The Optometrist's Guide to Student Loans

Chapter 3: Loan Forgiveness

There are there main ways where an optometrist can get their loans fully forgiven:

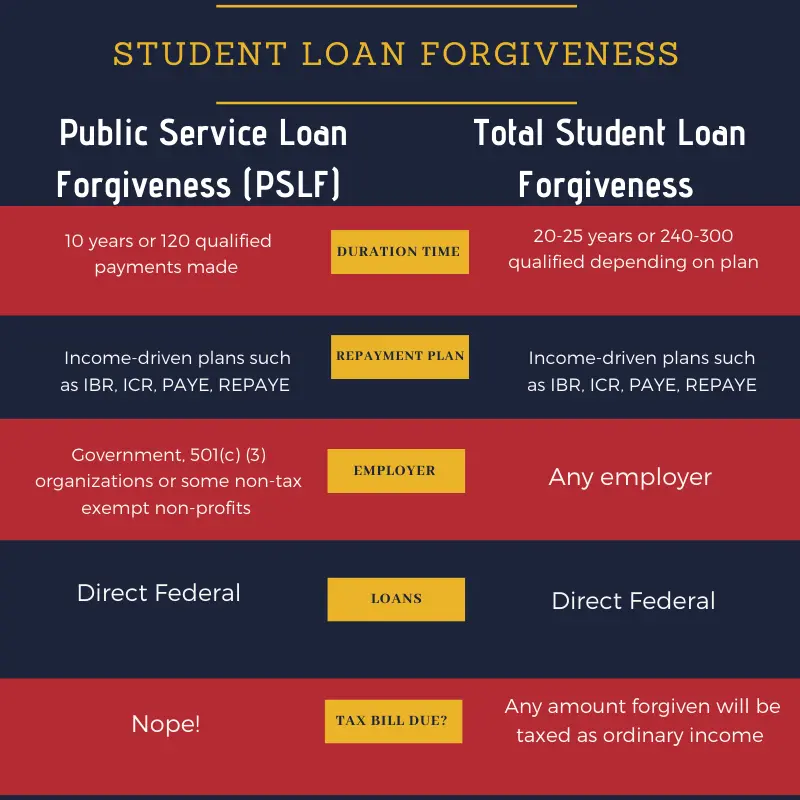

(a) Public-Service Loan Forgiveness (PSLF) 10 years

(b) Total Loan Forgiveness (ISAVE) 25 years

(c) Total Loan Forgiveness (PAYE) 20 years

III) Federal Loan Forgiveness Program (10-Year Public Service Loan Forgiveness or PSLF)

Started in 10/2007, doctors working for non-profit organization for 10 years can have their students loan fully forgiven if all requirements are met without a tax bill.

Financial Pearl

Don't opt for the standard 10-year Standard Repayment Plan, as it's the most expensive choice and our goal is to pay the least amount possible over 10 years.

Initiated in October 2007, doctors who work for a non-profit organization for 10 years can have their student loans fully forgiven, provided all requirements are met, and without incurring a tax bill.

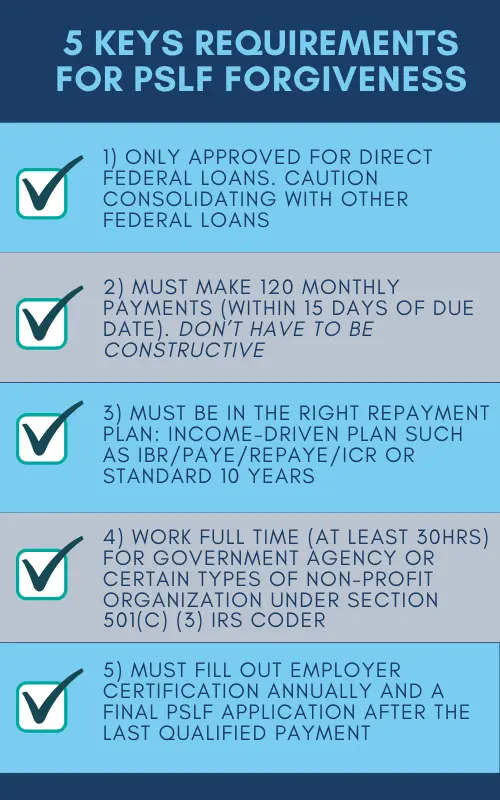

Let's delve into the specific PSLF requirements in more detail:

- Qualified Federal Direct Loans Only: Perkins Loans are technically ineligible, but you can make them eligible by consolidating them through a Direct Consolidation Loan.

- ⚠️ Caution: If you've been making standard 10-year or income-driven qualified payments and then decide to consolidate, you've just reset your PSLF timeline and will have to start the 10-year period all over again.

- ⚠️ Caution: If you've been making standard 10-year or income-driven qualified payments and then decide to consolidate, you've just reset your PSLF timeline and will have to start the 10-year period all over again.

- Qualifying Monthly 120 Payments: You can't expedite the process by making additional payments or larger amounts. Payments don't have to be consecutive, so if there's a gap in your full-time employment, you can pick up where you left off. Payments must be made in full within 15 days of the due date.

- Appropriate Income-Driven Repayment Plan: You must be under a qualifying repayment plan such as Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), Pay-As-You-Earn (PAYE) or SAVE (Saving on a Valuable Education). Payments under the 10-year Standard Repayment Plan also qualify.

- Full-Time Employment: You must work full-time (at least 30 hours per week) for a government agency or certain types of non-profit organizations under Section 501(c)(3) of the IRS code.

- No Tax Bill: Unlike 20-25 years total forgiveness, there will be no tax bill at the end of PSLF

Financial Pearl

Not all non-profit organizations qualify for PSLF; they must also be tax-exempt so check with your HR department. But as of August 2023, Kaiser optometrists, especially those in Texas and California, now qualify as employees of a non-profit organization and can thus apply for the 10-year PSLF program.

If you are one of the fortunate optometrists who qualify for the 10-year Public Service Loan Forgiveness (PSLF) program, this is usually the most financially prudent option. Just ensure you meet all the requirements and adhere to them for a decade. Be cautious, though, as some non-profit organizations are notorious for limiting associates to part-time hours—under 28 per week—to avoid offering benefits, which could disqualify you from the program, or worst letting you go unexpectedly prior to the 10 years.

IMPORTANT UPDATE (10/2021): 6 Massive PSLF Changes

On Wednesday Oct 6, 2021, the US Department of Education announced a massive overhaul to their 10-year Public Service Loan Forgiveness Program, essentially affecting all optometrists working for non-profit clinics like VA, IHS or non-profit universities.

As you already know, 10-year PSLF program allows optometrists with federal student loans to make 120 qualifying monthly payments while working full-time for a qualifying employer (non-profit 501 (c)) to have the remainder of their balance forgiven. These qualifying employers can include any federal, state, local or tribal government and not-for-profit organizations.

Here are the Key Points, but Click Here to Read "6 Massive PSLF Changes + 3 Student Loan Tips for Optometrists" in 2021

(1) Payments made on non-Direct federal student loan such as FFEL, Perkins loans now qualify for PSLF

(2) ALL type of repayment plans will now qualify for PSLF

(3) Previous payments made PRIOR to direct loan consolidation will now count toward PSLF

(4) Full audits of payment rejections due to technicalities

(5) The optometrist’s time spent in active duty will count toward PSLF, with a plan for all federal employees

(6) You have until October 31, 2022 to apply for relief under expanded PSLF

IV) Federal Loan Forgiveness Program ( 20-25 years Total Forgiveness)

Total Student Loan Forgiveness program, also known as Income-Driven Repayment (IDR) Forgiveness, typically kicks in after 20 or 25 years of qualified payments under certain income-driven repayment plans like PAYE or SAVE. The great thing about this program is that you can work for any employer, non-profit or private.

After making 240 or 300 qualified monthly payments (20 or 25 years, depending on the specific plan), any remaining loan balance is forgiven. It's crucial to note that under current law, the forgiven amount is considered taxable income, so you may face a "tax bomb" at the end of the repayment period. However, this does allow you to ultimately avoid paying the full balance of your loans, especially if your monthly payments are relatively low compared to your initial loan amount.

The program is especially beneficial for borrowers who have high debt levels compared to their income, as it allows for smaller monthly payments stretched over a longer period of time, culminating in loan forgiveness.

If you are pursuing total federal loan forgiveness program, we recommend two paths:

- Pay As You Earn Repayment Plan (PAYE): 20 years of income-driven payment (or 240 payments)

- SAVE (Saving on a Valuable Education): 25 years of income-driven payment (or 300 payments). We recommend this one since It offers a 100% interest subsidy on any accruing interest, meaning if your payments don't cover the interest, you won't be responsible for the interest that accrues. This is particularly beneficial in reducing the massive tax bill at the end of 25 years.

Financial Pearl

If you're aiming for federal total forgiveness, both the SAVE payment plan for 25 years and PAYE for 20 years are excellent choices. However, SAVE usually comes highly recommended due to its subsidized interest, which will help reduce your substantial tax bill at the end of the 20-25 year period.

For a more in-depth understanding, we strongly suggest consulting with one of our flat-fee student loan experts. You can click here for a list of OD-specific Certified Financial Planners (CFPs) who can guide you through the federal forgiveness program.

⚠️ Committing to this path requires both education and mental preparation, as 20-25 years is a significant time commitment. The last thing you want is to change your mind five years into the plan. Start setting aside money for that hefty tax bill you'll face at the end of the 20-25 years by saving in a separate brokerage account.

Three Situations Where Student Loan Forgiveness Might Make Sense for Optometrists

Although we generally don't advocate for loan forgiveness, there are three specific situations that we frequently encounter where it might be advisable for optometrists to consider this option for their own financial well-being:

- 10-Year PSLF Forgiveness: This option is suitable for optometrists who work full-time for 501(c) organizations or government agencies like Veterans Affairs, Indian Health Service, Kaiser, or academic non-profits, and are fully committed to staying in such employment for a minimum of 10 years. It's crucial to be fully aware of all program requirements, maintain meticulous records, and keep consistent contact with FedLoan Servicing.

- 20/25-Year Total Forgiveness for High-Risk Medical Conditions: This path may be particularly relevant for optometrists who have existing high-risk medical conditions that make them susceptible to partial or full disability, or even early death. This becomes even more pressing if they don’t qualify for disability or life insurance due to a lack of prior coverage. Those pursuing this route should also start saving for a substantial tax bill that would come due if the loans are forgiven and they are still alive after 20-25 years.

- 20/25-Year Total Forgiveness for High Debt-to-Income Ratio: This option could be beneficial for optometrists with a debt-to-income ratio of 2.5:1 or greater. While it's not impossible for an optometrist earning $100,000 to pay off a staggering $300,000 in student loans, doing so would require an extremely tight budget (think beans and rice), serious retirement savings, and would likely take much longer than 5-10 years to achieve.

In instances where the debt feels insurmountable, this could be a way out. However, they should also consider refinancing options in the future if their financial situation improves—such as moving to a lower cost-of-living state or receiving a salary increase. Additionally, they should start saving for the sizable tax bill that will come due upon loan forgiveness.

Like any rule of thumb, there are always exceptions. Numerous optometrists in our ODoF community with substantial loan debts have achieved the seemingly impossible feat of paying off their student loans within just five years through diligent work and frugal living.

⚠️ Speaking from personal experience, I was one of those optometrists who defied the odds. When I was a new graduate in 2015, working in the Bay Area of California, I earned a measly $85,000 a year while shouldering a $250,000 loan debt (principle +interest). This situation placed me in a debt-to-income (DTI) ratio of roughly 3:1, which, by conventional wisdom, should have led me to opt for federal loan forgiveness.

However, determined not to carry the burden of student loans for 20 or more years, I sought out as many fill-in jobs as I could. This hustle gradually increased my annual salary from $85,000 in my first year to $175,000 by my fourth year. By living frugally and below my means, I managed to pay off my loan in just 4.5 years. At the same time, I saved a significant amount for retirement and a down payment on a house. Both I and many of our ODoF members serve as living proof that conquering massive debt is possible with the right mindset and hard work.

Financial Pearl

Like any rule of thumb, there are always exceptions. Numerous optometrists in our ODoF community with substantial loan debts have achieved the seemingly impossible feat of paying off their student loans within just five years through diligent work and frugal living. Read their stories below

10 Practical Tips on How to Pay Off $221K+ Optometry Student Loans in 5 years

The Holland’s Journey: Paying off $660,000 Student Debt in 5 1/2 Years

"A lot of things in life can happen in 10 to 25 years! You cannot predict the future; no matter how well prepared you thinks you are. The simple point, being in debt for 25 years significantly limits your wealth building, that is why we do not advocate loan forgiveness programs for the majority of ODs"

Should I Pursue 20-25 Year Total Student Loan Forgiveness? 6 Reasons To Consider

Let's delve into whether you should even consider student loan forgiveness. At ODs on Finance, we personally advocate for every optometrist to take charge of their own financial destiny, rather than depending on government policies to shape their financial choices—especially not for a span of 25+ years. With that bias acknowledged, we view 20-25 Year Total Student Loan Forgiveness as a last resort for the following reasons:

(1) Extended Debt Burden: Staying in debt for two decades can be emotionally draining and could potentially impact your creditworthiness. This, in turn, affects other financial endeavors, like qualifying for a mortgage, practice loan or car loan.

(2) Interest Accumulation: Over a period of 20 years, interest on your loans will accumulate, possibly causing you to repay a much larger sum than the original loan amount.

(3) Tax Liability: Under current tax laws, the amount forgiven after a 20-year repayment term is considered taxable income. This means you could face a substantial tax bill in the year your debt is forgiven.

Financial Example

The case against federal forgiveness. Consider this: you'll still need to pay tax on any forgiven loan, which can be a hefty financial burden. Let's break it down with an example:

Dr. Normal has a typical student loan debt of $250,000 at an interest rate of 6.8%. She earns a $100,000 salary and opts for an income-driven repayment plan like PAYE, aiming for 20-year loan forgiveness. Her monthly payments start at $818 in the first year and gradually increase to $1,434 by the 20th year, based on her rising annual income.

After 20 years, here are some key figures:

- ⚠️ Total forgiven balance: $326,321

- ⚠️ Total payments made: $263,679 (higher than her original $250,000 loan)

- ⚠️ Tax liability on forgiven debt (assuming a ~40% tax bracket for doctors): $130,538

In total, she would end up paying $394,207—almost 1.57 times the original loan amount—over two decades.

(4) Complex Federal Eligibility Requirements: Like with any federal forgiveness programs, 20-year options come with their own specific, and sometimes intricate, eligibility requirements. You'll need to certify your income annually and maintain consistent communication with your federal servicers each month to ensure that all 240+ payments are verified.

If you've ever tried to call your federal loan service provider for help, you'll often find yourself on hold for hours.

For instance, in 2019, we noticed that professionals who started the 10-year PSLF program back in October 2007 should have had their loans forgiven by October 2017. Despite extensive searches across news outlets and financial blogs, we found only ONE person who achieved loan forgiveness through PSLF. We did, however, find multiple lawsuits against loan providers for misleading borrowers about what counts as a non-profit or delaying qualifying payments. Essentially, these professionals are left in limbo, needing to restart their loan payments with nothing to show for their past 5-10 years of payments.

Fast-forward to 2022, and we're seeing gradual approvals due to Biden's overhaul of the PSLF 10-year program to fix some glitches. While improvements have been made to the forgiveness program, it continues to leave many borrowers frustrated and confused.

(5) Changing Legislative Policies: Government policies and loan forgiveness programs are susceptible to changes. Legislation or program adjustments could affect your eligibility or loan forgiveness terms. There have been numerous proposals to limit the 10-year PSLF to just $57,000 or even eliminate it altogether. Though it would require congressional action, this could indeed happen in the future.

Economically speaking, the first wave of 20-25 year total forgiveness will start rolling in by 2027. Given the over $1.7 trillion in potential student debt to be forgiven, this could be a perfect financial storm in the making.

(6) Career Fulfillment and Satisfaction: Committing to 20 years in a specific employment setting solely for loan forgiveness could lead to job dissatisfaction if the role doesn't align with your career or personal interests.

In light of these complexities, optometrists should thoughtfully evaluate their long-term financial and career aspirations before committing to a 20-25 year federal loan forgiveness program. The takeaway is simple: life is unpredictable, no matter how well-prepared you think you are. Remaining in debt for 20-25 years could severely limit your opportunities for wealth-building.

I owe just over $157,000 on my student loan. I currently have the loan through nelnet. Would nelnet be able to tell me if I’m eligible for possible student loan forgiveness of some type? Thank you!