6 Massive PSLF Changes + 3 Student Loan Tips for Optometrists

KEY POINTS:

-

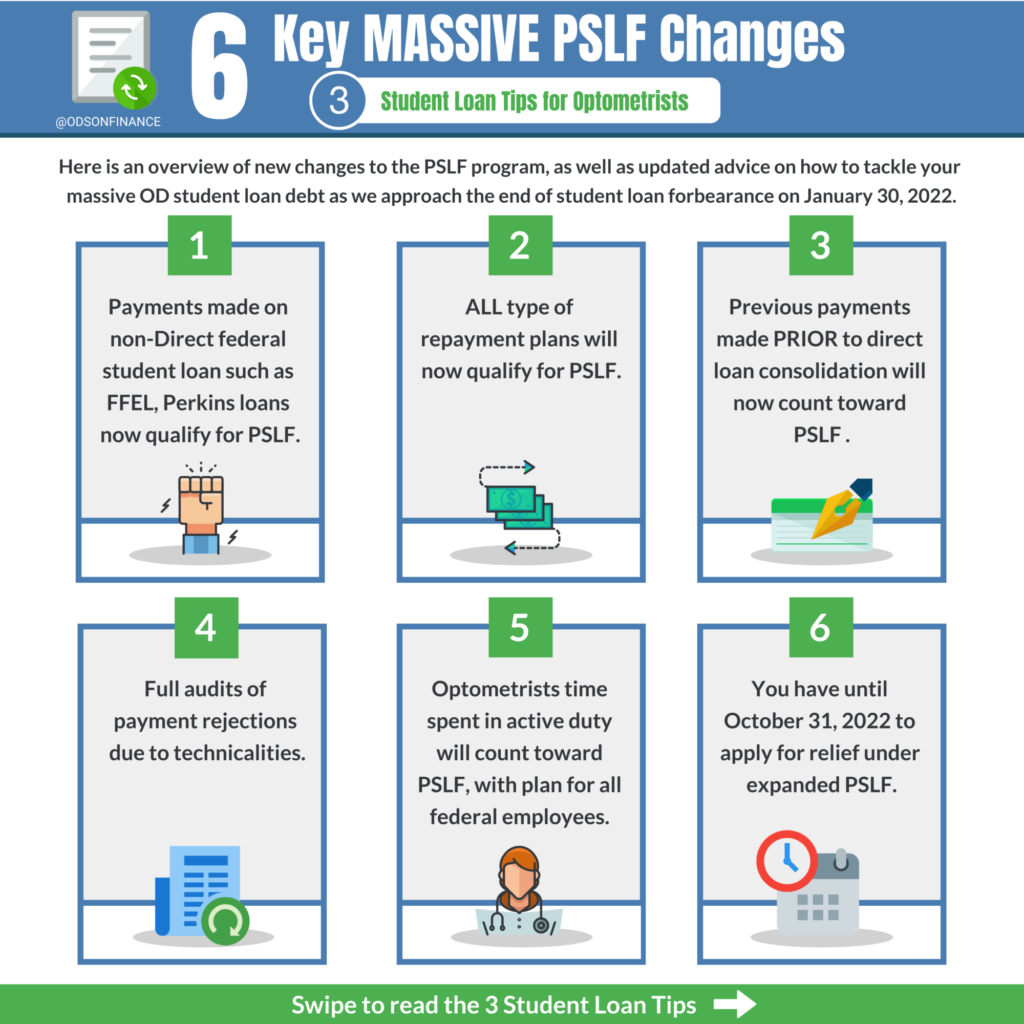

(1) Payments made on non-Direct federal student loan such as FFEL, Perkins loans now qualify for PSLF

-

(2) ALL type of repayment plans will now qualify for PSLF

-

(3) Previous payments made PRIOR to direct loan consolidation will now count toward PSLF

-

(4) Full audits of payment rejections due to technicalities

-

(5) Optometrists time spent in active duty will count toward PSLF, with plan for all federal employees

-

(6) You have until October 31, 2022 to apply for relief under expanded PSLF

-

(7) Optometrists with current federal student loans NOT pursuing forgiveness should start preparing to refinance prior to January 30, 2022

-

(8) Optometrists with current private student Refi loans should consider the “Refi Hack”

-

(9) Optometrists pursuing 20-25 total loan forgiveness have more hope at the end of the tunnel

On Wednesday Oct 6, 2021, the US Department of Education announced a massive overhaul to their 10-year Public Service Loan Forgiveness Program, essentially affecting all optometrists working for non-profit clinics like VA, IHS or non-profit universities.

As you already know, 10-year PSLF program allows optometrists with federal student loans to make 120 qualifying monthly payments while working full-time for a qualifying employer (non-profit 501 (c)) to have the remainder of their balance forgiven. These qualifying employers can include any federal, state, local or tribal government and not-for-profit organizations.

In this article, we will highlight an overview of new changes to the PSLF program, as well as updated advice on how to tackle your massive OD student loan debt as we approach the end of student loan forbearance expiration date at end of January 30, 2022:

(1) Payments made on non-Direct federal student loan such as FFEL, Perkins loans now qualify for PSLF

Under the new changes, the Department of Education will count payments made on non-Direct federal student loans, including FFEL loans and Perkins loans for optometrists towards PSLF (assuming that ODs had qualified employment during that time). Historically, these types of loans did NOT qualify for PSLF since they were not considered “federal”.

(2) ALL type of repayment plans will now qualify for PSLF

In the past, only optometrists enrolled under income-driven repayment plans (such as IBR, ICR, PAYE, REPAYE) or the 10-year Standard repayment plan could count as a qualifying payment.

Now ALL payments types during PSLF qualify, as long as the borrower was working in qualifying PSLF employment at the time that the payment was made.

(3) Previous payments made PRIOR to direct loan consolidation will now count toward PSLF

Historically, optometrists who accidentally consolidated loans effectively “restarted the clock” on their PSLF repayment term, and were basically screwed. This was a major issue for ODs because they lost all these years of qualified payments.

But now the Department will allow payments made PRIOR to Direct loan consolidation to be counted towards PSLF; provided that the borrower again was working in qualifying employment when the payments were made.

Please note however, payments made on Parent PLUS loans prior to Direct loan consolidation will still NOT qualify for PSLF.

(4) Full audits of payment rejections due to technicalities

Remember back in 2017 when the first round of 10-year PSLF applicants that were supposed to be forgiven had close to a 99.99% rejection rate?

Why? Many of those applicants were due to some minor technicalities such as not being in the right payment plan, etc

Great news! Now the Department will be conducting a full audit over the next few months, and indicates it will automatically adjust qualifying PSLF payments for borrowers who were unfairly rejected due to these kinds of technicalities.

(5) The optometrist’s time spent in active duty will count toward PSLF, with a plan for all federal employees

The Biden administration “will allow months spent on active duty to count toward PSLF, even if the service member’s loans were on deferment or forbearance rather than in active repayment,” which is typically a requirement for PSLF”

This is great news for our fellow ODs in active duty and ensures that while serving our country, they do not need to focus on their student loans. Biden also has plans to automate enrollment in PSLF for all military service members and federal government employees.

(6) You have until October 31, 2022 to apply for relief under expanded PSLF

Biden is implementing this PSLF program overhaul as a “Limited PSLF Waiver” that is being implemented using emergency executive authority. As a result, there is a limited time window during which the relief can be offered… ONE YEAR and the deadline is October 31, 2022.

Optometrists with Federal loans in 2010 & PRIOR

For any OD borrower PRIOR to 2010, they will only have 2 types of loans: Direct and FFEL

- Consolidate all FFELP and Perkins loans into a Direct Consolidation loan

- Submit the PSLF ECF form. Any previously ineligible years of payments will now count as long as you made payments of any kind on your student loans.

- If you only have Direct loans, you only have to CERTIFY ALL your years working at a nonprofit or government employer. You could pick up years of additional credit towards forgiveness even if you were in the wrong repayment plan.

- Lastly, ODs who are FFEL borrowers (over 10+ years) could technically qualify for immediate forgiveness if they are able to consolidate and certify at least 10 years of PSLF-qualified employment, completely tax-free!

Optometrists with Federal loans AFTER 2010

For any OD borrower AFTER 2010, there will likely only be Direct Loans (since FFELP ended in 2010), hence there is NO need to consolidate

- Submit the PSLF ECF form. Any previously ineligible years of payments will now count as long as you made payments of any kind on your student loans.

- If you only have Direct loans, you only have to CERTIFY ALL your years working at a nonprofit or government employer. You could pick up years of additional credit towards forgiveness even if you were in the wrong repayment plan.

- IMPORTANT: Even if you have any previous payments that was NOT income-based, remember that the new PSLF mandate order allows ANY payment to qualify. This is one of the most common reasons optometrists will mess up and not get the full benefit, because they will probably be neglecting to include all qualifying public service employment on their ECF.

(7) Optometrists with current federal student loans NOT pursuing forgiveness should start preparing to refinance prior to January 30, 2022

Since the CARES Student loan benefits are set to expire on January 30, 2022, with the likelihood of no more extension due to the economy opening up...

Our advice is still the same. Those optometrists with Federal Loans, enjoy the 0% benefits, make extra payments (more will just go toward principal) and/or prioritize investments and retirement.

For the majority of ODs, we recommend gathering your financial documents in November 2021 that are needed to refinance and start applying in early December.

There is a general consensus among our refi lenders that after 1/30/2022, there will be a mad rush of demand. Thus, bank lenders can choose to be more selective in their underwriting approval process (lower DTI, higher credit score, work experience, etc) and increase their overall rates.

This happened with personal loans a while ago, and I can see it happening with refi student loans.

If you are still on the fence, no worries, wait to reassess when more news is closer to 1/30/2022.

Financial Pearl

For optometrist with massive student loan, a good rule of thumb is If you have a debt to income ratio of less than 3:1, consider refinancing to get a lower fixed interest rate. I know this might seem impossible your 1st year but remember with each passing year, your doctor’s salary gets higher (with raise) while your debt gets smaller (via payment). As always, we advocate for multitasking and investing at the same time.

(8) Optometrists with current private student Refi loans should consider the “Refi Hack”

Re-fi rates are still fairly low at around 3-4% fixed, considering that inflation is ridiculously high at 4-5%. The fed announced recently that it doesn't plan to increase rate though 2022, but will gradually have 3-4 spikes until 2024 (but take that with a grain of salt since the economy can change).

On a side note, this is the most cash-back (up to $1000) that we have ever negotiated for our members or seen over the last 5+ years from re-fi companies, so take advantage!

If you can get 1% better, now is the perfect time to re-fi. A majority of ODs on Finance re-fi traffic is doing a form of refi- hack, which is jumping from lender to lender to capture the $1000 bonus (must meet the requirement minimum loan)

(9) Optometrists pursuing 20-25 total loan forgiveness have more hope at the end of the tunnel

If your debt to income ratio is 3:1 or greater, basically an optometrist with the same stagnant annual pay of $100,000 with a massive debt loan of $300,000, then consider applying for 20-25 year total loan forgiveness.

While we don’t advocate for total forgiveness here on ODsonFinance due to the emotional/stressful factors that many ODs don’t consider, we do realize that mathematically, this might be the best route for many doctors in order for them to start any significant form of retirement investments.

While this executive action does NOT affect doctors in 20 to 25 year forgiveness plans since no one will qualify for this program before 2031, this is a good sign that this administration might put in some future mandates to address the student crisis and make total student forgiveness more of a possibility.

Summary

Overall, this is a positive trend for optometrists especially those in 10 year PSLF and/or whomever are in any total forgiveness programs. The Biden administration showed us that it could use emergency authority due to the pandemic to push student loan reform forward. Of course, there will always be opposing parties due to radical news headlines “Rich doctors get student loans forgiven using tax-payer’s money!” to fuel social unrest, so be on the lookout!

Whatever you decide, have a solid financial plan and stick with it. As always, Dat and Aaron are here to help out and we will always keep you posted on all things student loans! Cheers to financial freedom.

Want to learn how to tackle your Student Loans? Check out The Optometrist's Guide to Student Loans

Want to get the lowest Refi Rate + $1000 Cash Back? Compare Recommended Refi Lenders

Related Articles

- « Previous

- 1

- 2

- 3

- 4

- Next »

Facebook Comments