10 Tips for a Successful Insurance Claim after a Fire

KEY POINTS:

-

(1) File a Claim

Contact your insurance company to begin the claims process

-

(2) Document Losses & Consider Requesting an Advance

You’ll have to document your losses in order to process your claim, and this is a critical step.

-

(3) Secure the Property

Secure damage that could cause other problems such as boarding up broken windows or tarping a roof. You may need to keep checking in on your property, making sure new problems aren’t arising such as leaks from rain, vandalism or theft.

-

(4) Verify Your Coverage

Know the ins and outs of their coverage if they haven’t looked at it in a long time. It is important to get a refresher. This can be done by reviewing your policy or simply chatting with your insurance representative.

-

(5) Keep the Ball Rolling

Insurance companies are required to handle claims in a timely manner, some have a very quick turnaround time of 10 business days.

-

(6) Track Living Expenses

If you have loss of use coverage and have to evacuate your home, be sure to document your expenses including hotel costs and food expenses.

-

(7) Get Multiple Repair Estimates

Obviously this only applies if you are repairing damage as opposed to a total loss. However, it is important to get multiple estimates on the cost of repairs.

-

(8) Decide IF you Want to Rebuild

If this is your primary residence, you will likely repair and rebuild. If this is a rental property or summer property, you are able to sell the property and use the insurance money for something else.

-

(9) Keep Paying Premiums

It may sound odd to pay premiums on a property policy that you are not currently living in. However, keeping your policy in effect is critical for the liability coverage.

-

(10) You Determine When the Claim is Finished

Many insurance companies seek to close claims quickly as this prevents further losses from being discovered and added to the claim. Be sure to take time and do your due diligences.

A fire is something that no one ever wants to deal with, and is something that can turn your life upside down for a while. Having proper insurance and understanding the process behind dealing with a fire are key for being able to recover from a fire. Let’s take a look at the steps of the insurance claim process.

Before you continue reading, let’s create a folder on your computer, and title it “Documents for Insurance Claims”. You’ll need it to add important items in. (You can thank me later.)

(1) File a Claim

First breathe. Inhale. Exhale. Slowly. Everything will be okay. Alright, let’s go!

The first thing you need to do is contact your insurance company to begin the claims process. This should be done as soon as possible. After all, the sooner you begin, the sooner you’ll receive a payment. Many companies have 24-hour lines available, while others have an online portal that you can easily fill out and upload supporting documents/pictures.

Let’s open that folder that you just created. Add a document in there with your insurance agent’s name, contact information as well as a link or contact information to report any future claims.

(2) Document Losses & Consider Requesting an Advance

You’ll have to document your losses in order to process your claim, and this is a critical step. Hopefully, you have created a contents list, which is an inventory of major belongings and their price (i.e. appliances, TVs, etc). This will be key to helping with the claim. If this is an investment property - be sure to provide documentation showing any recent upgrades, work and repairs you have made to the property.

Remember that scope of work and recent property inspection you just had? Save a copy in the folder that you just created. How about those beautiful post rehab photos? Yup, save a copy of those in the folder as well.

As you survey the damage, be sure to take lots of photos and videos. These will provide support and justification for your claim.

If you’ve had to evacuate your home without grabbing necessities such as clothing and toiletries, consider requesting an advance on the settlement in order to purchase these items. Be sure to understand if your coverage is for replacement value or actual cash value when replacing items.

This is a good time to consider adding renter’s insurance if you don’t have one on your rental property already. You can decide if you want to foot the bill for the renter’s insurance, or pass it on to your tenants. In case of an unexpected event like a fire, renter’s insurance can pay out to cover lost items such as electronics and appliances (television, computer, etc.), furniture and clothing, along with accidental damage to someone else's property and medical expenses and/or legal fees if someone is injured on your property.

Place the renter’s insurance policy along with the tenant’s lease agreement and contact information inside that folder.

(3) Secure the Property

Fire damage can open up your home to greater damage as well as make it more vulnerable to thieves. Insurance typically will not cover losses incurred due to failure to secure your home after a fire. Thus, it is important to secure damage that could cause other problems such as boarding up broken windows or tarping a roof. You may need to keep checking in on your property, making sure new problems aren’t arising such as leaks from rain, vandalism or theft.

(4) Verify Your Coverage

Most people don’t offhand know the ins and outs of their coverage if they haven’t looked at it in a long time. It is important to get a refresher. This can be done by reviewing your policy or simply chatting with your insurance representative. Here, you are looking for six types of coverage:

Coverage A

The actual physical structure of your home, which should at least cover the actual value of your home, but could also provide greater coverage. This is used to repair or rebuild your home. I recommend insuring, at the very least. the amount of your mortgage. I personally like to insure mine around what my house is worth.

Coverage B

For other structures on the property - like fences, mailboxes, sheds, and detached garages.

Coverage C

Deals with personal belongings that are damaged by the fire, which will either be the replacement cost or actual cash value with the former being better. If this is a rental property, please be sure to have renter’s insurance.

Coverage D

Deals with loss of use, which helps pay living expenses if you must live outside your home temporarily.

Coverage D

Deals with loss of use, which helps pay living expenses if you must live outside your home temporarily.

Coverage B

This is your personal liability coverage. This coverage protects you from instances where you are liable for negligent actions.

Coverage C

This is medical payments. Similar to medical payments on an auto insurance policy, this coverage is to pay medical bills for those who get injured while on your property.

If this is an investment property, I recommend adding “Loss of Rents" coverage. This policy will pay-out the rental income x how many months it will take to rebuild the property.

Lastly, make sure you know the difference between actual cash value vs. replacement cash value. A replacement cash value policy will be slightly more costly, but will not take into account depreciation and the age of the structures. Instead, the policy will pay out the full amount to restore the property in today’s dollars minus any deductible.

Don’t know what type of coverage you have? This is a perfect time to pick up the phone, call your insurance agent and have them go over in detail what you are covered for. Once you have finalized your insurance coverage, ask for the master policy emailed.

Now let's place a copy of the insurance policy in the folder.

So now, you have all important items in your folder:

- Insurance policy

- Renter’s insurance policy

- Agent’s contact info

- Rehab scope of work

- Post rehab photos

- Your tenant’s contact information.

(5) Keep the Ball Rolling

Insurance companies are required to handle claims in a timely manner, some have a very quick turnaround time of 10 business days. However, you can aid in this process by seeking to meet with an adjuster as soon as possible. The insurance adjuster will make an appointment to survey the damage.

Be sure to provide them with all documentation (as mentioned above). If you have receipts from damaged items, this can be helpful too. If you feel like the process is taking too long, contact your insurance company and attempt to expedite the meeting.

(6) Track Living Expenses

If you have loss of use coverage and have to evacuate your home, be sure to document your expenses including hotel costs and food expenses.

Note that while Coverage D will typically pay all hotel costs, it will only cover the difference between what you usually spend and what you actually spend on other costs.

Example: If you typically spend $200 a week on groceries and spend $350 a week on takeout due to not having use of a kitchen, it will reimburse the $150 difference.

(7) Get Multiple Repair Estimates

Obviously, this only applies if you are repairing damage as opposed to a total loss. However, it is important to get multiple estimates on the cost of repairs. Most insurance companies will have contractors they use for estimates and repairs, but estimates will vary, so getting several will help with decision-making. After all, you want to get a fair price and good quality work. Having multiple repair estimates is crucial to ensure that you are not overpaying.

Secondly, there are fire restoration companies that are usually the first responders following significant damage to a home from floods and fires, water damage, sewage backup and other major events. The job of a restoration company is to clean up the mess and to preserve and protect the home and its contents from further damage.

They usually will work with your insurance adjuster to ensure that you will maximize your claim payout. Be wary that fire restoration companies are not inexpensive and their prices may make your heart drop a little.

(8) Decide IF you Want to Rebuild

If this is your primary residence, you will likely repair and rebuild. However, if you need to rebuild, you don’t have to rebuild on the same site. You can choose a different location.

Additionally, if this is a rental property or summer property, you are able to sell the property and use the insurance money for something else.

(9) Keep Paying Premiums

It may sound odd to pay premiums on a property policy that you are not currently living in. However, keeping your policy in effect is critical for the liability coverage. However, if you will be out of your home for an extended time, you can request that your insurance coverage temporarily decrease the structure coverage and reduce the premium.

Finally, make sure to provide your new temporary address to your insurer for the purpose of liability coverage.

(10) You Determine When the Claim is Finished

Many insurance companies seek to close claims quickly as this prevents further losses from being discovered and added to the claim. Be sure to take time and do your due diligences. If your insurance company is having difficulty coming up with a settlement, consider hiring a public adjuster. This is an independently licensed professional that will negotiate on your behalf for a fee that typically averages approximately 12.5%.

Summary: Close the Claim and Don’t Worry

Once you are satisfied with the outcome and convinced all damage has been dealt with - close the claim. Don’t worry about being penalized. While automobile claims can cause policies to go up, homeowner claims do not have this effect unless a person is a habitual claimant. Rest assured you can file your claim without financial penalty. Likewise, there is no penalty, if you decide to sell the property. What you do with the property after the claim has been finalized is up to you.

Now that you’ve gone through the step by step guide on how to file a fire claim, rest assured that you have also created a safe haven of important documents in case a catastrophic event like this were to ever occur. Pat yourself on the back for being fully prepared. Lastly, remember that there is always a light at the end of the tunnel.

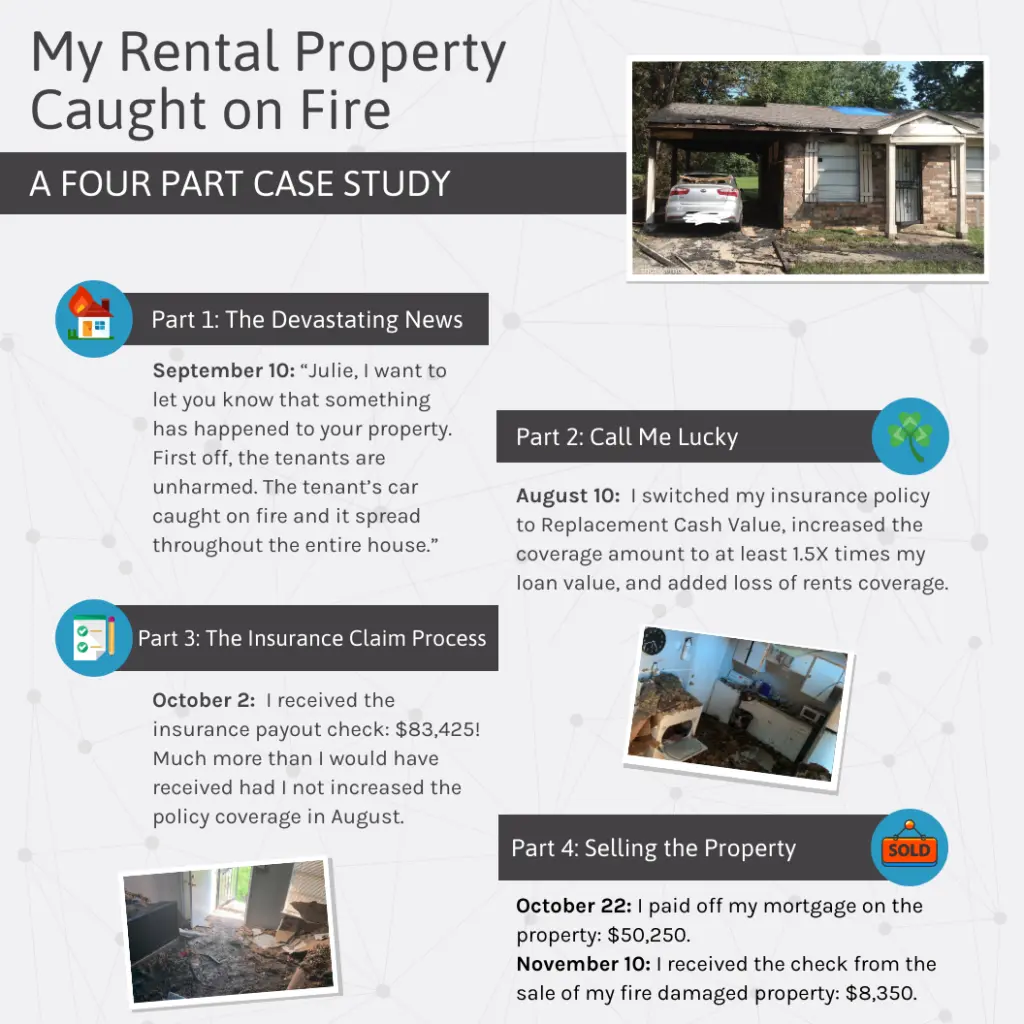

If you’ve missed it, please head over to read the latest "My Rental Property Caught on Fire 4-Part Case Study" how being properly prepared saved the day for me. If you find this helpful, please follow along my real estate investing journey on IG at House_hustle. Happy & safe investing!

Want to learn how to build your own RE portfolio? Check out Five Steps to Begin Your Real Estate Journey

Want to get a full blueprint on How to start? Buy our Book The Optometrist's Guide to Financial Freedom

Related Articles

- « Previous

- 1

- 2

- 3

Facebook Comments