.

(6) List of Recommended Resources

One of ODs on Finance goals was to provide heavily vetted financial professional recommendations for every aspect of personal and practice finance. When we initially took on vetted partners in 2019, we realized it was a huge gamble. We had no idea how our community would receive the promotion of these professionals, and we had no idea what the feedback would be. Fortunately, all these worries quickly became a thing of the past as our members reported great experiences with our partners.

The established trust between our partners and members helped grow our community and the demand to become a partner/sponsor of ODs on Finance. In 2020, we added 6 partners to our platform. The crazy part about this growth was that we had to turn down far more sponsors than what we added!

Our vetting process is broken up into 4 steps:

- Initial email exchange in which sponsor’s motives and background are assessed and researched

- Video call with prospective sponsor (~45 min to 1 hr) in which we discuss company philosophies, get a feel for personalities and ultimately judge fit with our platform

- Subsequent email exchange in which sponsorship details are highlighted and agreed upon. Agreements are Docusigned by both parties and active for 6 month increments.

- Follow up video call (~30 min) to gauge how sponsorship has impacted both sides and if any adjustments need to be made

Below is a list of new sponsors added in 2020 (as well as a list of our OG sponsors from 2019)

2019 and prior

Doctor Mortgage/ReFi

Fairway Mortgage (Josh Mettle)

CPA/Tax Planning:

Caro & Associates (Jose Caro CPA)

Hallows & Co.(Adam Roundy CPA)

Fee-Only Financial Planners:

Hayes Wealth Advisors (Natalie Hayes CFP)

Integrate Planning and Wealth Management (Adam Cmejla CFP)

Term Life/Disability Insurance:

2020

Practice Finances/Tax Planning:

Williams Group (Brad Rourke CPA)

Practice Finances/Revenue Boosting:

Doctor Mortgage/ReFi

Mortgage/ReFi/Broker

Business Loan/Equipment Financing

Student Loan Consulting

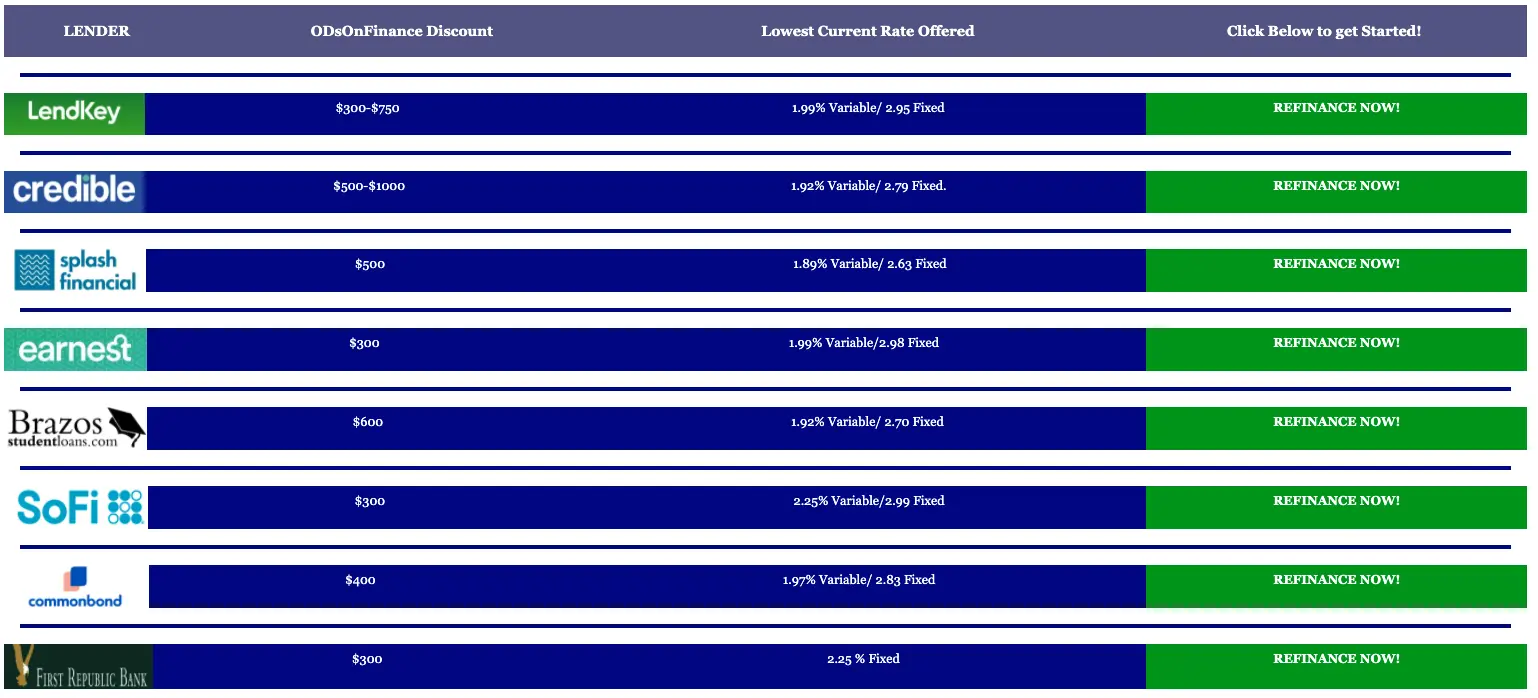

(7) Student Loan Re-Financing

One of the first steps to wealth building and achieving financial freedom is eliminating student debt. A substantial part of our mission is to help ODs understand student loan debt and pay it off as efficiently as possible. Thus, it seemed like a no brainer to create a network of student loan re-fi companies.

So how are we able to get the best possible rates and cash back? Simple, we have a leveraged relationship with each of our re-fi partners since ODs on Finance members are an extremely targeted market for these companies. Over the past two years, tens of millions of dollars of student loans have been re-financed through our partners, thus allowing us to negotiate for even better deals and more cash back. This year we were ecstatic to negotiate our first $1000 cash back deal with one of our re-fi partners. We hope that the rates and cash back will only continue to get better so that we can help new grads and those with student loans get the best rates possible!

Our student loan re-fi page, consistently ranks as one of our most visited pages. Here is a list of our current student loan re-fi partners and the rates/cashback they are offering through ODs on Finance:

(8) In-House Career Consultants

Dr. Chris Lopez has always been a great resource for anything related to employment, resume building and contract negotiation. In addition to being an active member in our community, he has contributed multiple articles on job searching to our platform. With multiple ODs asking for an employment/contract advice, we turned to Chris to be our first in-house consultant.

So far, Chris has helped multiple ODs with complicated contracts and received great feedback. All contract negotiation and career counseling is scheduled through our website and meetings are done remotely through Zoom. If you are looking for advice, schedule an appointment with Chris today!

(9) Annual Financial Report

Income

- Sponsorship Partner/Advertisements

- Amazon Affiliate Program (Recommended Books)

- Affiliate Program

- Referral Fees

- Book Royalties

- CE fees

Expenses

- Paypal fees (allows us to take credit cards)

- Hosting/Domain

- Business Registration

- Book Publishing/Editor/Narrator

- Audio Equipment/Software programs

- Web Design/Graphic Design Software programs

- Zoom Webinar/Calendly

- CE/Non-CE Speaker Honoraria

- Donations to school

As we have stated in the past, ODs on Finance was started with the intention of helping the optometric community get out of debt, build wealth and become financially literate. Although the growth of membership and addition of resources has led ODs on Finance to become a cash flowing business, we still hold true to our initial principals and mission.

While we try to be as transparent and unbiased when it comes to recommendations to our members, we realize the need to disclose any financial relationships or possible conflict of interest for all parties involved.

- We are incentivized to run guest content that relates to our advertisers’ businesses and sponsors.

- We are incentivized to recommend professionals from our list of resources

- We are incentivized to recommend you to read our book

- We are incentivized to recommend products that both Dat and I have developed individually for use or purchase by optometrists

(10) So What’s Coming Up in 2021?

To put it in simple terms, we are extremely excited for all the expansions we hope to roll out for ODs on Finance in 2021. In addition to the expansions listed below, we hope to continue pursuing our mission by releasing new articles, newsletters, posts and creating productive discussion.

(1) Financial Freedom/Practice Excellence Lectures + Scholarship Opportunities

- In 2020, we had the pleasure of visiting 4 schools to give our financial freedom/practice excellence lecture and offer our student audience the chance to win a $500 scholarship by writing up a 1-2 page lean business plan for their future practice. We are hoping to extend this lecture and scholarship opportunity to every optometry school in the US this year. If you are part of a school that we have yet to visit, let us know and we will get a presentation scheduled for you!

(2) More CE lectures

- Our end of the year CE experiment turned out to be a success. Many ODs showed up for both sponsored and paid lectures. We hope to have about 10 Live CE lectures available throughout this next year. All lectures will focus on practice growth and finance in order to align with our mission.

(3) Additional Resources

- We will continue to respond to different requests and needs from our optometric community. We hope to add a few more professional resources, including a practice consultant to our “in-house” consultants roster. Additionally, requests such as a simplified and economical job listing site and other financial tools are being thought through and should be coming out down the pipeline.

(4) Videos/Podcasts

- Traditionally, our YouTube and Podcast accounts have been used to archive Live events. We are hoping to provide a little more content this year by releasing 10-15 minute videos (and subsequent podcasts) on various financial topics. We hope to keep this fresh by having all four members of the ODs on Finance team release content on various topics, as well as bringing on guests.

(5) Practice Ownership & Management Book

- We (as well as many of you!) have noticed the absence of a modern textbook on practice ownership and management. We have begun the process of writing our second book - a full, easy to digest textbook on Practice Ownership and Management. Our trajectory for the book is to write all the basics of practice ownership and also recruit 10-20 contributors that are leaders in our field in order to create a unique read with complete, diversified information. Our goal is to release the book around Q3 2021!

(6)Becoming a LLC

- This one is mainly a bit of bookkeeping. With all the resources and moving parts that are involved with ODs on Finance, we will be transitioning our business entity from a General Partnership (GP) to a Limited Liability Corporation (LLC) per our lawyer’s advice.

As always, we want to thank you for being a member of ODs on Finance. Your presence and participation on the ODs on Finance is what makes the platform so great. We value each and every comment, question and message from our members since they help us grow and cater content for our community. Here’s to a prosperous and successful 2021!

-Aaron and Dat

Want to learn how to build your own portfolio? Check out The Optometrist's Guide to Investing 101

Want to get a full blueprint on How to start? Buy our Book The Optometrist's Guide to Financial Freedom

Want to read Annual Report 2019? Click here

Facebook Comments