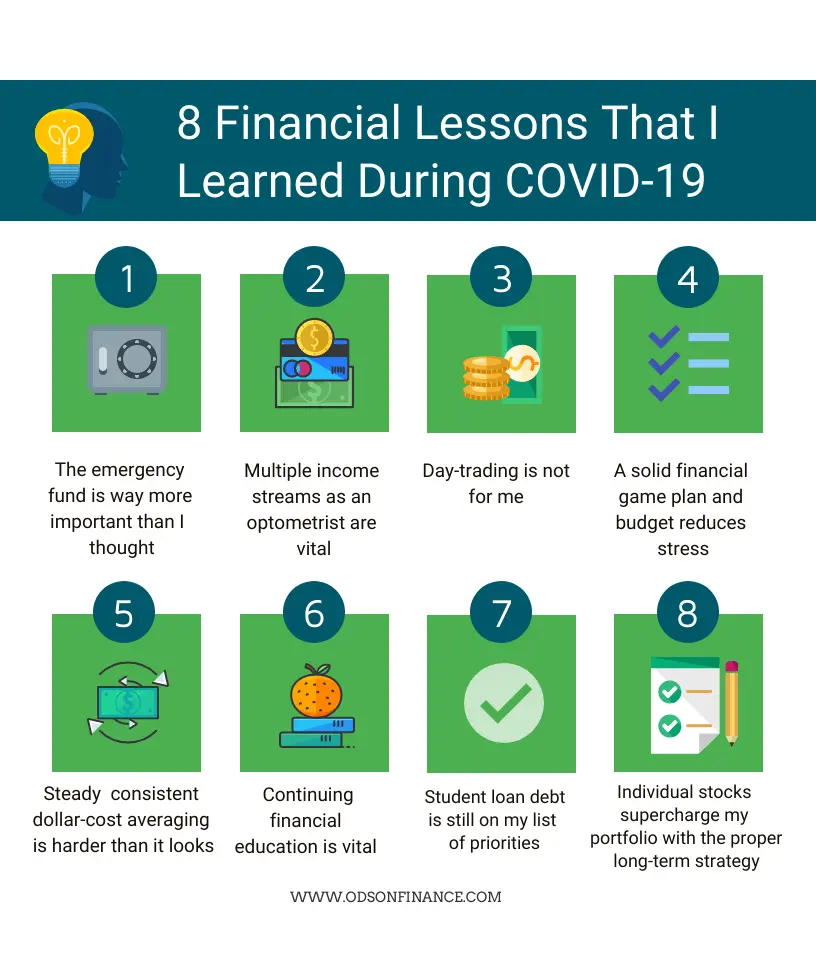

8 Financial Lessons that I Learned during COVID-19

KEY POINTS:

-

(1) The emergency fund is way more important than I previously thought

-

(2) Multiple income streams as an optometrist are vital

-

(3) Day-trading is not for me

-

(4) A solid financial game plan and budget reduces stress

-

(5) Steady and consistent dollar-cost averaging is harder than it looks

-

(6) Continuing financial education is vital to help you prepare for success

-

(7) Student loan debt is still on my list of priorities

-

(8) Individual stocks supercharge my portfolio with the proper long-term strategy

As we approach the end of August, we have experienced the worst market down-spiral in mid-March since the 2008 housing recession, with a -20% stock market crash. Luckily, year to date (YTD), the S&P 500 index has recovered nicely to roughly baseline. While we are not out of the woods yet, I have learned some important financial lessons, both as an investor and as an individual during this once-in-a lifetime catastrophe. Here are 8 things the pandemic has taught me.

(1) The emergency fund is way more important than I previously thought

Many financial experts recommend a solid 3 to 6 months emergency fund (in expenses) to prepare specifically for financial catastrophes such as a job loss and medical emergencies.

In the past, I always thought it was crazy to have that much cash (hello 2-3% inflation?) and have always leaned more toward 3 months and quite honestly even sometimes as low as 2 months in the past. My reasoning was that healthcare (specifically optometry) is a pretty stable job. Hey, everyone still needs glasses, even in a recession.

I also thought, if I lose my full-time job, I can always do fill-in or worst, move to the middle of Alaska to work. Second, my family is one town over, and I can always crash at their house if needed. Worst comes to worst, I can always liquify my stock portfolio within a week or so. Hence, most of my capital was in the stock market to produce the most profit.

But heck, I never expect the economy to just simply…freeze. During the early days of COVID when the market was tanking and optometrists were getting laid off, I quickly started to try to figure out how to tap into accounts to get more cash, so I can build up my emergency fund to a solid 6 months. While I didn’t panic, I did have to put a hold on investing to save up. Now I will always have a solid 6-month emergency fund at all times.

(2) Multiple income streams as an optometrist are now more vital than ever

As the mass majority of us were completely furloughed, laid off or had our hours reduced, we realize that healthcare isn’t as recession-proof as we once thought. The idea that there is complete financial security in healthcare is a myth. During the COVID-19 crisis, I realized that I needed to expand current or create new streams of multiple revenues. I cannot just rely on my OD salary.

I currently have around 4 outside streams of revenues which include stock investments in taxable accounts, doing online surveys, consulting and probably the most impactful, which is blogging on ODs on Finance. In the near future, I hope to increase to ideally 7 streams and try to dabble in real estate rentals (pending) or maybe even a completely different business. The ideas are limitless but execution is key.

But no longer can an optometrist simply thrive on just his or her doctor’s salary, so I strongly believe that if you haven’t begun to diversify your streams of income, start today.

Want to learn how to start your own passive income? Check out The Optometrist's Guide to Side Hustles

(3) Day-trading is not for me

What is Day Trading?

Simply put, day trading is basically speculation in stocks, determining whether a stock will go up or down. A trader must close that position either before the market closes (day-trading) or within a set of days/months (swing-trading). They often use a high amount of leveraging via options and short-term strategies to capitalize on small price movements, in order to make a profit. This is considered much higher risk and often is not considered investing

During the abundance of free time of working from home, I wanted to learn more about how day trading actually works. Anyways, I did what I normally would do with any projects that involve money, I educated myself through books, podcasts and financial articles. Once I was done with my “education”, I went through a trading stimulator. After 2 weeks, I realized a few things.

- (1) I hated analyzing charts to see where price movements would be. Identifying “candle-stick” patterns were so boring and I was not very good at it.

- (2) When I accomplished a big win, it was addicting. Instead of collecting the profit, I wanted to risk it more. I felt invincible and it was scary.

- (3) I was glued to my iPhone and computer almost all hours of the day, watching each price movement. Even with swing trading over a course of days, I was constantly checking the stock market. My fiancé wasn’t too happy.

Lastly, I realize I am a pretty boring and low-risk investor. I like stability and analyzing financial reports and actually learning about the fundamentals of the companies that I invest in. While I have a lot of respect for successful traders who can do it full time, it just doesn’t fit my personality so I am perfectly content with my low-cost index fund.

(4) A solid financial game plan and budget reduces stress

Most optometrists are trained to be well-organized, well-prepared and usually have their whole lives all planned out. Our whole educational journey from undergraduate to end of optometry school requires so much planning and preparation, so it always blows my mind when an optometrist doesn't have a solid financial plan in place.

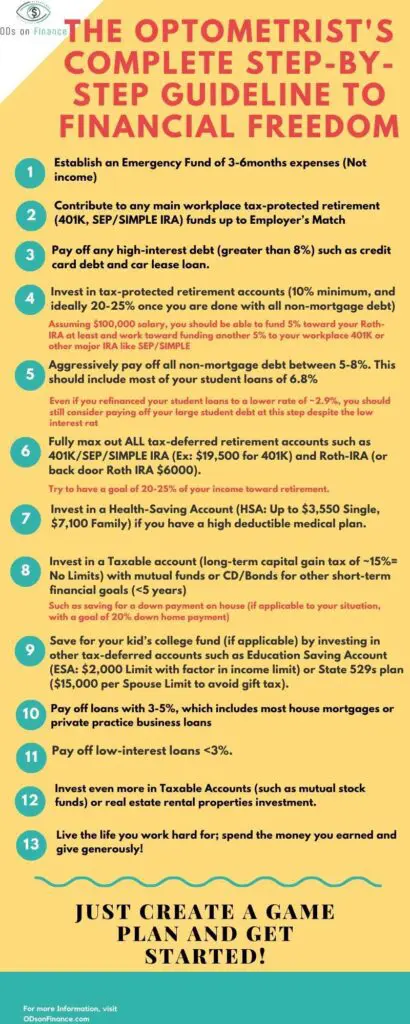

When COVID-19 hit, I already knew how much was in all my accounts, my monthly budget, and what my list of priorities were. Here is a quick step-by step guideline for my own personal plan (Left side)

Prior to COVID-19, I was currently doing a mixture of Step 5 (aggressively paying off all student debt, despite interest rate) and Step 6 (trying to max out all my 401K and Roth IRA). When the market spiraled down and my clinic was preparing to go on lockdown, I knew exactly how much I needed each month to survive and pay all my required bills and where all my capital/assets were held at.

Having a well-prepared written financial game plan can significantly reduce stress and limit any mistakes during time of emergencies.

Want to learn how to learn how to create your own financial plan? Check out A Complete Guideline Step-by-Step for the Optometrist

(5) Steady and consistent dollar-cost averaging is harder than it looks

I started my investing career back in 2016 at the age of 28 year old and never been through a major economic recession before. I must have read close to 50+ investing books that always preach index funds and consistent investing through the highs and lows of the stock market. So I always mentally told myself that I would never panic and sell if I experienced a 30-40% drop - like investors during the 2008 housing recession.

But man, the COVID-19 market crash of 2020 was tough to bear through, especially as it continues on going lower for close to a month. March and April was agonizing because in addition to uncomfortably seeing my whole portfolio which consists of S&P 500 Index stocks dropping 30% in a single week; I also continued to dollar-cost average and invest 25% of my paycheck into my 401K and a set amount in my taxable brokerage every 2 weeks. It was painful watching my hard-earned money go up in flames the moment it hit the market.

It took every ounce of energy and financial words of wisdom that I learned during my financial training to keep on going. While we are not out of the woods, I am glad that I did not panic sell in Mid-March or else, I would have missed out on the 30% gain over the next few months.

The famous saying that “An investor’s behavior is more significant than choosing the right funds or stocks” have never been so true during a major crisis.

(6) Continuing Financial education is vital to help you prepare for success

With the abundance of free time that COVID-19 allows me, I made it my mission to read every single investing book out there. I purchased close to 10+ investing books on Amazon; some were on Audible, ranging from topics such as personal finance books on budgeting, index funds, individual stocks, growth stocks, behavioral investing, words of wisdom from famous investors and even the “taboo dark side” that is day- trading.

These last few months of educating myself by reading great financial books have made myself a much better investor and allow me to analyze the market trends more efficiently.

(7) Student loan debt is still on my list of priorities

When the CARES student relief bill was passed in March (and likely extended to end of 2020) allowing for 0% interest and automatic forbearance for federal student loans, many optometrists saw this as a “complete free pass” to not worry about paying off their student loans.

During this time, prioritizing your cash emergency fund and maybe even fully funding your retirement such as 401K/Roth IRA, makes more sense mathematically, than paying off a 0% interest student loan. But it’s often too easy to forget about our debts when life starts to get busy until it finally balloons to a ridiculous amount.

If you can manage it with your monthly cash flow, at least try to continue paying the minimal required student payment of $1,500 or so a month to keep you on track.

I always find it interesting when people argue back that they can take money from not paying off low-interest debt and trying to invest instead for a higher return. While that is possible, honestly most people, including myself, will usually end up spending it.

(8) Individual stocks supercharge my portfolio return with the proper long-term strategy

We always advocate having a solid foundation of low-cost index funds for any successful investors. We like to think of this as the “basic level one” in investing. Can a portfolio of index funds be successful on its own? Absolutely!

While I do have the majority of my portfolio in index funds, investing in additional individual stocks has allowed me more flexibility when it comes to asset allocations and strategy.

Disclaimer: To be a successful individual stock investor, you have to be able to critically assess the value of how much the company is worth and keep up with current events and quarterly earning reports of that company. This often causes significant stress and time for beginning investors. But if one can correctly invest in the right company, like the next Google or Apple, then obviously the earning potential will be significantly great!

However, with all of that being said, investing in individual stocks is not for everyone and it is NOT EVEN NEEDED to be a successful investor. For the majority of investors, we recommend sticking with low-cost, passive stock index funds, as the core of your portfolio and you will do great!

Look, I love the S&P 500 index fund which consists of the top 500 US companies. But unfortunately, by nature, the index will also include restaurant, retail, hospitality (travel/hotel), and airline stocks which have all been devastated by COVID-19 and likely will either go out of business or will take 3-5+ years to recover to normal.

But will tech sectors like digital, software, telecommunications, E-commerce suffer? Probably not, and if they do suffer, they will definitely experience less losses compared to other sectors.

While I still dollar-cost average in my retirement 401K/Roth IRA with index funds, because it is long term and is less risky, I do pivot a majority of my taxable brokerage account toward more tech stocks or Tech Sector ETF funds.

Since the beginning of 2020, my retirement accounts (mainly S&P 500 index funds) returned -3% as of today, but my taxable brokerage (which contains Amazon, Apple, Facebook, Google, Nvidia, Intuit along with other Chinese tech giants) have returned close to 28% for the year.

Will this continue to beat the index fund all the time? HECK NO!

But being an individual stock investor especially with a long-term mindset, will allow us to invest in great well-run business for the long term by choosing the best performers and limiting the losers.

Want to learn how to build your own portfolio? Check out The Optometrist's Guide to Investing 101

Want to get a full blueprint on How to Invest in Individual Stocks? Check out our list of Recommended Books/Podcasts

Summary

If there was one lesson that perfectly summed up what the coronavirus pandemic has taught us about finance is to “expect the unexpected”. Even the smartest economic experts couldn’t have predicted this crisis and how much it has negatively impacted our society, both from a fiscal and social point of view.

The same lessons that we advocate when we start ODs on Finance back in 2017 still hold true today. By building up our emergency funds, living within our means, diversifying our profits by having passive streams of income, consistent and long term mindset and finally having a solid financial game plan, we can better protect ourselves against whatever curveballs life decides to throw our way.

Related Articles

- « Previous

- 1

- 2

- 3

- 4

Facebook Comments