8 Dos and Don’ts When Purchasing an Optometry Practice

KEY POINTS:

-

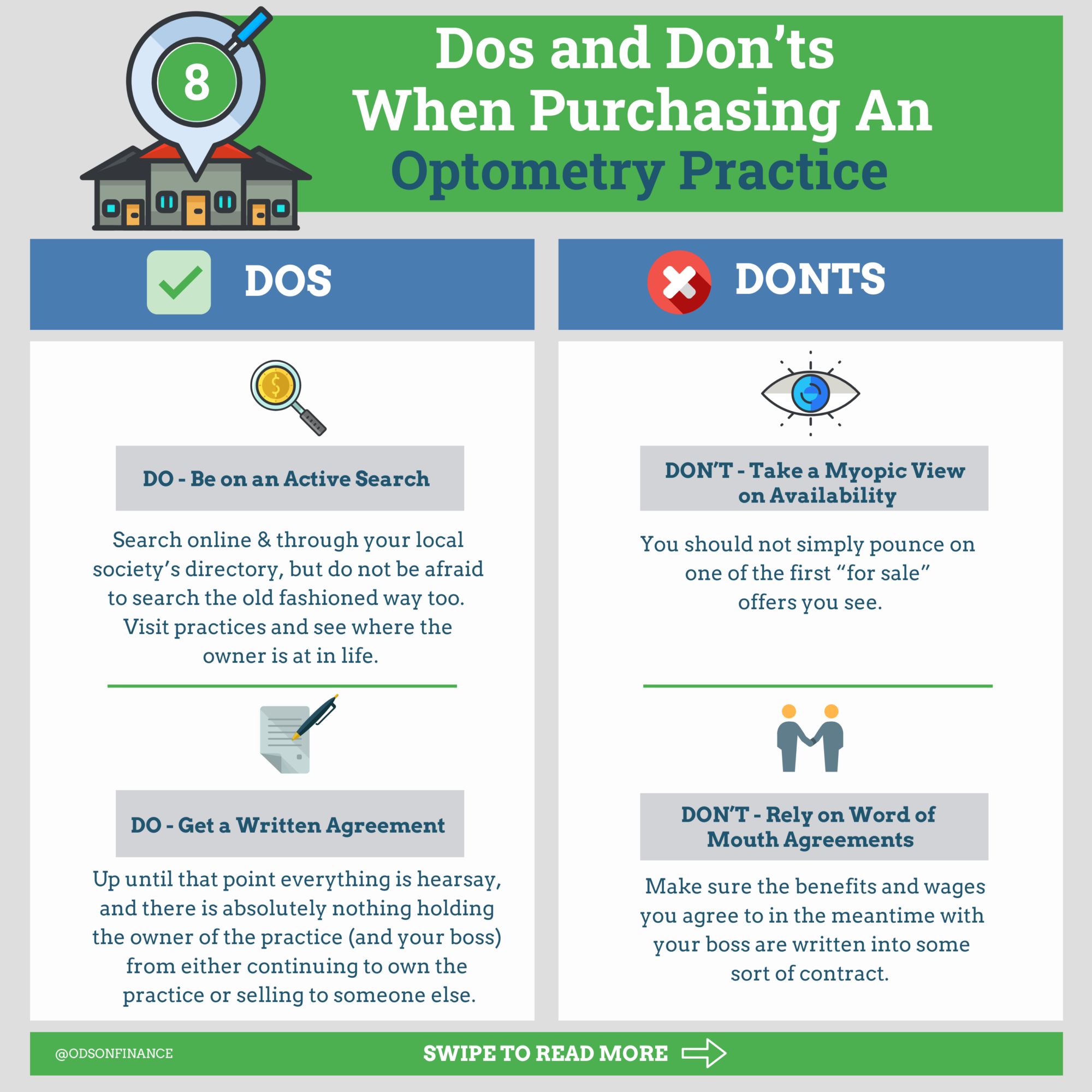

(1) DO - Be on an Active Search if You are in the Market to Purchase

-

(2) DON’T - Take a Myopic View on Availability

-

(3) DO - Get a Written Agreement if You’re Working from Associate to Owner

-

(4) DON’T - Rely on Word of Mouth Agreements

-

(5) DO - Perform Due Diligence

-

(6) DON’T - Jump in prematurely

-

(7) DO - Understand that Changes will Probably Need to Be Made

-

(8) DON’T - Let Old wounds Fester

Practice ownership is often heralded as one of the pinnacles of an optometric career. Having ownership of a practice often allows for higher income, and more importantly: freedom and autonomy to practice as one sees fit. In my career, I have had the privilege of buying my own practice as well as helping others through the buying process.

Here’s the thing about buying a practice. It ain’t no cakewalk. Buying a practice may be one of, if not the biggest purchase of an individual’s life. And purchasing a practice can be far more complicated than a car or house purchase - since the asset being obtained consists of many moving parts.

In this article we will cover some of the most common pearls and pitfalls of purchasing a practice. So whether you are a newly minted graduate looking to begin your legacy, or you are a seasoned veteran looking to acquire another piece of your empire - use these points to help guide you towards your next big purchase.

(1) DO - Be on an Active Search if You are in the Market to Purchase

I like to think of a practice as a vibrant, living organism. Each of these living organisms has been cultivated by different hands but with the same underlying principles that govern any business rooted in patient care. If you search around you’re likely to find many practices of varying sizes and philosophies for sale. While each practice may be fair game for a purchase, not every practice will hold your best interests at heart.

Search online and through your local society’s directory, but do not be afraid to search the old fashioned way too. Visit practices and see where the owner is at in life. Some owners may not consider selling until a visitor shows up and offers them the option.

(2) DON’T - Take a Myopic View on Availability

It’s true, finding a viable existing practice to purchase is becoming harder and harder due to private equity expansion as well as doctors choosing to hold onto their practices longer. That being said, you should not simply pounce on one of the first “for sale” offers you see. Bad deals do exist, and investing a hefty six to seven figure sum into a practice that lacks the fundamentals necessary to positively cash flow could create a multiyear headache.

(3) DO - Get a Written Agreement if You’re Working from Associate to Owner

If you decide to take the classic route of buying an existing practice, it kind of goes like this:

- You get a job as an associate during your new grad years

- The owner of the practice (who most likely is approaching retirement age) has you work for him/her for a few years - you gather experience both as a practitioner and on the business end

- You eventually purchase the practice outright or buy-in to become a partner

Wait, we’re missing something. Oh yeah, that’s right. Step 3 never happens if it’s a verbal agreement. If you do have aspirations of one day owning the business that you currently work for, then it is vital to have an agreement in writing. Up until that point everything is hearsay, and there is absolutely nothing holding the owner of the practice (and your boss) from either continuing to own the practice or selling to someone else.

(4) DON’T - Rely on Word of Mouth Agreements

Just as we mentioned before, word of mouth agreements do not carry a whole lot of weight. Keep in mind, this also applies to terms you may agree to while you work as an associate as well. If you’re playing the long game, and do have a written agreement to purchase a practice after a set amount of time, make sure the benefits and wages you agree to in the meantime with your boss are written into some sort of contract.

Need help with contract review? Set up an appointment with Dr. Chris Lopez OD

Want to learn more about red flags that occur in negotiating contracts? 3 OD Job Contract Red Flags to Watch Out For

Financial Pearl

"If you do have aspirations of one day owning the business that you currently work for, then it is vital to have an agreement in writing. Up until that point everything is hearsay, and there is absolutely nothing holding the owner of the practice (and your boss) from either continuing to own the practice or selling to someone else. GET IT IN WRITING!"

(5) DO - Perform Due Diligence

As with any big purchase, due diligence must be performed to ensure that you are getting what you signed up for. Due diligence is often defined as an examination of financial records before entering into a proposed transaction with another party.

Specifically you will want to obtain financial documents from the last three years that pertain to the practice you plan to buy. After thoroughly evaluating these documents you will want to analyze the ins and outs of the practice. Finally, with this knowledge it is time to plan for the future. How can this business be run more efficiently, and can it grow?

Due diligence is a long and arduous process, however it is an absolute necessity to ensure financial success.

Want to fully understand due diligence and all the necessary documents needed? Check out this 3 Important Steps to do Due Diligence For a Successful OD Practice Purchase

(6) DON’T - Jump In Prematurely

You wouldn’t buy your forever home sight unseen (at least I hope not!), so why would you buy an expensive business that you will be putting 40+ hours into a week, without truly evaluating it?

Just like purchasing a home, you want to look for a business with “good bones.” Whether your future practice is a “fixer upper” that will need hours upon hours of changes and fixing in order to become profitable; or your future practice is a well-oiled, turnkey machine generating hundreds of thousands in net profit - having good underlying philosophies and values are important. The only way you can truly learn if your purchase will have this is by diving headfirst into it. You don’t necessarily need to spend years working in it, however you should be familiarized with every facet from staff, to operations to finances.

Financial Pearl

" As with any big purchase, due diligence must be performed to ensure that you are getting what you signed up for. Due diligence is often defined as an examination of financial records before entering into a proposed transaction with another party"

(7) DO - Understand that Changes will Probably Need to Be Made

Nothing is perfect. Even if that practice you are purchasing has an optical made out of gold and a diamond encrusted phoropter, there are going to be changes that need to be made. Old processes will render obsolete. Equipment will need updating. Staffing will need to be changed. Marketing will need to be revamped. This is just the nature of jumping into a business that was previously run by someone else and is going through the aging process.

(8) DON’T - Let Old Wounds Fester

Problems in an existing business may immediately show up or might rear their ugly heads later on. Regardless of the timeline that problems show up on, it is important to be cognizant of two concepts:

- Many problems can be sniffed out through analysis of financials, staff performance and operations.

- Problems exist and can have multiple solutions

As a new business owner, there is always a temptation to not make changes, especially if the business is already profitable and “producing.” However, problems in a business are just like wounds on the skin - if they are not dealt with immediately, they could fester and grow exponentially creating a huge net negative effect on your practice.

Think about that toxic employee - how damaging is his/her behavior to the morale of your all star employees. Think about that operational procedure that causes 1 out of 100 patients to be unhappy. What if that one patient complains to everyone they know and puts you on blast online? The best course of action is to rip the bandage off, even if the initial pain may be immense.

Summary

In conclusion, it is important to approach the practice purchase process from an analytical, unbiased and patient standpoint. Take the time to fully gather all the data, both numbers and otherwise, to fully understand how the business you will buy operates. Then start formulating what changes will need to be made in order to make this practice yours. Getting off to a good start is vital for taking the business you just purchased and running it successfully for years in the future.

Want to learn how to build your own practice? Check out Recommended PM Resources

Need some financial consulting for your practice? Or how to start? Book a 1-hour Session with Mick Kling @ Practice Consulting

Related Articles

- « Previous

- 1

- …

- 5

- 6

- 7

Facebook Comments