8 Financial Mistakes that New Optometrists Make

KEY POINTS:

-

(1) Not Negotiating Enough Pay at the Beginning

-

(2) Not Asking for Annual Raise

-

(3) Not Thinking like a Business Owner

-

(4) Not Taking The Time To Learn Basic Financial and Investing Education

-

(5) Not Knowing How To Manage Their Student Loan Debt

-

(6) Not Living like a Student While in Massive Debt

-

(7) Not Paying Yourself First and Contributing to Retirement Accounts Earlier

-

(8) Not Having a Growth Mindset for the Long Term

The average new optometrist graduates at an average age of 28 year old (significantly behind non-OD peers in terms of income generation), with an average student loan debt of over $220,000+, with little or no retirement investments. Often new grad optometrists find themselves practicing in oversaturated cities and most importantly without any formal financial education. This is the perfect storm that often leaves many doctors mentally overwhelmed and prone to devastating financial mistakes. In this article, we will address 8 common financial mistakes that new OD graduates make and how you can avoid them to be financially successful.

(1) Not Negotiating Enough Pay at the Beginning

Your doctor salary is your financial shovel. The bigger your financial shovel, the more debt you can eliminate, or more cash you can put toward investments. Therefore negotiating a good base pay is vital to your financial success. As a new graduate, you are at the bottom of the pay totem due to lack of experience, but it doesn't necessarily mean you should be taking lowball job offers.

For example, in the Bay Area CA, for 2020, the average day rate for new graduates can range from $425 to $450 depending on modality. However, I’ve received hundreds of messages from new ODs with job offers ranging from $325 to $375 - that is less than a $100,000 annual salary! I often ask them, “Did you negotiate for a higher pay when you signed your contract?” and the sad part, the majority of the responses are “No, I am too scared to offend my future employer”.

Sorry to be blunt, but if you are a shy and passive optometrist who is too meek to know their true value as a doctor, then you will be taken advantage of. Talk to your fellow optometrist peers around the area to compare what the fair starting market value is for a new graduate and negotiate from there. Learn to be an excellent negotiator and know what benefits to ask for (such as 401K match, CE educations, health insurance, etc.).

Let do a quick comparison:

Let's do another scenario. Let’s say Timid Tim works extremely hard over the next 5 years to increase the office production and get a bit higher yearly raise at 5%, his annual salary after 5 years is only $104,250, $19,250 per year less than Successful Sally.

The takeaway is as a new graduate, or for any job position, know your fair market comps. For a typical optometrist salary, know your own value as a doctor, what you can bring to the office and how to negotiate.

Want to learn how to get a higher pay? Check out The Art of negotiating and How to Excel where most Job Candidates do not

(2) Not Asking for Annual Raise

Let's talk about inflation for a bit. The average yearly inflation is around 2-3%, which basically means today’s $100 dollar bill (in 2020) can only buy $97 worth of stuff in 2021. This means that an optometrist’s salary needs to increase at least 2-3% PER YEAR to adjust for a higher cost of living expenses.

It always blows my mind when I get hundreds of messages from optometrists complaining about their salary at an office that they've been working there for 3+ years and the first thing I ask is, “Did you ever ask for a raise each year?” Their jaws usually drop, shocked that I would suggest such a thing because they don’t want to be too greedy.

Remember that your employer has absolutely no incentive to offer you more money just because. So if you don’t ask for a raise, then don’t expect one.

-

(1) Keep track of all the projects you accomplish throughout the year, such as helping to increase production, website development, social media, staff training, etc. Your employer has his or her hands full trying to run the practice and often appreciates the reminder of all your accomplishments.

-

(2) Ask for a quarterly semi-casual touch-base where both parties can have a sit down and assess your progress and goals to improve for the following quarters.

-

(3) At the end of the year, usually early December, send a formal email listing all your past accomplishments, how you improved production and/or efficiency of the office, goals for next year, and proposed new day rate and any additional benefits such as more PTO or CE allowance.

-

(4) Schedule a one-on-one meeting where you and your employer can discuss each bullet point in more detail within the email.

-

(5) Ask for a standard cost-of-living wage increase of 2-3%, then the rest will be performance-based. This performance raise usually can be an additional 2-8% production raise or a simple one-time cash bonus for the year.

-

(6) Be honest when it comes to your own self-evaluation and be mindful of the office’s overall production. If the office had a bad year due to loss of business like a COVID-19 shutdown, then consider asking for a lower amount.

-

Bonus Tip: I usually ask for a higher amount, and expect my employer to meet me halfway. A successful negotiation is when both parties leave the table equally satisfied, content and most importantly, not bitter.

This doesn’t only apply to new graduates, because I have seen experienced optometrists who are sadly 5+ years out at the same location with the same stagnant pay as many new graduates. Why? All because they didn’t ask for a yearly raise.

(3) Not Thinking like a Business Owner

I have a lot of respect for my practice owner colleagues, because it is extremely difficult to run a successful practice; especially due to lower reimbursement from vision plans, increasing competition from online retailers and high overhead costs. With that being said, it always pisses me off when I see self-entitled, lazy optometrists who literally clock in and out, stay in their exam room watching youtube videos all day demanding a raise. THAT IS NOT OKAY!

The biggest financial mistake you can make as a new graduate is NOT thinking like a business owner. Ask yourself:

- What can I do to make my employer’s life easier?

- How can I increase production?

- How can I help the office grow?

If you have the same financial mindset as a business owner, then you understand being an amazing eye doctor is not enough - take on additional projects to help the business grow and why we need to push sales to increase net production.

Think like a business owner, be that rockstar associate OD so when it is time to ask for a raise, it is easier for your employer to give you the extra boost in pay, rather than risk losing you as a highly valued associate.

(4) Not Taking The Time To Learn Basic Financial and Investing Education

Optometry school taught us absolutely nothing about personal finance or how to properly invest. So it is no surprise that the typical new graduate is naive from a financial education point of view. Don’t worry, I didn’t even know what a 401K was when I graduated from SCCO back in 2015!

Similar to CE education about the latest glaucoma treatment, we must also educate ourselves on how to manage our budget, how to pay off debt and how to invest. This is how we get out of the rat race and away from living paycheck to paycheck. This is what separates the optometrist who has a financially fruitful retirement nest egg, compared to the optometrist working well into his or her 70s. Trust me that 70+ year old optometrist ain’t doing random fill-in shifts because they enjoy seeing patients, the majority of the time it is because they don’t have enough saved up.

Think about this, just learning to live on 50% of your take home pay, and investing the rest, an optometrist can easily invest $50,000 a year. In less than 2 years, they can have $100,000 in investments. Just putting that in a simple SP 500 Index fund making 10% a year, that is an instant passive $10,000 per year. That is 20 to 25 days of patient care a year that you don’t have to work moving forward. Why grind for 6+ days in your 50s or 60s when you can have enough passive income to support you?

With the unlimited free resources out there, whether it be books, audiobooks, podcasts, and youtube; there is no excuse to start learning. Listen to a financial podcast on your commute, read a book during your lunch, listen to an investing audiobook during your run, the possibilities are endless.

Need some Books to Read? Check out Recommended Books/Podcasts

(5) Not Knowing How To Manage Their Student Loan Debt

I know that a $200,000+ student loan debt is scary as a new OD graduate, but the worst thing you can do is stick your head in the sand and ignore it.

If your student loan debt is less than $250,000 and you are making at least a $100,000 salary; then 90% of the time the right pathway is as follows:

- Live on a budget

- Refinance to a lower rate with a private lender

- Try to finish off that massive debt within 5-10 years.

If your debt to income is greater than 3:1, then seek a professional financial advisor like Student Loan Planner who specializes in only student loans to see if 20/25 year total loan forgiveness is the right path for you.

Whatever your financial situation might be, your first month after you land your first paycheck is to come up with a financial game plan for your student loans as soon as possible.

Want to get $1000 Bonus and the lowest Refi Rate? Check out Student Refi Lenders

(6) Not Living like a Student While in Massive Debt

“Doctor lifestyle creep” can be one of the most financially devastating factors to a young optometrist’s career. I get it, you were a broke student for 8+ years and now that you got your first paycheck, you want to spend it enjoying life. I mean it is what society and your family expects of you as a “rich doctor” right?

WRONG, with a typical negative net worth of -$250,000, you are broker than the local homeless dude living under the bridge.

The good news is you have a pretty big shovel (aka your doctor’s income) to dig yourself out of debt. Just learn to live like a student for a few years, live on less than you make, sacrifice for a few years, and enjoy the benefits later on in life.

(7) Not Paying Yourself First and Contributing to Retirement Accounts Earlier

As fairly “young” doctors, the greatest advantage that new graduates have is TIME. Time to let your portfolio grow exponentially due to the magic of compounding. I know we pound the drum over and over again, but the best time to start investing, especially retirement is YESTERDAY.

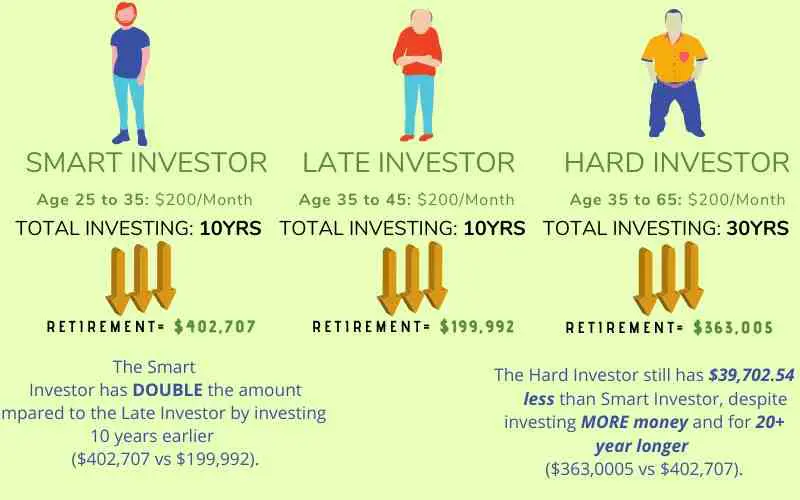

Example: Let’s look at 3 different doctor investors in this example. Doctor A is a Smart investor, Doctor B is the Late Investor and Doctor C is the Hard investor. Let's assume a typical 7% market interest rate.

-

At the time of retirement age, which is 65 years old for all three investors, we can see a few surprising results:

-

(1) By simply investing earlier at Age 25 (10 years before the Late Investor), the Smart Investor has DOUBLE the amount compared to the Late Investor ($402,707 compared to $199,992).

-

(2) The Hard investor started saving at Age 35 (10 years behind Smart Investor) and even though he tries to catch up and tried to save an extra $200 per month until he retires at 65 years ago. The Hard Investor still has $39,702.54 less than Smart Investor ($363,0005 vs $402,707).

-

(3) In addition, the Hard Investor put in more time and thus more money contributions compared to the shorter investing time by Smart Investor (30 years vs 10 years).

-

The moral of the story is that the sooner you start investing, the more time your money can work and grow. So it doesn’t matter how little you can contribute each month, even a measly $100 a month as a new OD resident can give you a boost. The goal is to start earlier and get into the habit of paying yourself first.

Financial Pearl

"Want to spend your money guilt-free and hate tracking your money? Consider developing a strategy called a REVERSE-BUDGET in which you pay yourself first. Once a month when you get all income via paycheck, immediately send it to your 401K/Roth IRA, monthly FIXED Expenses such as rent and student loan payment, in addition to other short-term investment vehicles. Then whatever is left over, that is all yours to spend GUILT-FREE on whatever you desire, even if it is for that Coachella ticket. But a word of caution, if it is running low toward the end of the month - it's time to start packing those sandwiches for work!"

(8) Not Having a Growth Mindset for the Long Term

Personally, I have actually pivoted my own financial mindset recently this past year. While I still believe that having a solid foundation rooted in stable low-cost index funds and budgeting is vital for new investors, one can often be too conservative or safe in their investing.

A big mistake that many young ODs can make is being too cautious with their career choice or investments. For example, young ODs might opt to work for a lower paying “safer” associate FT position for 5+ years vs taking the risk to open their private practice, which can potentially accelerate their earning potential (of course if ran properly).

For others, it might be not taking the risk to pursue/open that side business that you were always passionate about because it was too financially risky. This can expand to many other life examples such as having too many bonds in a portfolio or GASP! ...Too many index funds/ETFs??? Blasphemy!

The point that I am trying to cultivate is that IT IS OKAY to take more risks financially and career-wise. It is okay to leave that high paying retail associate position that you hate for a lower paying private office position if it opens up an opportunity for partnership. It is okay not to work that extra 6th day of OD fill-in to pursue your side business.

The key is that once you have all your financial ducks in a row, you are not living paycheck to paycheck, which in turn can allow you to take more “risky” and well-analyzed future endeavors that can pay off massive dividends in the future.

Remember that it is often okay to fail and even lose money because you have TIME on your side which will allow you to recover. There are multiple stories of successful billionaires that have gone bankrupt with their numerous businesses, but the key is that they are able to recover and start over simply because they were younger. Obviously, if you are nearing retirement, err on the more conservative side.

Summary

As a new OD graduate, you have so many negative factors working against you that can often feel overwhelming. I made the 8 financial mistakes listed in this article when I graduated in 2015, from getting low balled at $325 per diem due to lack of negotiation, to not knowing what a Roth IRA was, to spending a majority of all my 1st year paycheck trying to live the “doctor’s lifestyle”.

If you can avoid these 8 financial mistakes as a new graduate, then you will be significantly ahead financially compared to your fellow peers. Happy investing and cheers to financial freedom!

Want to learn how to build your own portfolio? Check out The Optometrist's Guide to Investing 101

Want to get a full blueprint on How to start? Buy our Book The Optometrist's Guide to Financial Freedom

I’m a 4th year student graduating in May. Your advice and notes are helping me so much!