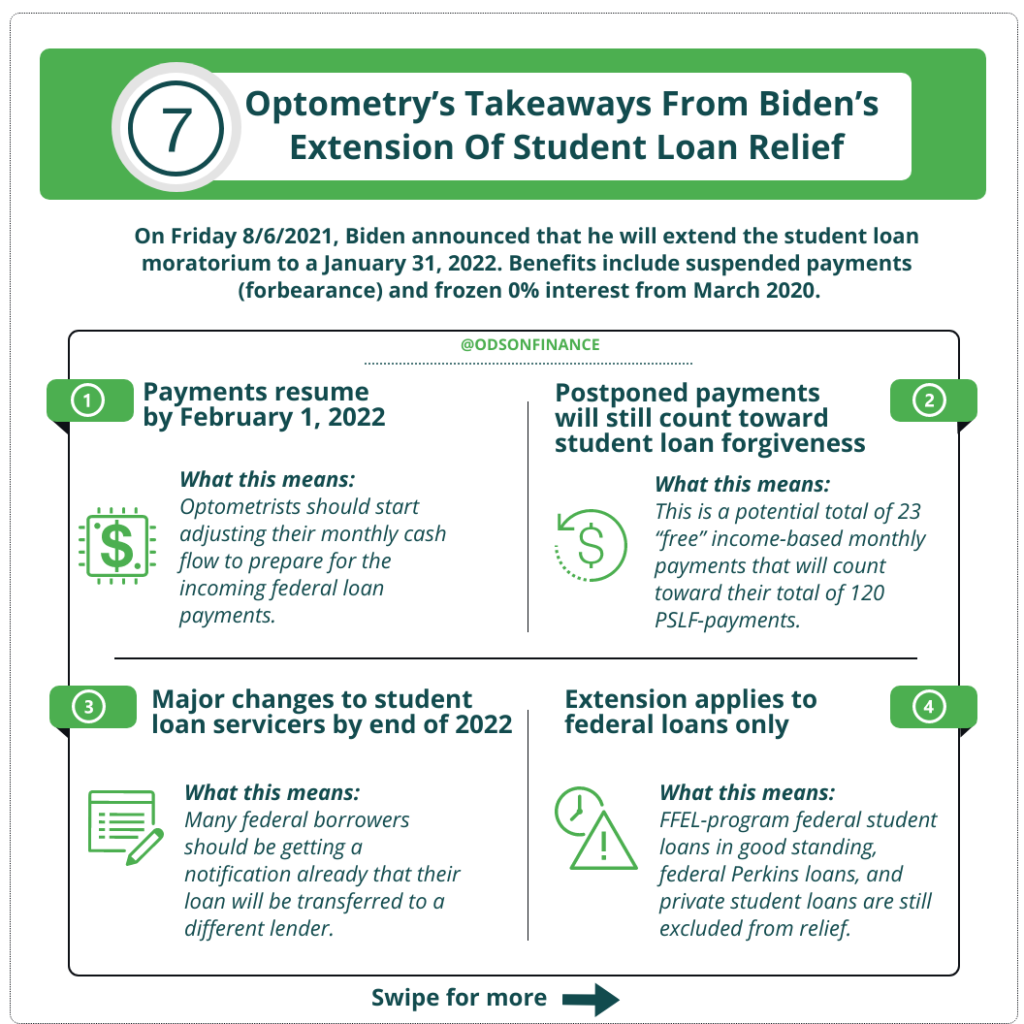

7 Takeaways for Optometrists From Biden’s Extension Of Student Loan Relief

KEY POINTS:

-

(1) Biden states that this is the ‘final’ extension of the student loan moratorium

-

(2) Postponed monthly payment will still count toward student loan forgiveness program

-

(3) Major changes to student loan servicers by end of 2022

-

(4) Only Federal loans are still covered by the student loan extension

-

(5) Potential for student loan cancellation is unlikely

-

(6) Optometrists with federal loans should still wait to re-assess as we approach early January 2022

-

(7) Refi rates are still at a historical, all-time low, so refinance often at no additional charge.

Last Friday afternoon, Biden announced that he will extend the student loan moratorium (which was supposed to expire at the end of September 30,2021) to a new date of January 31, 2022. Benefits include suspended payments (forbearance) and frozen 0% interest from March 2020.

While there are a lot of moving parts, here is what you should be aware of if you are an optometrist with federal loans:

(1) Biden states that this is the ‘final’ extension of the student loan moratorium

While there is no legal requirement that this will be the final extension, the Biden administration is making it clear that borrowers should expect to resume repayment by February 1, 2022. They hope that this final extension will “give students and borrowers the time they need” to “restart” repayment.

So optometrists should start adjusting their monthly cash flow to prepare for the incoming federal loan payments.

(2) Postponed monthly payments will still count toward student loan forgiveness program

On the Department of Education’s updated website, they confirmed that paused payments during the suspended months will be treated the same as before.

Similar to previous student loan extensions, this is great news for ODs who are enrolled in income-driven repayment terms such as 10 year Public Service Loan Forgiveness (PSLF).

Continuing from the start of March 2020 until January 2022, that is a potential total of 23 “free” income-based monthly payments (including principal + interest) that will count toward their total of 120 PSLF-payments. Assuming a $200,000 student loan debt for the typical OD’s salary of $120,000 enrolled in an IBR repayment plan, and 6.8% interest, that is a potential saving of $961 per month (or $22,121 total)

While we don’t advocate or recommend 20-25 total loan forgiveness unless you have a significantly high debt to income ratio (3:1 or greater), this will also count toward your total 240+ required income-based payments.

(3) Major changes to student loan servicers by the end of 2022

If 2020-2021 showed us anything, it showed how inefficient or poorly-run most federal student loan servicers are with poor customer support.

FedLoan Servicing, and Granite State Management will not be renewing their servicing contracts with the Department of Education (it is unclear if this is by choice or early termination), but regardless, many federal borrowers should be getting a notification already that their loan will be transferred to a different lender.

This was definitely one of the biggest reasons why Biden decided to pause payments. If he had not extended the student loan moratorium, the servicing transfers would have occurred just as borrowers restart their payments, which would have led to massive confusion and chaos. This extension will allow more time for the department of education to work out some kinks.

With that being said, I can see a major revamp within the next 5+ years on how loans will be handled moving forward - such as a better application process, more clarification on certain programs like repayment plans/forgiveness, and hopefully better customer support.

(4) Only Federal loans are still covered by the student loan extension

Unfortunately, the Biden administration did not expand the coverage of the student loan moratorium when he extended the relief into early 2022. So as a result, the types of loans are still the same. Only government-held federal student loans and FFEL-program student loans that are in default are covered by the extension. FFEL-program federal student loans in good standing, federal Perkins loans, and private student loans are still excluded from relief.

Sorry fellow ODs! Private loans or refinanced private loans are still not covered.

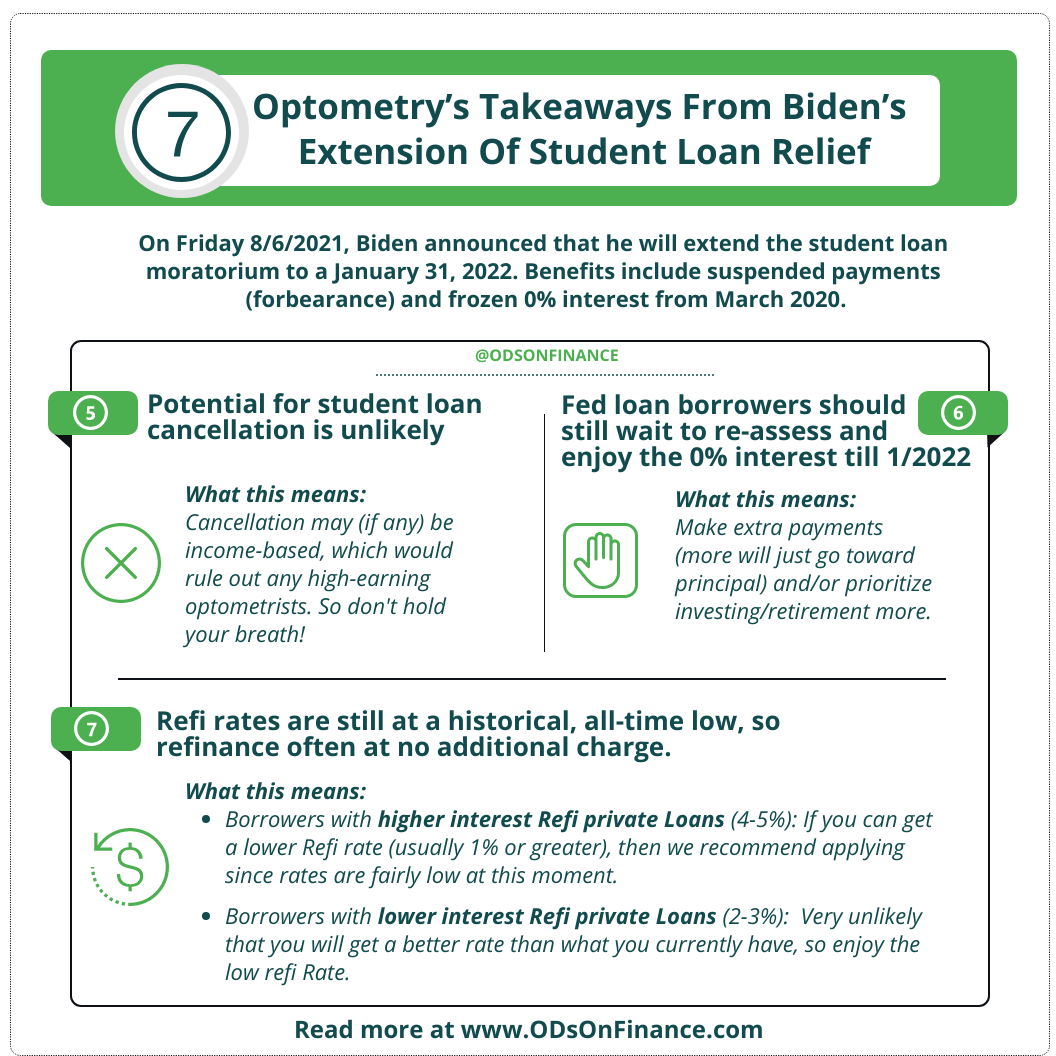

(5) Potential for student loan cancellation is unlikely

Biden ran on the political platform that he is a big advocate for student forgiveness up to $50,000 but recently during his interview, he stated that the best he can do is $10,000.

Since April 2021, the Biden administration has been conducting a legal review of potential authorities that could be the basis for some sort of student debt cancellation via executive action (still on-going). But as other members of congress have argued, it is unlawful for Biden to pursue this forgiveness without congressional approval.

Long story short, it is unlikely that student loan forgiveness will happen anytime soon. If so, it will likely be $10,000 and income-based, which would rule out any high-earning optometrists. So I wouldn’t hold my breath waiting for any form of loan forgiveness.

(6) Optometrists with federal loans should still wait to re-assess as we approach early January 2022

Since the CARES Student loan benefits are set to expire on January 30, 2022, our advice is still the same - those optometrists with FedLoans should enjoy the 0% benefits, make extra payments (more will just go toward principal) and/or prioritize investing/retirement more; then reassess when more news comes out at the end of 1/30/22. We do not recommend aggressive extra loan payments at this time.

(7) Refi rates are still at a historical, all-time low, so refinance often at no additional charge.

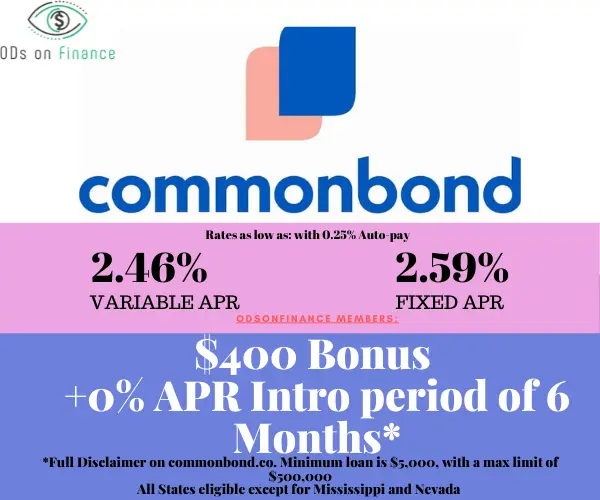

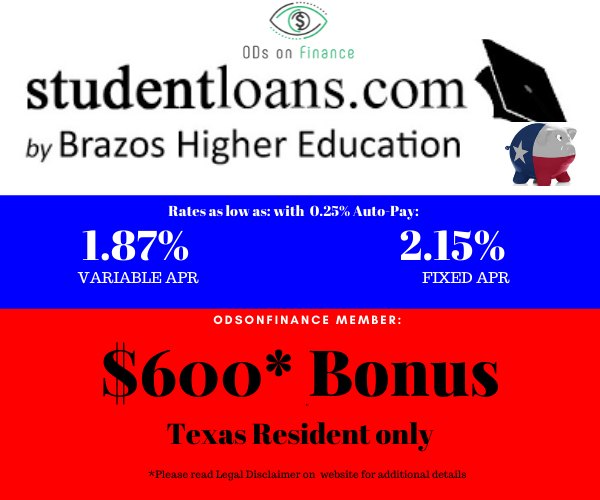

Borrowers with higher interest Refi private Loans (4-5%): If you can get a lower Refi rate (usually 1% or greater), then it is often worth the hassle of applying. We do highly recommend refi since rates are historically low at this moment, and at 5% inflation, this is like borrowing money for free.

- Continue making your required monthly payments, shop around for the lowest rate and capture that $1000 bonus

Borrowers with lower interest Refi private Loans (2-3%): Very unlikely that you will get a better rate than what you currently have, so enjoy the low refi Rate.

- Continue making your required monthly payments and enjoy that low fixed rate!

Editor's Note

Want to learn how to manage your student loans? Check out The Optometrist's Guide to Student Loans

Want to compare the lowest rate and best bonus back? Check out Recommended Student Refi Partners

Facebook Comments