7 Optometry Student Loan Updates Before End of 2022

KEY POINTS:

-

(1) Biden will NOT extend student relief past January 31, 2022

-

(2) 100% student loan cancellation is likely NOT to happen, but still shows promise of a possible $10,000 forgiveness.

-

(3) Recent Change in 10-year PSLF show more application approval for instant forgiveness since early October 2021

-

(4) Federal interest rate could potentially increase sooner in 2022 than expected, but still unpredictable.

-

(5) Optometrists with current federal student loans NOT pursuing forgiveness program should start preparing to refinance prior to January 31, 2022

-

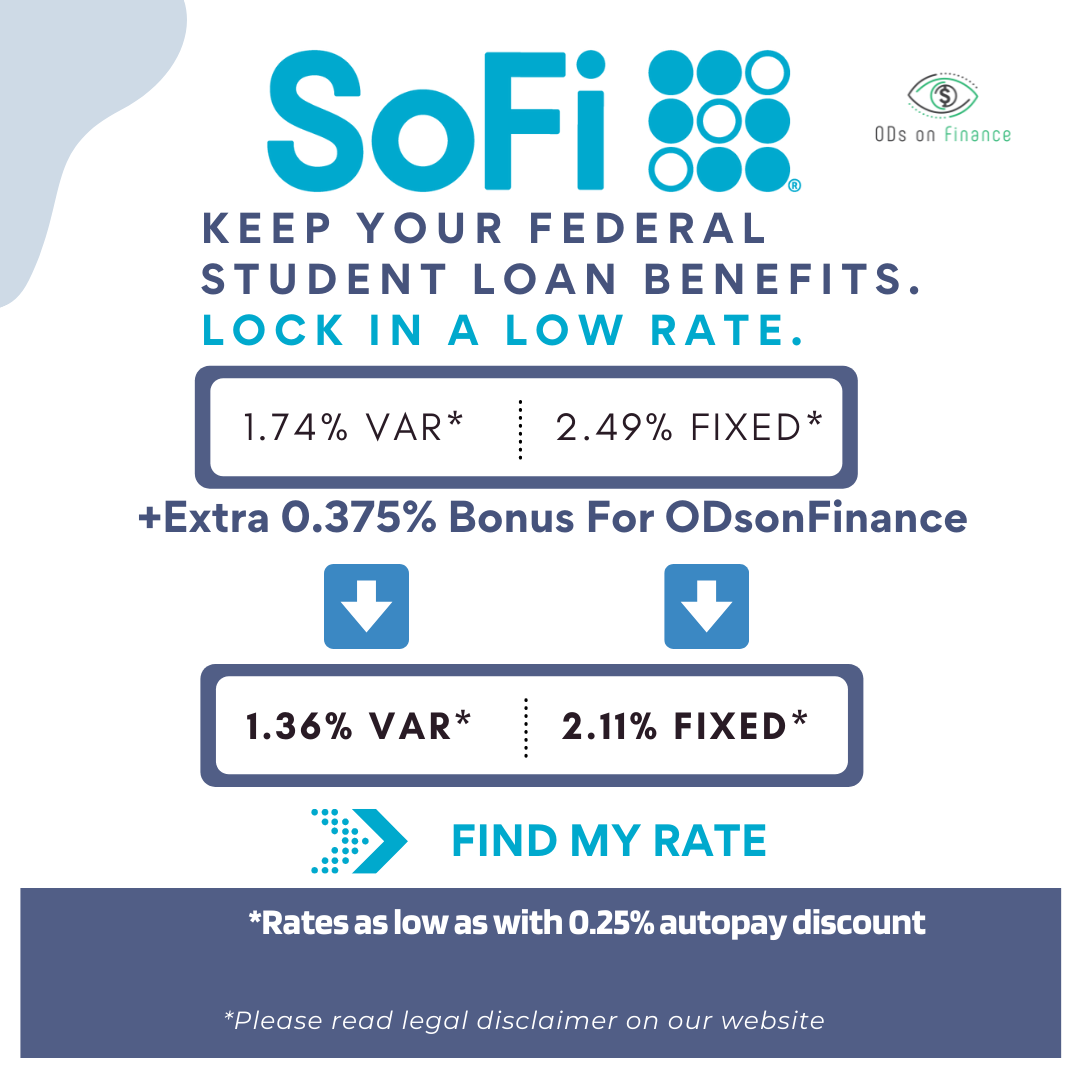

(6) Sofi’s 0.375% Discount Promo for ODsonFinance Members

-

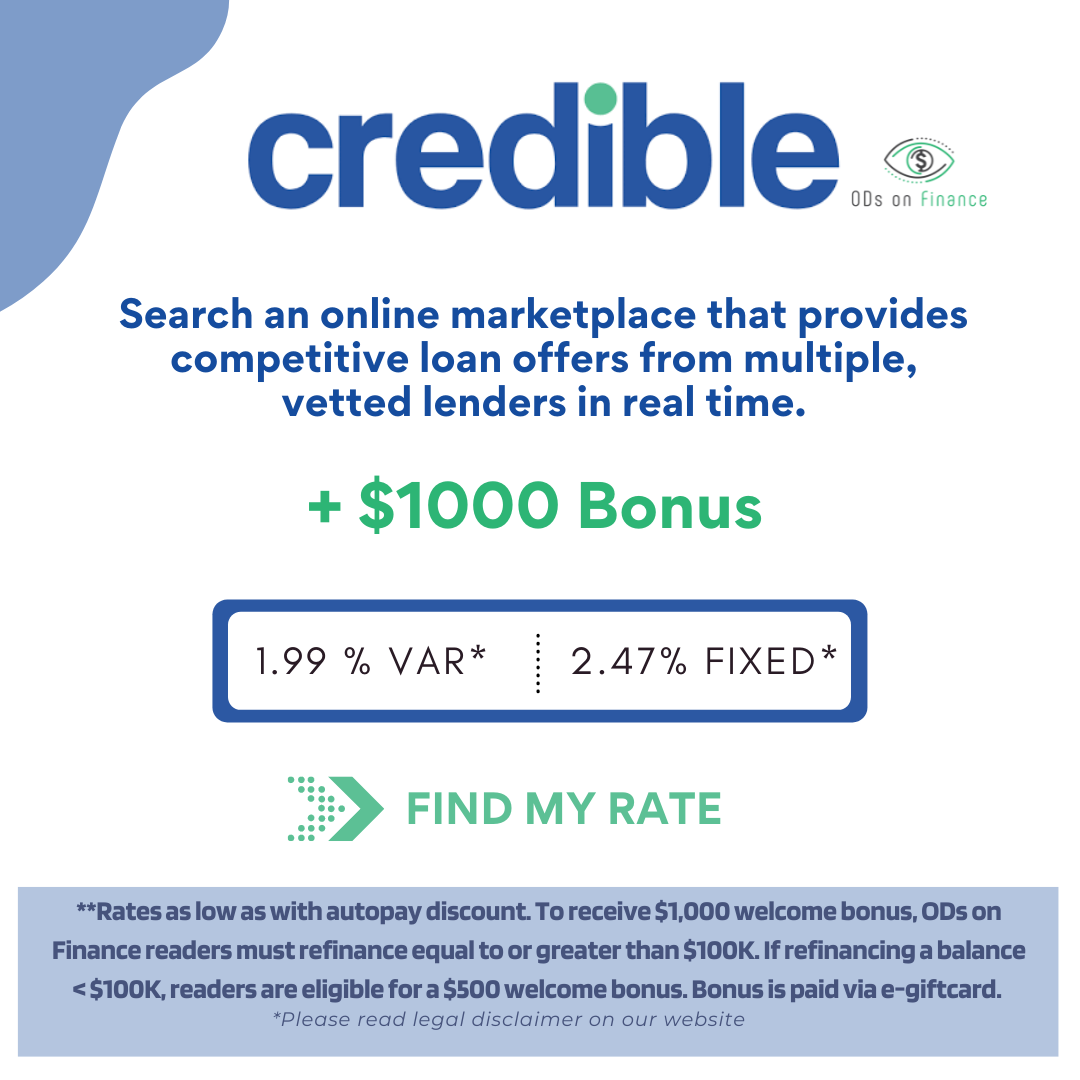

(7) Optometrists with current private student Refi loans should consider the “Refi Hack” with the $1000 Bonus every 3-4 Months

I cannot believe that it is the end of 2022. It has definitely been a crazy past 2 years with a lot of ever-changing federal legislations regarding student loans. As we approach the federal 0% interest benefit expiration date on January 31, 2022, here are some 7 new updates in the world of optometry student loans.

(1) Biden will NOT extend student relief past January 31, 2022

In a recent press briefing, White House Press Secretary Jen Psaki confirmed to reporters that the Biden administration won’t extend student loan relief — and the student loan payment pause will end January 31, 2022. While she did indicate that they are “still assessing the impact of the Omicron variant”, overall the Department of Education is already communicating with borrowers to help them to prepare for return to repayment on February 1.

(2) 100% student loan cancellation is likely NOT to happen, but Biden still shows promise of a possible $10,000 forgiveness.

Some optometrists have been hoping that the Biden administration will use his executive power during his administration by enacting wide-scale student loan cancellation, especially wiping out $1.59 Trillion US student debt . However, there is no indication that Biden will cancel everyone’s student loans. Therefore, optometrists should not expect Biden to cancel student loans before student loan relief at the end of January 2022.

A small glimpse of hope still shows that the president still supports wide-scale student loan cancellation of up to $10,000, but would need congress approval.

(3) Recent Change in 10-year PSLF show more application approval for instant forgiveness since early October 2021

Back on Wednesday Oct 6, 2021, the US Department of Education announced a massive overhaul to their 10-year Public Service Loan Forgiveness Program, essentially affecting all optometrists working for non-profit clinics like VA, IHS or non-profit universities. This allows them to re-certify a lot of payments that didn’t count in the past toward their 120 total PSLF payments. Click here to read more in detail.

It's been almost 2 months now, and as I scoured the internet on PSLF Facebook group and reddit forums, I definitely see a significant uptick in borrowers getting their loan instantly forgiven after filling the federal PSLF ECF Form.

If you are an optometrist going for 10-year PSLF, remember that you have until October 31, 2022 to apply for relief under the expanded PSLF Bill. Overall, this is great news for our fellow optometrists working for non-profit hospitals and institutions!

(4) Federal interest rate could potentially increase sooner in 2022 than expected, but still unpredictable.

In the upcoming week, the Federal Reserve could decide to speed up the end of the bond-buying program, which signals that we can expect to see hiking interest rates in 2022.

In addition, with the spread of the COVID Omicron variant causing uncertainty in the society, which normally will have a negative effect on the economy and overall stock market. But due to recent research showing less deadly impact of Omicron and the fact that we are simply more prepared this time around. It is expected that our economy will recover quicker.

(5) Optometrists with current federal student loans NOT pursuing forgiveness program should start preparing to refinance prior to January 31, 2022

I don’t expect a drastic spike past January 31, 2022 since I haven’t seen any gradual increase in all lender’s rates for the last month. But you have to understand that student loan refinance is a private consumer product, which is also influenced by supply and demand.

So if there is too much demand (lots of borrowers applications), then rates will steadily climb up, promo bonus will go down (or even away) and/or banks can be picky about who they want to approve such as requiring a lower debt to income (DTI), better credit score or longer work history.

Our student loan refi partners have indicated to us that there is a massive spike in refinance application traffic in Nov-Dec 2021, especially for healthcare providers like optometrists, dentists and medical doctors. This means that a lot of borrowers are taking advantage of historically low fixed rates now and locking it in, rather than dealing with crowds at the end of January 2022.

Financial Pearl

"Student refinance loans is a consumer product. So if there is too much demand (lots of borrower applications), then rates will steadily climb up, promo bonus will go down (or even go away completely) and/or banks can be picky about who they want to approve such as requiring OD to have a lower debt to income (DTI), better credit score or longer work history"

(6) Sofi’s 0.375% Discount Promo for ODsonFinance Members

After months of hard negotiation with their legal & compliance team, we are super excited to announce a new brand re-launch with Sofi leadership for our community! This is the first promo of its kind out there, even better than Laurel Road’s own 0.25% discount. This will essentially save the typical optometrist a net total discount of 0.625% (along with auto-pay 0.25% discount).

In addition, here are other awesome perks that Sofi offers:

- Academic deferment, military deferment, forbearance

- Loans are discharged on death or disability

- Free Financial Planning

- Con: There is no Cosigner release

Unfortunately, this is only for new Sofi applications but if you need any guidance, feel free to message me directly on facebook or email us at Admin@ODsonFinance.com

(7) Optometrists with current private student Refi loans should consider the “Refi Hack” with the $1000 Bonus every 3-4 Months

Since there is no origination fee to refinance your student loans (unlike a mortgage) and the application process is rather quick online, a majority of ODsonFinance refinance traffic is doing a form of refi- hack, which is jumping from lender to lender to capture the $1000 bonus (must meet the requirement minimum loan). Unfortunately, it does take 90-120 days after your loan closes for the bonus to get paid out, so optimistically, one could only do this max 4 times a year, netting a total of max of $4,000.

Please caution that this is considered a hard credit pull which can result in a lowering of your credit score, so proceed carefully.

Currently, Credible, Splash and Lendkey all offer $1000 Bonus as their sign-up promo.

Summary

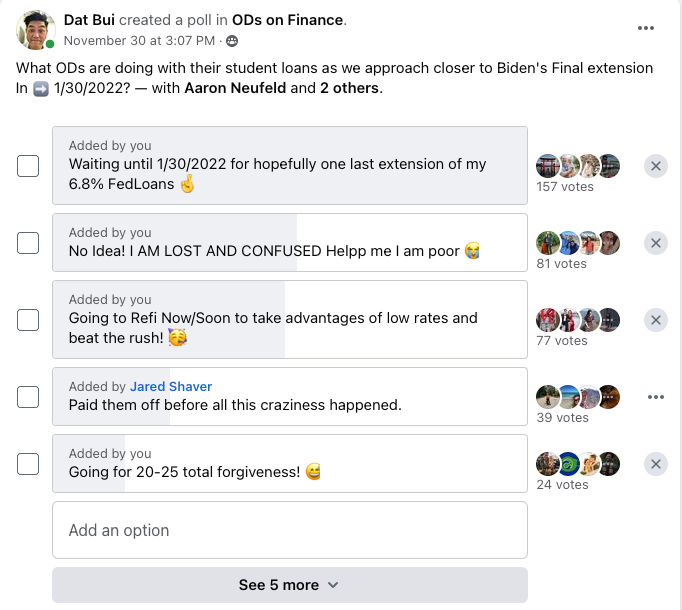

Wondering what your fellow ODs are doing with their student loans? We did a quick poll in our Facebook group and here are the results (left)

Whatever you decide, have a solid financial plan and stick with it. As always, Dat and Aaron are here to help out and we will always keep you posted on all things student loans! Cheers to financial freedom. Here are some great resources we gather for you to read!

Want to learn how to Refinance Your Student Loans? Check out How to Refinance your Student Loans in 3 Easy Steps

Want to find more? Check out OD Student Loans if I Die, Become Permanently Disabled, or Become Bankrupt?

Going for 10 years PSLF? Check out Six Massive 10-year PSLF Changes in 2021

Facebook Comments